Better Benefits, Lower Costs

2021 Retirement Plan Contribution Limits

2021 Retirement Plan Contribution Limits

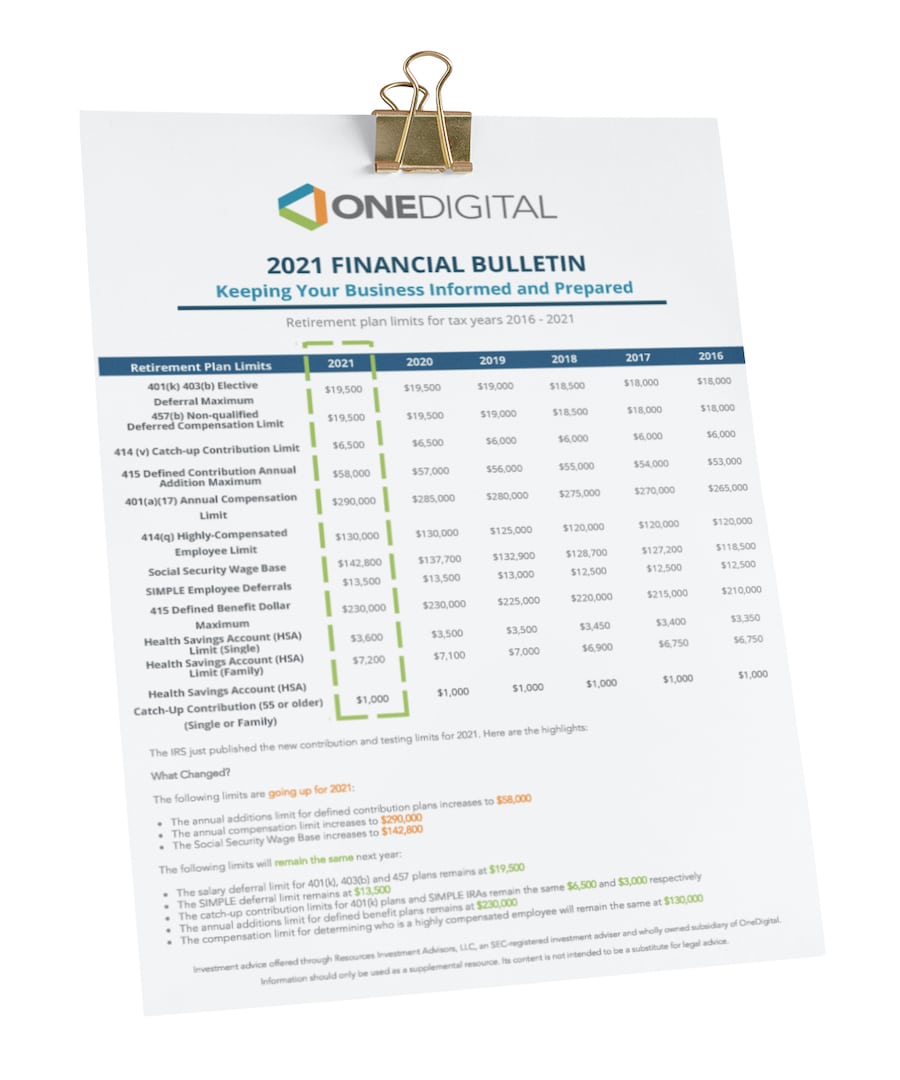

The IRS has announced cost-of-living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2021.

Employers offering retirement plan benefits, including a 401(k), 403(b) or 457(b) should review the updated limits every year. In the case of 401(k) plans the IRS also limits contributions for highly compensated individuals, so these plan limit changes could impact your non-discrimination testing and plan status.

Retirement plans play an important role in incentivizing saving for retirement through tax deductions. Individuals can also use these limits to determine the most tax-efficient way to save for their retirement based on if they have access to an employer plan, what their salary is and how old they are. For 2021, the maximum contribution to a 401(k) plan, either traditional or Roth, for employees under age 50 is $19,500 (same as in 2020). If you are over 50, you are eligible for a catch-up contribution of $6,500 (same as in 2020).

| Plan Limit | Qualifier |

| 401(k) 403(b) Elective Deferral Maximum | individuals in a 401(k) or 403(b) plan |

| 457(b) Non-qualified Deferred Compensation Limit | individuals in a 457(b) plan |

| 414 (v) Catch-up Contribution Limit | individuals in a 401(k) or 403(b) plan and over age 50 |

| 415 Defined Contribution Annual Addition Maximum | individuals in a 401(k), 403(b) or profit sharing plan |

| 401(a)(17) Annual Compensation Limit | individuals in any qualified plan |

| 414(q) Highly-Compensated Employee Limit | individuals in any qualified plan |

| Social Security Wage Base | individuals in a profit sharing plan if allocation is based on SS wage base |

| SIMPLE Employee Deferrals | individuals in a SIMPLE plan |

| 415 Defined Benefit Dollar Maximum | individuals in a defined benefit plan |

| Health Savings Account (HSA) Limit (Single) | individuals with an HSA account and single |

| Health Savings Account (HSA) Limit (Family) | individuals with an HSA account with a family |

| Health Savings Account (HSA) Catch-Up Contribution (55 or older) (Single or Family) | individuals with an HSA account and over age 55 |

Download the 2021 Financial Bulletin to review contribution limit changes that may impact your company and employees.

Interested in learning more about financial wellbeing for your workforce? Check out the recent blog: How to Help Employees Save for Retirement (and Plan for the Future) Amidst a Financial Crisis.

Share

Related News & Updates

Article, Tools & Infographics

2024 Retirement Plan Contribution Limits

11.06.2023