Compliance Confidence, No Headaches

Computing Overtime Using the Fluctuating Workweek Method

Computing Overtime Using the Fluctuating Workweek Method

Recently the Department of Labor updated the fluctuating workweek method.

Over the years, employers have been reluctant to use the fluctuating workweek method due to ongoing confusion regarding its application and the proper payment of overtime compensation. Under the new ruling, greater clarity has been provided as well as the inclusion of incentives, bonuses, or other premiums in the calculation of the regular rate of pay.

Background

Under Section 7(a) of the Fair Labor Standards Act (“FLSA”), employers must pay non-exempt employees overtime at a rate of one and one-half times their regular rate of pay for any hours worked in excess of 40 in a standard workweek. However, if a salaried, non-exempt employee works a fluctuating workweek (e.g., the employee’s hours vary from week to week), the FLSA allows the employer to pay these employees using the fluctuating workweek method.

Fluctuating Workweek Method

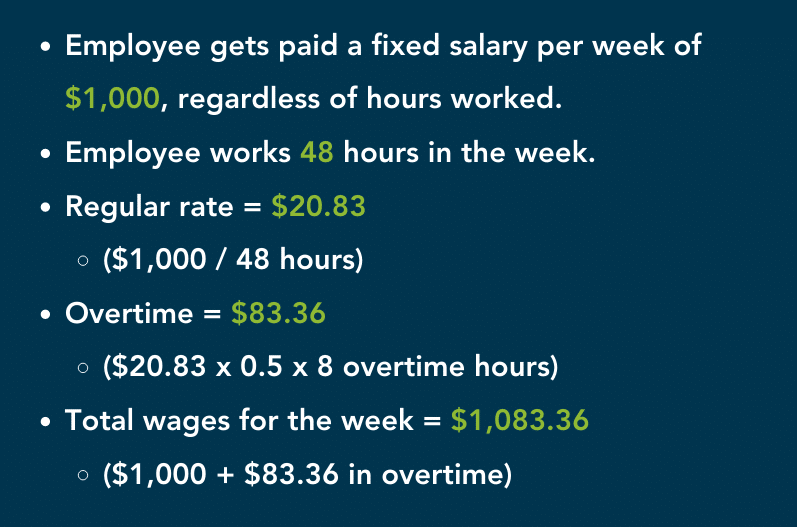

Under the Fluctuating Workweek Method, the employer, with employee agreement, agrees to pay the employee a fixed salary per week at straight time regardless of the number of hours worked. The regular rate is determined by taking the total wages for the week divided by the total hours worked. Overtime is then calculated at half (0.5) of the regular rate for every hour worked over 40 hours in the week.

Example:

Expanded Ruling

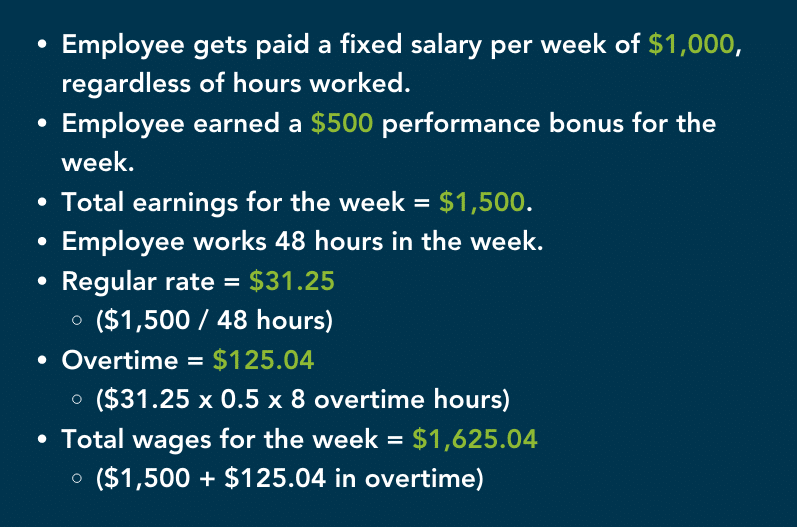

On May 20, 2020, the Department of Labor (“DOL”) expanded the existing FLSA ruling to allow employers to use the fluctuating workweek method for salaried, non-exempt employees who are eligible for an incentive or bonus. Prior to this new ruling, employers were typically not able to use this method for those eligible for an incentive or bonus. The expanded ruling includes additional pay above base wages, such as bonuses, incentives, commissions, and hazard pay. Any additional compensation received in the pay period must be added into total wages for purposes of calculating the regular rate of pay. Overtime would then be due at a rate of half (0.5) of the regular rate of pay for any hours above 40 in the workweek. Employers are still required to maintain accurate recordkeeping of hours worked from week to week to ensure proper calculation of the regular rate as the rate may fluctuate from week to week based on actual hours worked, impacting overtime earnings.

Example:

Exclusions

This ruling is made under federal law. Employers must always comply with state-specific laws which may be more stringent than federal law. Currently, the fluctuating workweek method is prohibited in some states including Alaska, California, New Mexico, and Pennsylvania. Employers should check with local regulations for applicability.