Better Benefits, Lower Costs

2020 Healthcare Cost Projections: How to Make Your Health Plan Work for You

2020 Healthcare Cost Projections: How to Make Your Health Plan Work for You

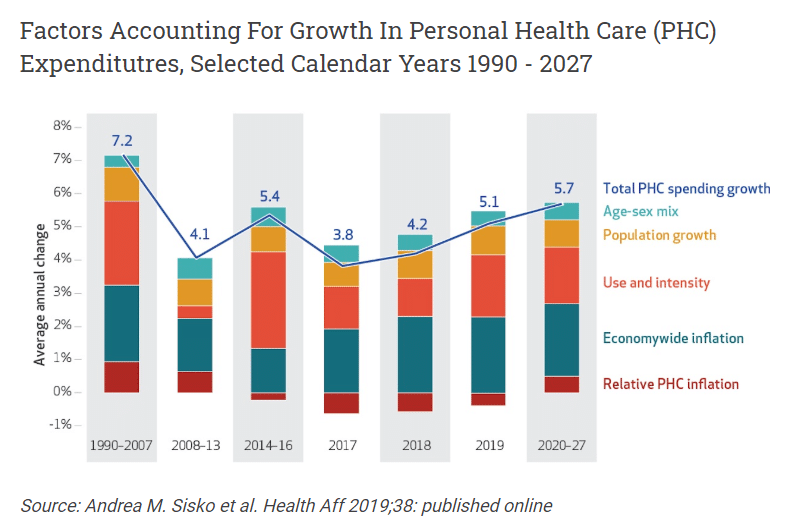

The employer health insurance market has seen a tremendous amount of innovation over the last five years or so; however, healthcare spending continues to increase at a rapid pace.

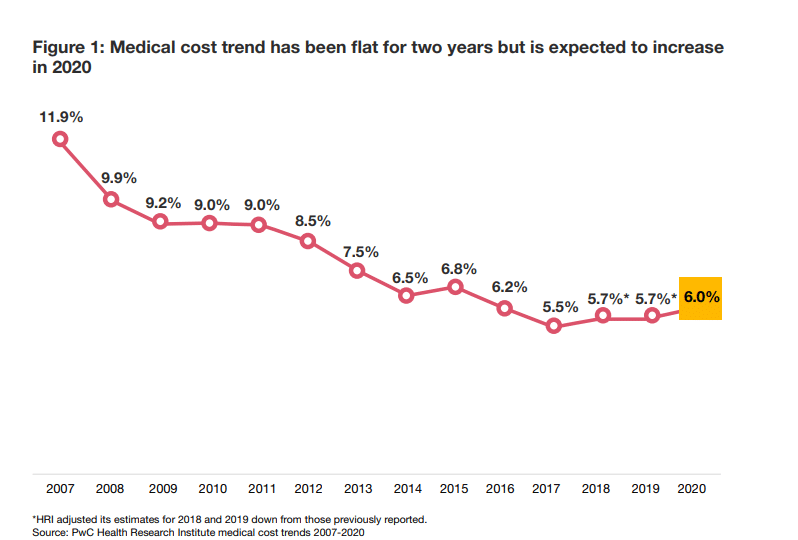

PwC’s Health Research Institute expects a 6.0% increase in 2020, and recent studies by SHRM and The Office of the Actuary at the Centers for Medicare & Medicaid Services (CMS) coincide with these expectations. In fact, healthcare spending has hovered in the 6.0% range for the last several years, a rate that is unsustainable for most employers.

Significant drivers of healthcare spend are and will continue to be:

- Chronic Disease such as cancer, diabetes, heart-related issues and other conditions that drive a majority of the cost. In fact, 60% of adults have a chronic disease, with 40% managing two or more.

- Prescription Drug Spending, particularly related to specialty medications, continues to increase exponentially. Specialty drugs accounted for 1% of prescriptions in 2019 but totaled 40% of total drug costs. Many in the industry estimate that prescription drug costs will increase to 50% of overall healthcare spend in the next few years.

- Behavioral and Mental Health are increasingly becoming visible drivers of both medical and prescription drug costs.

- The market has been slow to change. There continues to be a disconnect between what consumers want and need from the industry, such as better transparency, convenience, and quality outcomes and what the traditional marketplace currently offers to them, which causes challenges. Boutique companies and other organizations are trying to be disruptive, but it has been an evolution and not a revolution to date.

There’s Promising News

For employers willing to take proactive control of their health plan, leveraging some of the innovative solutions in the marketplace, healthcare spending can be driven down. This requires several procedural steps, bold leadership and getting comfortable with change.

The high-level process, which is really the creation of a story that employers should “write” each year with their trusted benefits consultant looks something like this:

- Connect organizational business goals to the employee benefits program in a meaningful way. What are the goals? What are the pain points? How will success be measured? What is the outline of the story to be written?

- Leverage business intelligence and data such as market trends, benchmarks, demographics, claim utilization patterns, etc. to better understand unique drivers of cost and how they impact the organization as a whole. This is foundational information and translates into the first few chapters of the story.

- Combine the insights and business intelligence gathered in the first two steps to develop a proactive, multi-year strategic plan to control and manage the health plan and costs –and to meet organizational goals. This is the story.

- Execute the plan to achieve the desired value and performance. Socialize the story to key constituents, including employees.

The traditional status quo approach will not achieve long-term success for employers. However, results that bring value to the organization and impact the business positively over time require bold leadership and embracing change. There are a tremendous amount of innovative solutions in the marketplace that can be brought together for employers in the form of a new health plan that drives high performance for employers and their employees.

Here are 6 solutions that are disrupting the industry and will continue to be “hot” in 2020 and beyond:

-

Self-Funded Programs

Self-funded programs will continue to grow in all employer segment sizes, but particularly within small and mid-sized employers. The options from which to choose from are many, including insurance carriers or third-party administrators (TPAs). In fact, the TPA market likely will continue to grow as they tend to be more transparent and flexible than insurance carrier programs.

-

Group Captives

A progressive way to manage risk, engage employees and control costs over the long-term, group captives are increasingly becoming more prevalent. Captives are an excellent vehicle to collaborate with like-minded employers and provide the ability to control the success of the health plan. Increasingly, small and mid-sized employers frustrated with the status quo and open to self-fund with a TPA will continue to entertain group captives.

-

Network Alternatives

Traditional, broad carrier networks are beginning to show “wear and tear” as consumers question the payment methodology and lack of full transparency in the prices. Alternative networks such as tiered networks (e.g., ACOs), reference-based pricing (i.e., Medicare Cost Plus), bundled episodic payments, stand-alone Centers of Excellence networks, and direct-to-provider networks will continue to gain momentum as consumers look for lower cost, more transparent options.

-

Wellbeing

Behavioral and emotional health is becoming more of a concern for individuals and employers alike. To support the surge of interest from consumers, employers will continue offering benefits that support the whole person–physical, behavioral, emotional and financial. If done well, not only can these programs save money over time, but also they can be a great way to attract and retain employees.

-

Targeted Disease Management

As noted above, costs associated with chronic disease states are a significant source of strain for most employers. Employers will continue to implement and showcase programs that can support individuals with cancer, diabetes, heart conditions, etc. Additionally, the fields of bio-genomics and pharmacogenomics, both of which strive to develop customized treatment plans for a person’s unique gene make-up, will continue to grow in popularity.

-

Consumer Experience

The terms “consumerism” and “employee engagement” have been tossed around for years, mainly under the guise of Consumer-Directed Health Plans (CDHP) and traditional health and wellness programs. However, with the generational shift in the marketplace, consumers are looking for a different and improved experience, one that is high in convenience, ease-of-use, transparency and quality outcomes. Mobile apps, consumer concierge, advocacy and navigation tools, and convenience care such as telemedicine, local clinics and urgent care centers will continue to grow as millennials become a much larger percentage of the workforce.

In short, there are many promising solutions in the marketplace for employers to meet business goals, control healthcare costs over the long-term and provide quality benefits to attract and retain employees, basically creating a high-performance health plan. However, leadership must be bold and open to change to optimize the full value of these innovations. If done the right way, the establishment of a new health plan, one with an ecosystem of programs directly focused on employees, can optimize the value and results of the employer’s health plan over time.