Compliance Confidence

Affordable Care Act (ACA): Limits, Fees and Penalties Through 2021

Affordable Care Act (ACA): Limits, Fees and Penalties Through 2021

↓ Want to download this? Click here to download the InfoBrief.↓

The Affordable Care Act (ACA) contains a number of limits and penalties that apply to employers.

Staying on top of the requirements can be a challenge. Our team of compliance experts has put together a guide of the important provisions employers need to stay on top of to ensure organizational compliance.

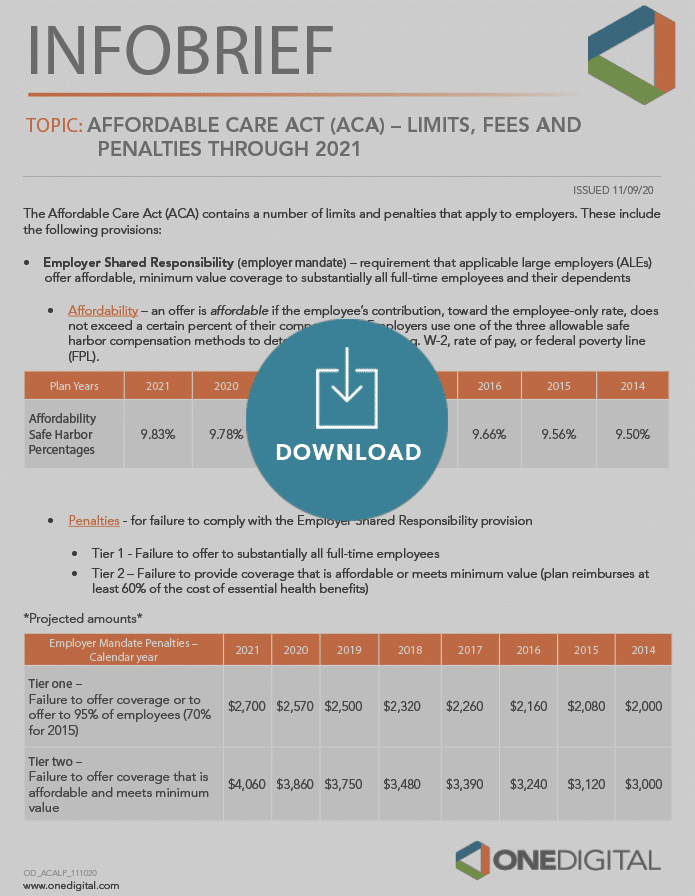

Employer Shared Responsibility (employer mandate) – requirement that applicable large employers (ALEs) offer affordable, minimum value coverage to substantially all full-time employees and their dependents

- Affordability—an offer is affordable if the employee’s contribution, toward the employee-only rate, does not exceed a certain percent of their compensation. Employers use one of the three allowable safe harbor compensation methods to determine affordability, e.g. W-2, rate of pay, or federal poverty line (FPL).

Plan Years |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

| Affordability Safe Harbor Percentages | 9.83% | 9.78% | 9.86% | 9.56% | 9.69% | 9.66% | 9.56% | 9.50% |

- Penalties—for failure to comply with the Employer Shared Responsibility provision

-

- Tier 1 – Failure to offer to substantially all full-time employees

- Tier 2 – Failure to provide coverage that is affordable or meets minimum value (plan reimburses at least 60% of the cost of essential health benefits)

*Projected AmountsEmployer Mandate Penalties—

Calendar Year2021

2020

2019

2018

2017

2016

2015

2014

Tier one—

Failure to offer coverage or to offer to 95% of employees (70% for 2015)$2,700 $2,570 $2,500 $2,320 $2,260 $2,160 $2,080 $2,000 Tier two—

Failure to offer coverage that is affordable and meets minimum value$4,060 $3,860 $3,750 $3,480 $3,390 $3,240 $3,120 $3,000 Market Rules

-

-

- Flexible Spending Accounts—the maximum amount of annual pretax dollars employees may put aside through payroll deduction to pay for qualified medical expenses

- Health Savings Account (HSA)—an employee-owned bank account coupled with a qualified high deductible plan

-

Listed below are the new limits, fees, and penalties for 2021, along with historical perspective.

Account Limits

2021

2020

2019

2018

2017

2016

2015

2014

Health Care Flexible Spending Account (FSA) $2,750 $2,750 $2,700 $2,650 $2,600 $2,550 $2,550 $2,500 Dependent Care Flexible Spending Account (FSA) $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 Affordable Care Act (ACA)

Annual Out-of-Pocket Maximums Self-only: $8,550

Family: $17,100Self-only: $8,150

Family: $16,300Self-only: $7,900

Family: $15,800Self-only: $7,350

Family: $14,700Self-only: $7,150

Family: $14,300Self-only: $6,850

Family: $13,700Self-only: $6,600

Family: $13,200Self-only: $6,350

Family: $12,700Health Spending Accounts (HSA)

High Deductible Health Plan

Annual Deductible Minimums Self-only: $1,400

Family: $2,800Self-only: $1,400

Family: $2,800Self-only: $1,350

Family: $2,700Self-only: $1,350

Family: $2,700Self-only: $1,300

Family: $2,600Self-only: $1,300

Family: $2,600Self-only: $1,300

Family: $2,600Self-only: $1,250

Family: $2,500Annual Out-of-Pocket Maximums Self-only: $7,000

Family: $14,000Self-only: $6,900

Family: $13,800Self-only: $6,750

Family: $13,500Self-only: $6,650

Family: $13,300Self-only: $6,550

Family: $13,100Self-only: $6,550

Family: $13,100Self-only: $6,450

Family: $12,900Self-only: $6,350

Family: $12,700Health Spending Account (HSA)—Maximum Contribution

Maximum Contribution Self-only: $3,600

Family: $7,200Self-only: $3,550

Family: $7,100Self-only: $3,500

Family: $7,000Self-only: $3,450

Family: $6,850/$6,900Self-only: $3,400

Family: $6,750Self-only: $3,350

Family: $6,750Self-only: $3,350

Family: $6,650Self-only: $3,330

Family: $6,550Transportation Fringe Benefits

Parking Mass transit n/a n/a $265/mo

$265/mo$260/mo

$260/mo$255/mo

$255/mo$255/mo

$255/mo$250/mo

$250/mo$255/mo

$130/moFees—Paid by Health Plan—per covered life

2021

2020

2019

2018

2017

2016

2015

2014

Transitional Reinsurance Fee n/a n/a n/a n/a n/a $0 $27 $44 Patient-Centered Outcomes Research (PCORI) Plan years ending 1/1 - 9/30 TBD TBD $2.54 $2.49 $2.39 $2.26 $2.17 $2.08 Plan years ending 10/1 - 12/31 TBD TBD TBD $2.54 $2.45 $2.39 $2.26 $2.17 Click here to download Affordable Care Act (ACA): Limits, Fees and Penalties through 2021

-