The wording caused an uprising, divided a House and ignited a debate that had to be settled by the nation’s highest court. After months of jockeying between the Administration, Congress and the states about the fate of the law, the Supreme Court put to rest the controversial King v. Burwell case. The decision to keep subsidies intact was announced moments ago. Those of us on the sidelines are wondering if the case was ever about upholding the law or merely a platform for political rhetoric for opponents of Obama’s controversial health care reform. What was the lawsuit all about?

Resolving the Question of Who Gets Tax Credits

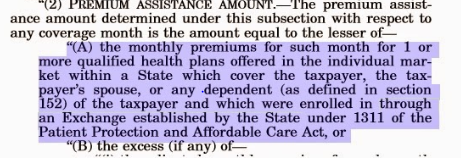

The question hinged on whether the tax credits were intended only for state-run exchanges and not federally facilitated exchanges. On the one side, proponents were confident that the law intended for the tax credits to apply to both state and federal exchanges, but plaintiffs were strict on semantics. They contended that the tax credits apply only in the handful of states that had bothered to establish their own exchanges. It’s clear by contesting this key provision, certain factions didn’t want to preserve the health law in its current state and were perhaps using this lawsuit as a wedge they hope to widen.

Opposing Sides

“Obamacare is busted,” claimed House Ways and Means Chairman, Representative Paul Ryan. There is no surprise here. Congressional Republicans have made no attempt to hide their contempt about provisions of President Obama’s health care reform. Some have been champing at the bit to overhaul the entire law, and King v. Burwell, was an entrée into negating a key ACA provision – and perhaps unraveling the entire law. On the other side of the heavily charged debate, Health and Human Services Secretary, Sylvia Matthews Burwell warned of a “death spiral” if the Supreme Court voided the health law’s tax credits. Burwell said a reversal would create a widespread disruption and leave many Americans uninsured. But all that is moot with today’s landmark decision.

The Final Ruling

The Supreme Court ruled, 6-3, to allow tax credits for federally facilitated exchanges. It may be a blow to the plaintiffs, but it’s probably a big relief to the 8 million or so Americans that could have been faced with tough decisions and likely increases in health insurance costs. The tax credits help lessen the financial impact of health care premiums for coverage for millions of Americans including 700,000 children. If the Court had ruled in favor of the plaintiffs, proponents argued that many Americans would probably go uninsured and that states would be scrambling to set up exchanges that could obviously not be created overnight.

What’s Next?

Now that this issue is put to rest, we’re waiting for the next big debate over Obamacare. Expect political posturing to heat up with the upcoming elections when the divide over health care reform is bound to get wider. For now, a reprieve from the political banter and bashing is as welcome as rain in sunbaked California.

We’ll keep you updated on all ACA compliance news including the Supreme Court decision on same sex marriages due out in the coming days.