The first presidential debate may be over; however the analysis and predictions regarding its impact are only beginning. A variety of topics were discussed, yet there was one topic that was glaringly absent — health insurance.

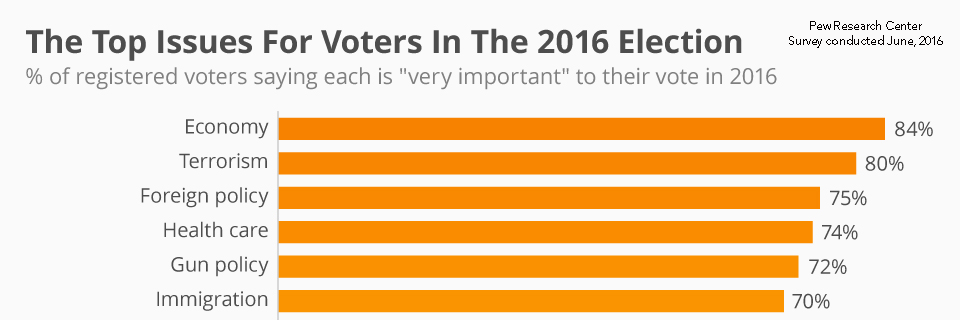

A recent Pew Research poll identifies the top issues for voters in the 2016 election. Healthcare is nearly the third most important issue the nation is concerned about, yet the topic failed to make the agenda for the first debate.

While our American healthcare system wasn't discussed in the last presidential debate, this election will most definitely have something to say about the impact on employer-sponsored health insurance and, specifically, the Affordable Care Act (ACA). Let’s look at the reported positions of each candidate to get a sense of what we might anticipate depending on which candidate ends up in the White House.

As indicated on her website, Hillary Clinton’s healthcare position includes the defense and expansion of the ACA, which would include a “public option” and the ability for people over the age of 55 to buy into Medicare. In addition, she wants to expand coverage to families regardless of their immigration status. Overall, a Clinton presidency will likely result in an expansion of federal regulation of the health insurance market.

Donald Trump’s website highlights a repeal and replacement of ACA, the promotion of Health Savings Accounts (HSA), the introduction of block grants to states for Medicaid innovation, establishment of state high risk pools, and allowing the purchase of insurance across state lines. In general, a Trump presidency will likely result in the reduction of federal regulation of the health insurance market.

Beyond the presidential election, the makeup of Congress — and specifically the Senate elections — will likely have a more significant impact on the future of ACA. It’s important to note that the ACA was signed into law by President Obama during a period in which the Democratic Party controlled both the House and the Senate.

Currently, the Republican Party holds a strong majority in the House, with 246 Republicans, 188 Democrats, and one vacant seat. Even though all 435 seats are up for election this November, it would be surprising for the Democrats to regain control of the House.

The Senate might be a different story. There are 34 contested seats this election with Republicans defending 24 seats, while the Democrats have 10 seats. This congressional makeup will be critical for either presidential candidate’s ability to implement changes to ACA, or any other policy positions for that matter.

As we get closer to the election, we will continue to anticipate and monitor changes to healthcare regulations that may impact our clients. From an employer’s perspective, our informal survey generally highlights the following three areas of concern:

- Taxes: Most should be aware of the various employer taxes which are a critical part of the funding of ACA (e.g. PCORI, HIT, and Transitional Reinsurance). However, the one that most concerns employers and their planning is the potential impact of the Cadillac tax. The Cadillac tax will impose a 40% excise tax on health plans that exceed a defined cost threshold. Surprisingly, both candidates have expressed their concern about the impact of the Cadillac tax and its potential repeal. One of the challenges in modifying/eliminating this tax is that it was designed to be one of the largest revenue sources to fund the overall regulation.

- Definition of Full Time Employee: Prior to ACA, the generally accepted definition of a full time employee was someone working 40 hours or more per week. ACA’s definition of full time changed the hours worked threshold to 30. With the backing of the US Chamber of Commerce and some House of Representative proposals, there has been, albeit, a modest push to return to the prior definition. Beyond Donald Trump’s general position of “repeal,” there has not been any specific detail from either candidate regarding their position.

- Reporting: One of the biggest irritations for employers is the new burden related to reporting. The administrative and financial expense associated with remaining compliant is a function most businesses would like to see removed. If Clinton wins in November, these required tasks will likely remain in place. Trump’s election and a hold on Congress by Republicans is possibly the only scenario that would allow for a political dynamic that could even consider addressing this requirement.

Unlike the first debate — and with nearly 30 days before the election — it would be surprising if we don’t hear more about the future of ACA from both candidates and their running mates. Based upon the campaigning to date and with three debates remaining, it is likely to be a tumultuous ride through to Election Day.