Better Benefits, Lower Costs

Q2 2022 Markets In Focus: A Rocky Start for Finances and the Global Economy

Q2 2022 Markets In Focus: A Rocky Start for Finances and the Global Economy

The year got off to a rocky start, economically speaking, and investors are keeping a close eye on multiple situations affecting finances and the global economy. The first quarter of 2022 was tumultuous with geopolitical turmoil. Fortunately, despite the ongoing fluctuations, it’s not all doom and gloom.

Let’s take a closer look at some of the factors at play and what to watch in the months ahead.

The Markets

U.S. stocks were down more than 8% total in January and February, with a slight recovery in March (+3.7%), as the economic impact related to the war in Ukraine heightened uncertainty. While the first days of the conflict put American investors on edge about the potential for greater market volatility, the war led to a surge in commodity prices with continued disruptions in supply chains, resulting in a prolonged stint of higher inflation.

Items of note:

- Growth continues in 2022 as the impact of COVID-19 wanes, although some slowing occurs as the economy reaches full employment, monetary policy becomes tighter, COVID-19–era fiscal impulse reverses, and the Ukraine crisis raises energy prices and the dollar temporarily.

- Most investors typically think of bonds as something that offsets equity risk, i.e., zigging when stocks zag, but this was far from the case in the first quarter, as bonds experienced steep losses amid interest rate risk, inflation, increasingly hawkish monetary policy expectations and volatility.

- On the other hand, it’s been a mixed bag for equities, which are generally expected to be riskier and more volatile than bonds.

- Geopolitical effects on the European economy are still in question, which impacts commodity prices and the overall global economic outlook.

The Yield Curve

The yield curve is a chart showing interest rate yields of debt securities, e.g., U.S. treasuries with different maturities. It signals expectations about future interest rates that, in turn, reflect expectations of future real economic activity and monetary policy.

Generally speaking, an upward curve means a healthier economy with high growth expectations. Flatter or inverted curves indicate the economy is slowing down and that investors are uncertain about the economy’s future economic conditions or business cycle outcomes.

At the end of the first quarter, the dreaded yield curve inversion happened. It’s long been considered a dependable indicator of recessions on the horizon, consistently predicting nine of the last 10 recessions. Historically, a recession occurred about 14 months on average after the yield curve inverted.

During a recession, for example, short-term rates typically fall as the real demand for credit weakens and the Federal Reserve eases monetary policy. If investors anticipate a recession, they will expect short-term rates to tumble in the future. Right now, the 10-year yield is below its 2-, 3- and 5-year counterparts but remains higher than the 1-year yield. The spread between the 10-year and 2-year yields is the one that investors keep an eye on most.

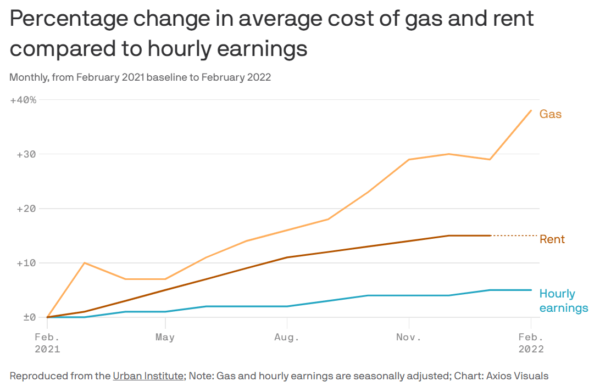

Inflation/Rising Costs

Inflation is on everyone’s mind as prices continue to go up. The most noticeable impacts of inflation have been on energy, food, and vehicle prices. In fact, almost 70% of inflation over the past year has come from these sectors, combined with pandemic-impacted reopening categories.

- The Consumer Price Index (CPI) was up 8.5% year-over-year in March, following a 7.9% annual gain in February. The widely followed index for all items kept creeping up with 1.2% month-over-month increase in March.

- Gasoline costs drove half of the monthly increase (national average of over $4/gallon compared to $2.86 a year ago).

- Food was also a sizable contributor, as Americans paid more for vegetables, meats, and dairy products.

- The war between Russia and Ukraine has put even more pressure on energy, food, and other critical commodities, which means headline inflation is likely to continue running high for a few months.

- It’s also concerning that inflation has recently broadened to impact more than just goods prices.

- Core inflation (outside of energy, food, vehicles) and pandemic-impacted areas are now contributing more than 2.5% to inflation, which is higher than pre-crisis.

- And, for the first time in almost a year, services prices rose faster than durable goods prices in February. If that happens at the same time as wages grow (which is the current situation), the demand and prices for goods could remain high, and inflation may not come down in a predictable way.

Interest Rates

Interest rates are also on our mind, as we saw the first of multiple expected rate hikes from the Fed in March.

Officials are still signaling they expect to lift the rate by nearly 2% by the end of this year (including March’s increase), which will put the rate at or slightly higher than pre-pandemic levels. Fed Chairman Jerome Powell stressed that the committee is “aware of the need to return the economy to price stability and determined to use our tools to do exactly that.” He also signaled it might come at an even faster pace than previously foreshadowed.

Increased risk of commodity-led inflation was a big reason why yields surged towards the end of the quarter, as investors expected even tighter monetary policy this year to combat that. This was the key dynamic driving markets over the quarter. Fed’s decision to raise interest rates is now heavily conditioned on inflation dynamics rather than employment, which is a big switch from what we saw last year.

Mortgage and Housing Notes

While the hike moved interest rates a quarter percent overall, mortgage rates rose more quickly after the Fed’s announcement. In the week following the hike, the average rate on the 30-year fixed mortgage rose more than a full percent, and it spiked near 5% in March.

Combined with the reduced inventory of houses currently available, rising rates make buyers and sellers even more anxious than usual this spring, which is typically the busiest season of the year for real estate. Renters are also feeling the strain, as their rent bill has gone up steadily, and they’ve been priced out of the market for new homes.

If consumer pessimism toward home-buying conditions continues and the recent mortgage rate increases are sustained, then we expect to see an even greater cooling of the housing market than previously forecast.

— Mark Palim, Fannie Mae's vice president and deputy chief economist

Wages & Jobs

The employment and hiring markets are going strong, with a low unemployment rate of 3.6% to end the quarter. Another indicator? Unemployment claims fell to the lowest rate since 1969.

The prime-age employment-population ratio is an even better measure and shows the proportion of 25–54-year-old adults who are currently employed. As it stands, it’s equivalent to the average level in 2019, which was one of the strongest labor markets in a couple of decades.

While there is good news for workers, the reshuffle continues to put stress on employers who are struggling to fill open positions and keep up with quickly increasing wage demands. The government sector has taken longer than the private sector to recover.

Also of note, wage growth has now replaced government support as the primary driver for disposable income gains. Average hourly earnings are up 5.6% year-over-year as of March, although it’s still not enough to outpace inflation. Rising compensation means increased spending on services, which may feed off the inflation spiral without an offsetting falloff in goods prices (as goods demand wanes).

Putting It All in Perspective

While Omicron took COVID-19 infection rates to a new high, the global economic conditions appear to be looking up as the pandemic subsides. Yet, the recent Russia-Ukraine conflict and accompanying sanctions cast a shadow on the outlook. The U.S. economy’s performance in the past few months has been better than most people anticipated. High and sustained Inflation and related problems, such as tangled supply chains and steep commodity prices, may continue to challenge businesses and policymakers, but the U.S. economy is performing well by most measures.

All things considered, the Fed appears hopeful that supply disruptions will fade and inflation will revert lower by itself instead of being forced lower. A Fed that supports economic growth means an environment that is positive for corporate profits and risk assets in general. The confluence of two factors – inflation and corporate profits – could determine the fate of equity markets, and the outlook for bonds will depend on where the monetary policy goes from here.

Want more from CIO Saumen Chattopadhyay? Check out his recent post: 5 Reminders for Investors When the Markets are Volatile.

The material and opinions provided in this post are meant for general illustration and/or informational purposes only and should not be construed as investment, tax, or legal advice for any individual. Although the information has been gathered from sources believed to be reliable, each reader must decide whether it is valid and applicable to his/her own unique circumstances. To determine which investment(s) may be appropriate for you, consult your financial adviser prior to investing. Diversification does not protect an investor from market risk and does not ensure a profit. Any economic forecasts made in this commentary are merely opinion, and any referenced performance data is historical. As a result, neither is a guarantee of future results, as all investments involve risk. All referenced indices are not managed and may not be invested into directly.

Some information has been obtained from sources we believe to be reliable. OneDigital Investment Advisors makes no representation as to the accuracy or validity of this information.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.