A Brief Overview of The Affordable Care Act (ACA) and Projections for 2018

About eight years ago, the ACA made its way into the spotlight promising greater access, choice, and coverage for all. The population primarily needing assistance included those ineligible for employer-sponsored health insurance or either of the entitlement programs Medicare or Medicaid. The individuals with the poorest health had little to no choices for health insurance and the options available were extremely expensive. Although the smallest population, they are most vulnerable.

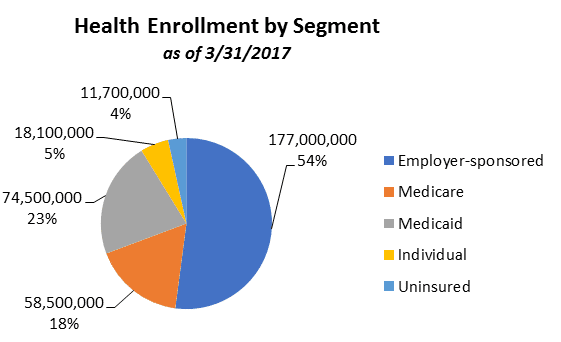

Today’s healthcare enrollment numbers help us understand the story. In 2010, 50 million people were without health insurance coverage. Seven years later, the number is 11.7 million people. While a great improvement, this change didn’t come without a cost.

http://www.markfarrah.com/healthcare-business-strategy/Health-Insurance-Enrollment-Shifts-and-Market-Segment-Trends.aspx

The marketplace faces significantly higher costs in both medical goods and services, and its corresponding health insurance premiums. The trajectory of cost escalations, including administrative expenses, results in a higher deductible and out-of-pocket expense for recipients. Since 2016, there’s been an 11 percent decline in individual market health insurance enrollment. At the end of this year’s open enrollment, we’ll see an even greater number.

The downward market trajectory and unsustainable costs led to the ACA “repeal and replace” platform. OneDigital’s coverage of the year’s events began with the President’s executive order encouraging repeal and replace, and requesting that the departments “ease the regulatory burden” of the law. For the greater part of 2017, our ACA Watch page focused on the legislative developments and the use of a budget reconciliation vehicle to pass ACA repeal and replace legislation. From February through September, we kept pace with Congress in their efforts to make things better. In the end, Congress was unable to affect sweeping change.

Now that Congress is back to regular order, the parties and committees will continue to work on specific issues. Working issue-by-issue, however, is a long process. Whether the market can sustain itself as it waits for solutions, is the real question.

We will see a few things happen before the end of the year. The first focuses on the results of tax reform and the second is the end of year funding package.

1. Results of Tax Reform

Earlier this month, the House passed its tax reform bill. This week, the Senate will begin debates on their version of the bill. While the bill addresses tax reform, it also has consequences for several ACA provisions. Listed below are the components of both the House and Senate bills that would impact employers.

| Employer Provisions | House | Senate |

| Corporate Tax Rate | Flat 20%, effective 2018 | Flat 20%, effective 2019, no expiration date |

| Excise Tax On Tax-Exempt | 20% on highly compensated individuals | Same as House |

| ACA Individual Mandate | No provision | Modifies fine amount to $0 beginning 2019 |

| Archer MSAs | Eliminates deductibility of contributions | No provision |

| Dependent Care | Eliminates annual exclusion at end of 2022 | No provision |

| Moving Expenses Reimbursement | Eliminates employer-provided qualified moving expenses, except for military | Eliminates employer-provided qualified moving expenses, except for military |

| Tuition Reimbursement | Eliminates deduction for all non-work-related education reimbursements | No provision |

| Transit And Parking | Eliminates businesses ability to deduct these expenses | Eliminates businesses ability to deduct these expenses + individual’s ability to deduct $20/week for bicycle commuting |

| Paid Leave Credit | No provision | Credit of 25% EE’s earnings during leave |

From an ACA standpoint, the potential elimination of the individual mandate looms ahead. While the House bill does not address this, the Senate bill will zero out the individual mandate penalty. This could result in a further negative impact on an already unstable marketplace. While the House did not include this provision in their bill, they have indicated that they will back this provision should the Senate pass their bill. We should see final outcomes in the next week or so.

2. End of Year Funding Package

The second areas that may change are in the health insurance tax (HIT), the annual tax levied on all health insurers that pass through to consumers, and the "Cadillac Tax". There is a significant push to include delays for both of these taxes. Last year’s moratorium on the HIT tax will end and the amount has been incorporated in the 2018 rates to individuals and groups. There is support on both sides of the aisle for this delay.

For 2019 plan years, employers will also have to prepare for the “Cadillac” tax. The tax will be assessed in 2020, for the 2019 plan year. Our OneDigital Compliance Team, along with many others, is pushing for a delay. Employers will need to start planning for this and, as we explain to regulators and lawmakers, we will see employers decrease health insurance coverage so as not to pay this additional tax. This is contrary to the entire healthcare reform initiative and will have devastating effects on the greatest number of individuals.

We are actively working to advocate on your behalf for these delays and with the regulatory agencies to help reduce the administrative burdens related to the sponsoring of employee health insurance coverage. Look for more information in the coming weeks as the year winds down and contact your local OneDigital representative if you have additional questions.