There are a number of major changes for Connecticut businesses with 50-99 full-time eligible employees that will take effect in 2016 as a result of Health Care Reform. Effective January 1, 2016, the small employer definition will change to an employer who employed an average of at least 1 but not more than 100 full-time (30+ hour per week) employees on business days during the preceding calendar year. Therefore, employers with 50-99 employees will now need to conform to small employer rules which used to apply only to employers with less than 50 eligible employees. There will be big changes such as limited plan design flexibility, rating changes, and additional paperwork/information required from employees.

Rating System Restructuring One of the biggest changes for businesses with 50-99 eligible employees is the restructuring of the rating system. Rates for a particular plan used to be composite based on tiers: Employee Only, Employee plus spouse, Employee plus children and Family. As of January 1, 2016, the plan is for groups of this size to be rated like small businesses with less than 50 eligible. The rates for a particular plan will be based on location of the company and the age of the employee as well as the ages of their family members.

- Companies that are “bad risks” could benefit from community rating meaning that your rates could be better than expected if you are used to large increases based on your claims experience.

- Companies that are “good risks” could be penalized with community rating. If you normally have great renewals because you are an overall healthy group, there’s a possibility that your renewals could increase after being put into a pool with some unhealthy members.

Family Size Matters The number of family members on the plan will now be considered in the calculation of plan rates. For example, a 46 year-old with a spouse and three children could pay considerably more than a 46 year-old with a spouse and one child. The number of children in an employee’s family, their ages, as well as the age of their spouse—are all deciding factors in calculating the monthly premium.

Family Health Statements will be required Another requirement will be that upon enrollment into the group plan, a member must fill out the Enrollment Form as well as a Family Health Statement. Aetna’s form states: “Information provided on this form will have no effect on, nor be considered when calculating premiums and/or cost sharing and will not affect your eligibility for coverage. This information is provided so that your health insurance plan can better manage potential adverse health issues and assist you in preventing or managing chronic health conditions you may have or which you may have the potential of developing.”

Age Curve Requirements Per Federal requirements, the age curve is compressed to a ratio of 3:1, which means that the premium rate charged by the carrier may vary by age, but may not vary by more than 3:1 for adults between 24-64. All of these reasons mean that there could be significant pricing swings for employees in 2016. As a side note— so far in Connecticut we do not have to worry about tobacco use for each family member in order to calculate member rates and it appears that this will continue into 2016, but that still hasn’t been decided.

Calculating Rates—A Primer If you have not already been asked by your current carrier, the new year will require additional information that you will need to procure from employees who elect your organization’s insurance coverage. As of January 1st, 2016, not only do you need the employee’s date of birth, but you also need the date of birth for each member of the family that the employee intends to enroll.

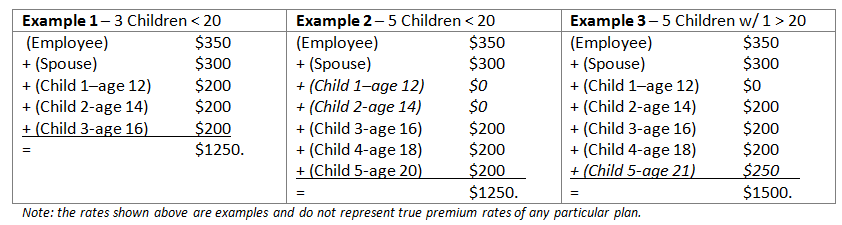

Per Ex. 1 below, if John Smith has a wife and three children, employers will have to look at the rate grid for his age and get his rate, and then go to his wife’s age and get her rate, and then each of the children get their rates. As long as the children are 20 years-old or less, the rate will be the same for each child. Next, add each of these rates together. In Ex. 2., if the employee has five children under the age of 21, he will pay the same monthly rate as if he has three children because only the three oldest children under 21 years of age are charged.

But of course—it’s not always that simple. What if one of those children is over 20 years old? Ex. 3 shows that he will have to pay for that dependent as if he or she is an adult. Now, John Smith has to pay for four children. Prior to 2016, if a child came off of an employee’s plan because the child got a job with their own insurance and the employee still had one or two other children on their plan, the rate didn’t change because it was a Family Plan or an Employee Plus Child(ren) plan. Also, in the event of the birth of a new child, the rate will increase if there are less than 3 children enrolled. In 2016, these types of events can potentially increase or decrease the family rate.

How does one stay abreast of the multitude of changes that have gone into effect since the beginning of Health Care Reform? Employers must have a broker that they see as a trusted advisor. Here at OneDigital, we strive each day to earn that trust. We will also be holding an event in April which will take a deeper dive into this topic! For more information about how ACA changes in 2014 might impact your small business, please call a OneDigital Advisor at 800-364-7575 or visit us online at onedigital.com.