The Affordable Care Act (ACA) requires that group health plans place limits for enrollees on the maximum out-of-pocket costs for Essential Health Benefits. Starting with the 2016 plan year, the annual in-network, out-of-pocket maximum (OOPM) for self-only coverage is $6,850, while the annual in-network OOPM for “other-than-self-only” (family) coverage is $13,700. Under the new 2016 OOPM rules, the HHS, DOL and Treasury issued a series of notices earlier this year that clarified that the self-only OOPM applies to each individual, whether the individual is enrolled in self-only or “other-than-self-only” (family) coverage. This is referred to as an “embedded” individual OOPM, because the self-only OOPM applies for each individual even if the plan imposes a family deductible or family OOPM that exceeds the self-only OOPM of $6,850. This new 2016 OOPM rule applies to all sizes (both insured and self-funded) non-grandfathered group health plans (but not to retiree-only plans).

Background:

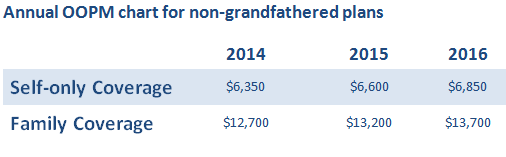

The annual OOPM is the most you can be required to pay towards Essential Health Benefits (EHB) during a policy year. The OOPM is comprised of deductibles, co-pays, and coinsurance that an insured person pays out of pocket. Once the plan’s OOPM is met, the health plan starts paying 100% for covered EHBs. The Affordable Care Act has imposed limits on OOP maximums in health plans since 2014. However, before the new OOPM 2016 rule, the maximums may have applied separately for self-only coverage and “other-than-self-only” (family) coverage. Below is an annual OOPM chart for non-grandfathered plans:

Embedded Individual OOPM and Non-High Deductible Health Plans

In the past, many group health plans have imposed one OOPM for individuals with self-only coverage and a higher aggregate OOPM for individuals with family coverage. For example, a plan with a $6,000 OOPM for individuals with self-only coverage and a $12,000 OOPM for individuals with family coverage would not pay 100% for eligible expenses until the family as a unit had incurred $12,000 in eligible expenses. If one family member incurred $10,000 in claims, that individual family member would continue to have cost-sharing obligations (e.g., deductibles and co-pays) until the family as a whole incurred $12,000 in claims.

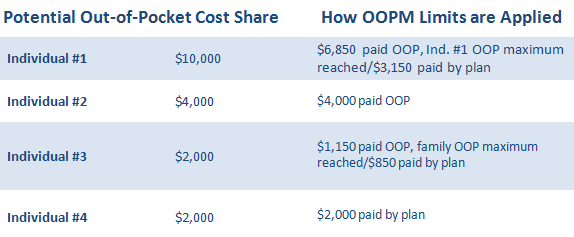

The new 2016 OOPM guidance prohibits this type of plan design. Once an individual reaches the statutory OOPM ($6,850 for 2016), the plan must pay 100% of eligible expenses for that individual. Plans can still have family OOPMs, but they also must “embed” the individual OOPM within the family OOPM. In this example, the plan could still have a family OOPM of $12,000, but it would also have an individual OOPM of $6,850.

Let’s break down the above example:

Family of four with $6,000 self-only OOPM/$12,000 family OOPM

For illustration purposes, it’s assumed the expenses are incurred in this order from top to bottom.

The new 2016 embedded OOPM rule is a significant change that will affect the way many employer-sponsored plans operate today, especially; high deductible health plans (HDHPs). Stay tuned for part 2 when we explain how the new embedded self-only maximum rule applies to HDHPs!