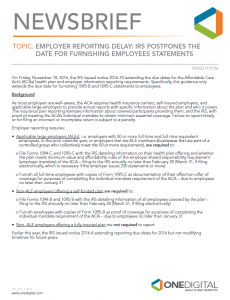

On Friday, November 18, 2016, the IRS issued notice 2016-70 extending the due dates for the Affordable Care Act’s (ACA) health plan and employer information reporting requirements. Specifically, this guidance only extends the due date for furnishing 1095-B and 1095-C statements to employees.

Background

As most employers are well-aware, the ACA requires health insurance carriers, self-insured employers, and applicable large employers to provide annual reports with specific information about the plan and who it covers. The insurance plan reporting itemizes information about covered participants providing them, and the IRS, with proof of meeting the ACA’s individual mandate to obtain minimum essential coverage. Failure to report timely or for filing an incorrect or incomplete return is subject to a penalty.

Employer reporting requires:

- Applicable large employers (ALEs), i.e. employers with 50 or more full-time and full-time equivalent employees, in the prior calendar year, or employers that are ALE members (businesses that are part of a controlled group who collectively meet the 50 or more requirement), are required to:

- File Forms 1094-C and 1095-C with the IRS detailing information on their health plan offering and whether the plan meets minimum value and affordability rules of the employer shared responsibility requirement (employer mandate) of the ACA – filing to the IRS annually no later than February 28 (March 31, if filing electronically, which is necessary if the employer issues 250 statements or more)

- Furnish all full-time employees with copies of Form 1095-C as documentation of their offer/non-offer of coverage for purposes of completing the individual mandate requirement of the ACA – due to employees no later than January 31

- Non-ALE employers offering a self-funded plan are required to:

- File Forms 1094-B and 1095-B with the IRS detailing information of all employees covered by the plan – filing to the IRS annually no later than February 28 (March 31, if filing electronically)

- Furnish employees with copies of Form 1095-B as proof of coverage for purposes of completing the individual mandate requirement of the ACA – due to employees no later than January 31

- Non- ALE employers offering a fully-insured plan are not required to report

Earlier this year, the IRS issued notice 2016-4 extending reporting due dates for 2016 but not modifying timelines for future years.

Transition Relief

The IRS understands that employers, insurers, and other providers need additional time beyond January 31 to gather and analyze information necessary to be able to furnish accurate statements to employees. Therefore, the Department is extending the due date by 30 days. Additionally, the notice also extends penalty relief to those who show good-faith efforts to comply and file timely but whose returns or statements contain incorrect or incomplete information.

| Reporting Category | Employee Statements | IRS Paper Filing | IRS Electronic Filing |

| Extended Deadline | March 2, 2017 | February 28, 2017 | March 31, 2017 |

Click here for a printable version of this article.

Click here for a printable version of this article.