If you are familiar with how risk health and welfare plans are financed in the U.S. then you know how in most instances they are dealt with overseas. This blog post, and a series to follow, will outline methods of benefit financing, spread of risk and tools to assist employers with multinational employees to better budget and account for their global employee benefit plans.

For all points of perspective in this and following blog posts, when we refer to “ global” or “local” benefit plans we are speaking strictly about the benefits placed through local insurers providing coverage for local employees in a specific country. While creative financing can be applied to offshore or expatriate/mobile benefit plans, to keep our discussions clear and focused we will consider the local plan—the group medical plan in Singapore written thought the Insurance Corporation of Singapore ICS -- for example.

In general when providing locally compliant, competitive, usual and customary supplemental benefits (above and beyond local mandates/social security programs), an insurance policy is issued by a capitalized and licensed local insurer. The vast majority of policies issued are fully insured, meaning the rates and calculated premiums are set for the agreed period and during that period all eligible claims are paid. There is no chance for a refund nor is there a policy ending “extra” premium to be paid. If claims and insurer expenses exceed premiums, a rate increase at policy renewal is most likely to happen. If premiums are less than claims and expenses, then all margins (profits) kept by the insurer and one would expect no rate action or possibly a rate decrease.

Fully insured is in most instances the best approach for clients as they can budget for these policies with some certainty. Also, these plans which are sometimes referred to as “non-participating” or “non-par” (meaning the policyholder is not participating in any extra margins or premium surplus) are usually the most cost efficient.

Fully insured also works well for smaller groups as it is harder to determine their claim activity. In general actuarial terms, as a group is larger, the law of large numbers comes into play and more accurate can an underwriter price a policy based on past claims data. For a group that is large, insurance companies will offer a “participating” or “par” accounting approach that allows for a refund or partial refund of premiums in a period when claims and expenses are less than premiums. At times too, the term “experienced-rated” is used to classify that experience from claims data is used to determine rates as well as offer the possibility of a premium refund

For very large groups, or for those with a high tolerance for risk, “self-funding” is a very good way to finance a policy. A claims payer, either insurance company or a third party administrator (TPA) will pay claims for the client. The client provides funds to the claims payer to pay claims. The claims payer invoices the client a percentage of claims paid usually plus a fixed per employee amount to cover their expenses. Self- funding is the most accurate way to pay for a plan as a client pays the cost of the actual claims. Usually to mitigate large catastrophic losses the client will buy stop loss insurance that provides a limit per individual claim or on an overall aggregate basis.

There are methods in between fully insured and self-funding such as “minimum premium” and “retrospective premium” arrangements. For our purposes it is enough to know that there are hybrid finance approaches to employee benefit finance around the world.

Most multinational companies have many country locations and can have populations that are varied but usually are of the size that qualify for group insurance policies. If so they can take advantage of an approach to financing these many global plans through what is known as “Multinational Pooling.” In general, multinational pooling or just “pooling” is a system of spreading risk by placing employee benefit insurance contracts globally with an associated “network” of insurance companies. Insurance contracts that were fully insured, with no chance for return of excess funds are now globally “experienced rated.” There is the potential to gain an 8-15% refund of paid premiums.

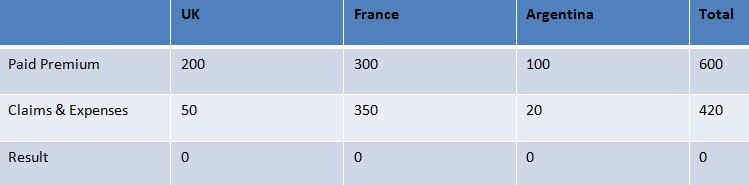

To illustrate in very simple terms how pooling works refer to the next two accounting examples. First we have a situation before pooling is applied:

Total paid premium is 600, insurers expenses including claims, taxes, commissions, and retentions is 420. In the UK, the 150 is profit for the local insurer, France has a loss and will look at a rate increase and in Argentina the local insurer has a profit of 80. Total client cost is 600.

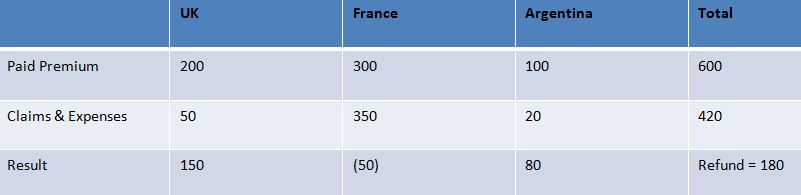

Now if we place the insurance contracts with carriers that are part of a Multinational Pooling Network or Company, using the same figures we arrive at an accounting that is:

Total paid premium is 600 (can be less due to single source purchase buying power). Total expenses is 420 (might be higher for insurance retention adjustment for losing potential profits). The result is that the “margins” are now passed to the client and can reduce overall net cost. Net client cost =420. Losses can take place, and be carried forward to future years in situations where expenses exceed premiums.

Multinational pooling is a way of global experience rated refund accounting. In the next part of this series I will cover the types of pools available, their pros and cons as well as a review of the various insurance networks. I will conclude this blog series with a discussion on current and future pooling trends.