Better Benefits

Auto-Features That Should Be Added to Your Retirement Plan Today

Auto-Features That Should Be Added to Your Retirement Plan Today

As the world becomes more automated, many employees also favor auto features in their workplace retirement plan.

In response, many companies are looking to leverage auto features to help their employees save more and be more prepared for retirement. Studies show that plans with auto-features have an advantage in terms of retirement readiness over plans with no auto features. Below are some of the most common and widely utilized auto-features that you should consider implementing within your plan.

Automatic Features

Enrollment

Auto-enrollment is when employees are automatically entered into their employer’s retirement plan. When enrolled, employees automatically contribute a specified amount into their account from each paycheck. This is called the default contribution rate and is specified in the plan document.

Participants are now accepting a higher default contribution rate than ever before. At auto-enrollment and default contribution at 7%, opt-out rates are only at 4.6%, allowing employers to push the default contribution rate of participants without the worry that they will opt-out of the plan. Higher contribution rates create an excellent opportunity to start building savings.

Employers are required to set up a default investment for their employees who do not make an election decision. Therefore, employees are not only automatically enrolled into the retirement account, but their funds are also automatically invested in a predetermined investment by the plan.

Re-enrollment

Often, if employees opt-out of the original enrollment, they are left by the wayside and are less likely to opt-in themselves. That’s where adding re-enrollment to the auto-features within your plan can be a great benefit. Re-enrollment allows those who may have been forgotten to be re-engaged. Having a re-enrollment period on an annual basis allows those who have opted out in the past the ability to opt back in and those who have opted in to change their contribution rate.

Auto-Escalation/Increase

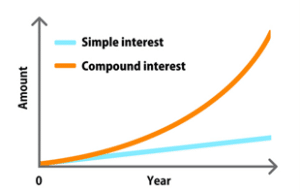

Auto-escalation is a retirement plan feature that regularly increases an employee's contribution amount. Commonly escalation within a plan is done on an annual basis. Increasing just one percent every year can result in thousands upon thousands of dollars more at retirement because of the compounding nature of savings accounts.

Benefits of Compounding

All automatic features look to accelerate the advantage of compounding interest. Compounding is the process in which an account’s earnings are reinvested to generate additional earnings over time. The benefit of compounding is that the account will grow from both the initial investment and the additional earnings being reinvested. The more interest earned over time, the more money people will see in their pockets during retirement. By starting early, retirement savings have the time to compound their earning potential.

Below is a graph that illustrates the advantage of compound interest and how it can be much greater than simple interest. An employee may lose out on significant potential earnings by only gaining interest from the initial investment.

For illustrative purposes only

Employees Are Ready for the Shift to Automation

As technology gets better and the world becomes more automated, it's crucial to stay ahead of the curve and not get behind the times as an organization. Employees are ready for this shift and will benefit from increased convenience that automated features within your plan can provide. Help your employees on the path to better retirement savings by adding some of the automated features outlined above.

To learn more about plan features that could benefit your employees, watch Retirement Plan Features Worth Considering in Every Plan.

Some information has been obtained from sources we believe to be reliable. OneDigital Investment Advisors makes no representation as to the accuracy or validity of this information.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.