High deductible health plans (HDHPs) may qualify for pairing with a health savings accounts (HSAs) if they meet all the IRS’s annual requirements.

Likewise, the IRS establishes particular requirements for the actual savings account itself. As is customary, the IRS communicates the new limits prior to the beginning of each calendar year. On May 4, 2017, the IRS’ Revenue Ruling 2017-37 describes the following 2018 limits effective January 1, 2018, for contributions to HSA bank accounts:

- Individual plan maximum contribution = $3,450

- Family plan maximum contribution = $6,900

On December 22, 2017, H.R. 1(115), the Tax Cuts and Jobs Act of 2018, passed into law. Among other things, this law modifies the calculations the IRS uses to set specific annual dollar limits, including those for contributions to HSA bank accounts. As a result, the March 5, 2018, IRS Revenue Ruling 2018-18 clarifies the new the new limits for contributions to HSA bank accounts:

- Individual plan maximum contribution = $3,450

- Family plan maximum contribution = $6,850

Individuals and employers who contribute to HSA bank accounts and are funding or pre-funded the full family amount will need to make some modifications.

-

Maximum family contribution of $6,900 was made prior to the March 5 revenue ruling:

the individual will need to deduct the excess $50 contribution, plus any interest earned, and claim it as income for 2018. There is no guidance at this time as to whether employers will need to treat this $50 amount as gross wages on the W-2.

-

Maximum family contribution of $6,900 was planned but not funded prior to the March 5 revenue ruling:

the individual and employer will need to modify the remaining contributions for the year so as not to exceed the annual maximum of $6,850.

At this time, there has been no mention of whether this new calculation will affect the limit for Flexible Spending Accounts (FSAs). So, unless the IRS issues guidance changing this limit, it will remain at $2,650.

UPDATE: IRS REVENUE RULING 2018-27

Understanding the burdens placed on individuals and employers who pre-funded the maximum contribution for the year, the IRS reinstates the HSA family annual limit for 2018 to $6,900. The revenue ruling further addresses those individuals and employers who may have since refunded the difference between the original maximum of $6,900 and the revised maximum of $6,850. With the restoration to $6,900, those who may have already distributed the $50 from the account are left with questions about the tax consequences that may be associated with this distribution.

The IRS 2018-27 rule provides the following clarifications itemizes these scenarios and the tax consequences:

- If the $50 distribution is a refund of the individual’s or the employee’s contribution:

- repay back to their HSA with no tax consequence, if done by April 15, 2019

- keep the $50 excess disbursement with no tax consequence, if distribution by April 15, 2019

- If the $50 distribution is attributable to the employer’s contribution and the amount was not included in the employee’s wages, the employee must use the amount for qualified medical expenses in order to avoid any taxation on the amount

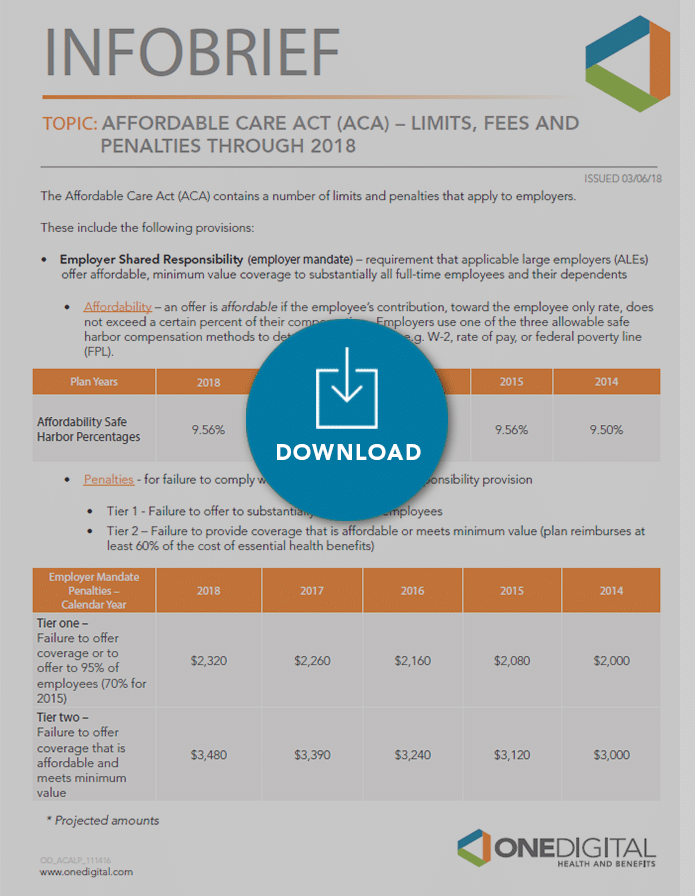

We've updated the 2018 Infobrief describing all the limits for the year.

DOWNLOAD THE INFOBRIEF: Updated Affordable Care Act (ACA) - Limits, Fees and Penalties Through 2018.

Contact your OneDigital representative if you have questions or would like more information regarding the updates to the HSA family contribution rate.