Healthy People, No Headaches

How to Automate Your Retirement Savings

How to Automate Your Retirement Savings

According to the Federal Reserve, only 36% of Americans’ savings are on track for retirement.

The average age for retirement has risen from 62 to 64 for men and 60 to 62 for women, causing many Americans to work longer or pick up a part-time job in retirement to supplement their income. A 30-year-old American making $60,000 a year will need almost $2 million in savings to be ready to retire – which may seem impossible to many of us. But it can feel more achievable when you start to take advantage of some of the tremendous automatic features built into retirement plans designed to help you save.

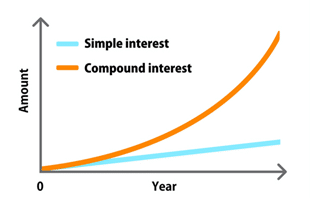

Benefits of Compounding

The goal of all automatic features is to use the concept of compounding to your advantage and allow your money to work for you. The more money in your account, the more it will grow with time. Compounding interest is when your account’s earnings are reinvested to generate additional earnings over time. The benefit of compounding is that the account will grow from both the initial investment and the additional earnings being reinvested.

Below is a graph that illustrates the advantage of compound interest and how it can be much greater than simple interest. You may lose out on significant potential earnings by only gaining interest from your initial investment.

For illustrative purposes only

Whether through your initial investment or your compounding interest, the more you take advantage of automatic features, the more you will be set up for success in retirement.

Automatic Features

Enrollment

Auto-enrollment is when you are automatically entered into your employer’s retirement plan. Once you are enrolled, you will automatically start contributing a specified amount into their account from each paycheck. This is called the default contribution rate and is specified by your employer. Please refer to your company’s plan document for specific details.

Auto-enrollment traditionally happens at the beginning of the year or when you start at a new company. This is the best time to become familiar with the details of your company’s retirement plan. Don’t miss out on this enrollment period because if you choose to opt-out, it may take up to a year to enroll back in.

The great thing about auto enrollment is if you are enrolled, you’re more likely to stay enrolled. The Vanguard Group found that 92% of new hires were still saving within their employer’s retirement plan three years after being automatically enrolled.

Auto-Escalation/Increase

Enrolling in your retirement plan is important, and it is also important how much you are contributing to your plan. The higher your contribution rate and the earlier you can increase your rate will effectively allow you to save more. Once enrolled in your plan, you are able to set your contribution rate. A general rule of thumb is to set your contribution rate high enough to receive your company’s match. But this may not be enough if you’re behind on your savings. That is where auto-escalation comes into play.

Auto-escalation is a retirement plan feature that regularly increases your contribution amount. Commonly escalation within a plan is done on an annual basis. Adding auto-escalation to your retirement plan allows you to increase your contribution rate automatically, so there’s no way to forget about increasing it. Some plans even auto-enroll you in auto-escalation to take more possible errors out of the equation. Contributions will continue to be taken out of your paycheck automatically. Increasing just one percent every year can result in thousands upon thousands of dollars more at retirement because of the compounding nature of savings accounts. A final savings strategy with auto-escalation is to set your auto-escalation to increase around your company’s annual review to lessen the impact of the contribution change by pairing it with a potential raise.

Auto escalation has been extremely popular in the past five years. Of plans that have auto-enrollment, only 65% of plans had auto-escalation five years ago. Whereas today almost 79% of plans have the pair of features. This is a great sign for you. That means that almost all plans you’re in today can be set up for auto-escalation.

Make the Shift Today

Time is your friend when it comes to savings. To be prepared for retirement, you need to save a hefty sum of money. Using the auto-features in your company’s retirement plan is a great way to start saving with very little lift on your own. With auto features, you are less likely to get off track with your savings.

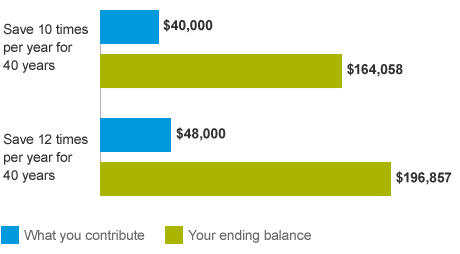

As described by Vanguard, “If you planned to save $100 a month and missed two contributions every year until retirement, you could wipe almost $33,000 off your final account balance—way more than the $8,000 in missed contributions.”

Automating your savings could mean you'll have more money for retirement

Source: Vanguard Retirement*

How to Get Started

Most recordkeepers will allow you to make changes directly on the website itself, no matter who they are. If you have issues logging in or locating your account, there are ways to get you back online. Keep in mind if it is an employer-sponsored plan that you have not opted out of, they will set up the account for you. You can give the recordkeeper a call or simply select password reset to gain access. Once you have access to your account, you can update or change existing settings. You can instantly change contribution rates, beneficiaries, current and future investments, dividend and capital gains elections, the contribution rate for pretax and Roth, as well as updating important contact details if they have changed. Lucky for us, they make this process very easy to follow and make changes as needed.

So get started today! Make sure that you use automatic features to help you reach your goals so that you can live out your dreams of sitting by a lake watching the sun go down.

Want to learn more about wealth management strategies for individuals? Check out our video, One Thing You Can Do To Prepare For Retirement During Each Decade.

Some information has been obtained from sources we believe to be reliable. OneDigital Investment Advisors makes no representation as to the accuracy or validity of this information.

Investment advice offered through OneDigital Investment Advisors LLC, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.

*This hypothetical illustration assumes an annual 6% return. The illustration doesn't represent any particular investment, nor does it account for inflation. The rate of return is not guaranteed. The final account balance does not reflect any taxes or penalties that may be due upon distribution. Withdrawals from a traditional IRA before age 59½ are subject to a 10% federal penalty tax unless an exception applies.