Better Benefits, Lower Costs

2022 Retirement Plan Contribution Limits

2022 Retirement Plan Contribution Limits

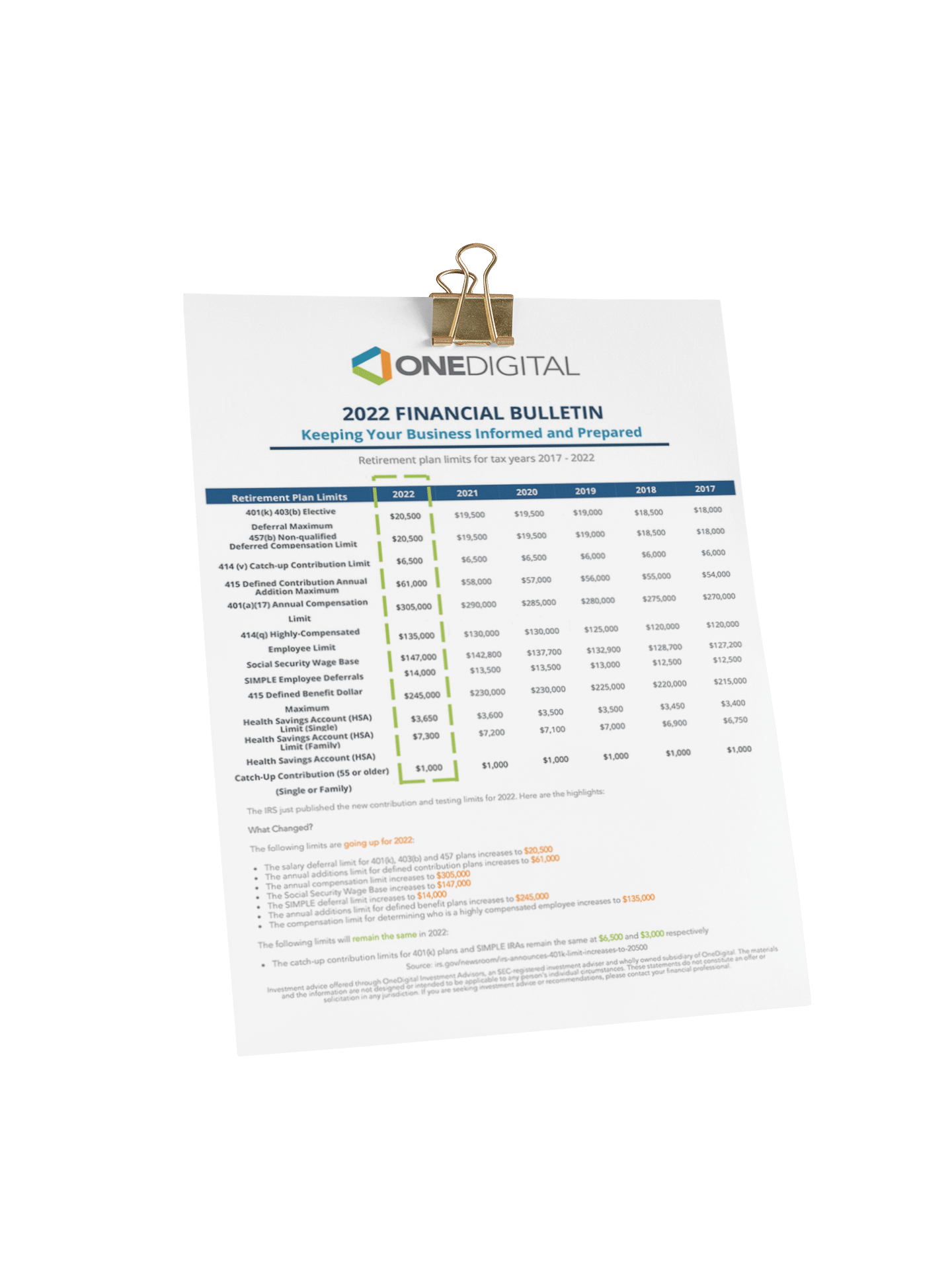

The Internal Revenue Service (IRS) has released all retirement plan limits for the 2022 calendar year.

These limits are adjusted for inflation on an annual basis. In some cases, limits are the same as those in the calendar year 2021.

Benefit |

2021 |

2022 |

Change |

| 401(k) 403(b) Elective | $19,500 | $20,500 | $1,000 Increase |

| Deferral Maximum 457(b) Non-qualified Deferred Compensation Limit | $19,500 | $20,500 | $1,000 Increase |

| 414(v) Catchup Contribution Limit | $6,500 | $6,500 | No Change |

| 415 Defined Contribution Annual Additional Maximum | $58,000 | $61,000 | $3,000 Increase |

| 401(a)(17) Annual Compensation Limit | $290,000 | $305,000 | $15,000 Increase |

| 414(q) Highly-Compensated Employee Limit | $130,000 | $135,000 | $5,000 Increase |

| Social Security Wage Base | $142,800 | $147,000 | $4,200 Increase |

| SIMPLE Employee Deferrals | $13,500 | $14,000 | $500 Increase |

| 415 Defined Benefit Dollar Maximum | $230,000 | $245,000 | $15,000 Increase |

| Health Savings Account (HSA) Limit | $3,600(Single) $7,200(Family) |

$3,650 $7,300 |

$50 Increase $100 Increase |

| Health Savings Account Catch-Up Contribution (55 or older)(Single or Family) | $1,000 | $1,000 | No Change |

Download the 2022 Financial Bulletin to review contribution limit changes that may impact your company and employees.

Action Steps

- Update retirement plan designs for the new limits and make sure that plan administration will be consistent with the new limits in 2022.

- Communicate the new retirement plan limits to employees.

Interested in learning more ways to help your workforce? Check out the recent advisory session: 401k Plan Features That Can Help Your Employees Live Financially Free!.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.

Share

Related News & Updates

Article

2023 Retirement Plan Contribution Limits

10.24.2022

Article, Tools & Infographics

2024 Retirement Plan Contribution Limits

11.06.2023

Article

2023 IRS Employee Benefit Plan Limits

12.07.2022