Better Benefits

Drive Retention With the New Student Loan Repayment Options for Employees

Drive Retention With the New Student Loan Repayment Options for Employees

Increase Retention By Offering An Employer Student Loan Repayment Program for Employees

Looking for an edge to make you an employer of choice? This could be the answer.

Debt, specifically student loan debt, weighs heavily on much of the workforce. While many have felt relief over the last two years due to the student loan moratorium, a harsh shift is coming on August 31, when the student loan pause ends and payments resume. Not good news for your employees. Resumption of student loan payments will impact employees’ real-income budget and likely reduce their quality of living.

The stress of strained finances coupled with inflation also affects employees’ job performance and exacerbates their interest in pursuing outside opportunities for higher salaries.

None of this bodes well for employers. Retention rates are at an all-time low, and keeping talent is a top priority amidst a historically tight labor market.

Here’s the good news: Due to the modified CARES Act, employers are uniquely positioned to offer to pay student loan debt for their employees as a benefit. Imagine the impact on your employees and prospects of having a huge chunk of student loan debt paid for them.

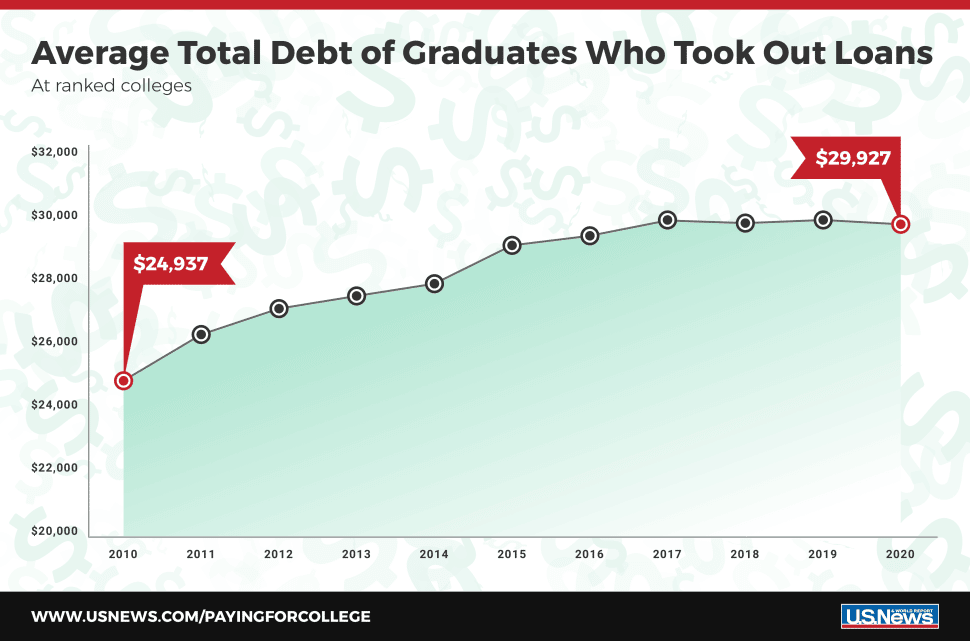

On average, a new college graduate has anywhere from $27-32k in student loan debt. The CARES Act allows companies, for the next four years, to participate in tax-free student debt repayment of up to $5,250 per year, meaning employers have the opportunity to pay a cumulative $21,000 in pre-tax dollars towards their employee’s student loans. By adding student loan repayment as a company benefit, an employer can offer to effectively wipe away two-thirds of an employee’s student loan debt load, making them an employer of choice in the market to both attract and retain top talent. Retaining an employee is much more cost-efficient than hiring and training replacements.

On average, a new college graduate has anywhere from $27-32k in student loan debt. The CARES Act allows companies, for the next four years, to participate in tax-free student debt repayment of up to $5,250 per year, meaning employers have the opportunity to pay a cumulative $21,000 in pre-tax dollars towards their employee’s student loans. By adding student loan repayment as a company benefit, an employer can offer to effectively wipe away two-thirds of an employee’s student loan debt load, making them an employer of choice in the market to both attract and retain top talent. Retaining an employee is much more cost-efficient than hiring and training replacements.

There is a trend of paying inflated salaries or boosting salaries to retain good people. But with the student loan payment benefit, employers shift from a salary boost to student loan debt repayment (SLDR) and save money doing so. It’s actually more cost-effective for an employer to cover $5,250/year in student loan debt for four years rather than adding that amount to an employee’s salary. For example, instead of a $65,250/year salary, the employer pays a $60,000/year salary and pays $5,250 SDLR pre-taxed dollars. The benefits are significant - employees are able to use pre-tax dollars toward student loan debt, accelerating the payoff AND employers are exempt from payroll taxes for this benefit. Win-Win.

Learn more about the inextricable link between financial stress, productivity and how employers can help alleviate this burden, here: “How Student Loan Repayment Programs Can Help Alleviate Financial Stress.”