Compliance Confidence, Lower Costs

Be Prepared for Your Retirement Plan Audit

Be Prepared for Your Retirement Plan Audit

Does the shifting regulatory environment have your team feeling stressed and unprepared?

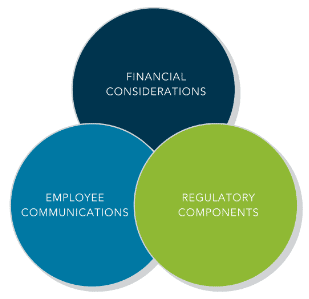

A mismanaged retirement plan can result in testing and audit failures and lead to unforeseeable expenses potentially impacting your company's financial stability. In partnership with a team of qualified plan administrators, leading companies align plan provisions with organizational objectives by integrating financial considerations, employee communications, and regulatory components into a unified strategy.

What is a retirement plan audit?

The U.S. Department of Labor (DOL) requires all businesses that offer benefits and retirement plans to more than 100 employees to conduct an annual audit. The number of participants dictates whether you have a large or small plan. Employees become included as "participants" (per the instructions to Form 5500) on the date on which the employee becomes eligible to participate – regardless of whether they contribute to the Plan.

Focus Areas

- Compliance - verification that the plan is operating within DOL and IRS regulations

- Financial reporting - determine the accuracy of financial information reported on Form 5500

Make sure all eligible participants are captured:

- actively participating employees (employees who are deferring and/or receiving contributions)

- all eligible employees (based on the requirements of the plan document) who have yet to enroll or have elected not to enter the

- retired, deceased, or separated employees who still have assets in the plan

What happens during a retirement plan audit?

Whether this is your first audit, or you’re experienced with the process, we highly recommend asking your current 401(k) providers and advisory team to make recommendations on several experienced and expert audit firms to consider. For a first-time audit, the auditor will request a significant amount of Plan Documentation to understand the plan provisions and compliance procedures. We always encourage companies to engage with their auditor early in the plan year to make the proper preparations. Communication and Pre-Planning are the keys to success, which is why we’ve laid out what one can expect to happen during the audit below.

Present required documentation

- Participant or personnel records

- Payroll files

- Contributions

- Distributions

- Loans

- Support for any prohibited transactions

- Key discussions or decisions about the plan

- A list of the plan’s service providers

Field Analysis

While on-site or remotely, the auditor will meet with company personnel responsible for the EBP plan and gain an understanding of the internal controls, accounting processes, and risks. You should expect an auditor to review a sampling of distributions, loans, and employees and request the supporting files and documentation for the samples selected.

Reporting & Filing

The auditor will provide a draft of the financial statements, report, and correspondence related to any internal control deficiencies uncovered during the review. Once approved, the auditor will provide the company with a finalized report and audited financial statements to be attached to Form 5500 which is submitted to the DOL.

Audits must be completed seven months after the end of the Plan Year.

We are here to help!

Conducting an audit can prove to be stressful, time-consuming, and expensive. Audits generally cost the company or the plan $10,000 - $20,000 annually and create additional administrative work. Growing companies that are adding eligible participants are often surprised by this new requirement and additional cost.

OneDigital Retirement Plan Administration offers a range of third party administration services customized to proactively design and administer a plan that supports employees appropriately and remains audit ready.

-

- Create Structure – Your Plan Adviser (or plan administrator) is imperative to the audit process they are responsible for creating a structure for your company around Plan Compliance, Documentation Standards, and Investment Due Diligence – all things that will make the audit process much smoother

- Explore Alternatives – There are alternative plan design structures that could be implemented to remove or delay the audit

- Pooled Employer Plan (PEP) Options – In a PEP environment, each participating plan pays a much smaller portion of the overall audit expense for the PEP. Instead of a $10,000-$20,000 audit expense, the PEP charges each plan a fractional share of the audit (usually $1,000 - $2,000

OneDigital is always here to help and support our clients. Want to learn more about how you can prepare for your retirement plan audit? Check out this recent blog post: Year-End Checklist for Your Retirement Plan or reach out to your local OneDigital retirement consultant team.

Investment Advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and a wholly owned subsidiary of OneDigital.