Compliance Confidence

New Rule Allows Employers to Use Individual Coverage HRAs in Employee Benefit Programs

New Rule Allows Employers to Use Individual Coverage HRAs in Employee Benefit Programs

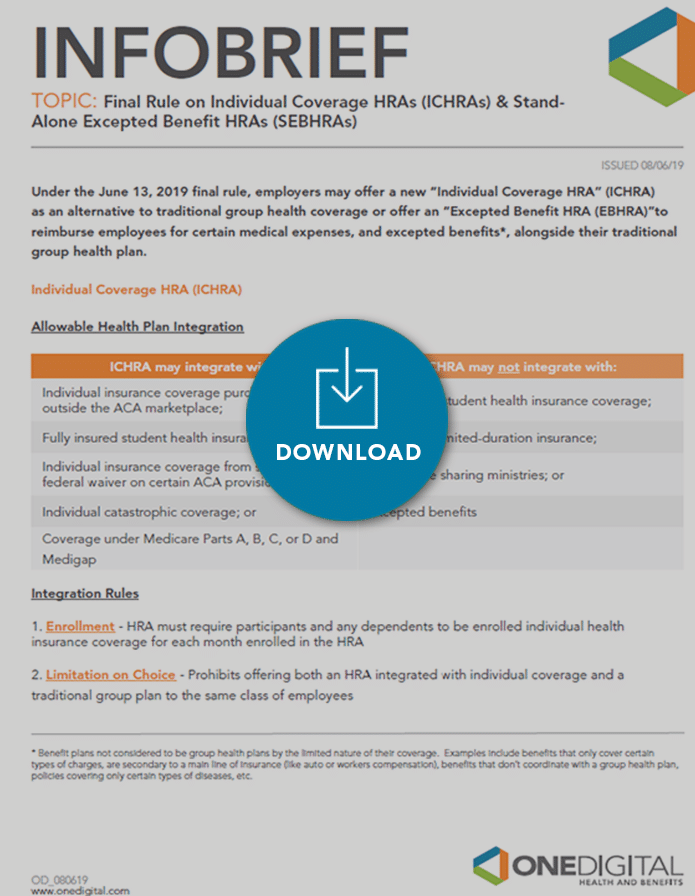

↓ Want to download this? Click here to download the InfoBrief.↓

On June 13, the Departments of Health and Human Services (HHS), Treasury (IRS), and Labor (DOL) issued the final rule providing employers additional methods for using health reimbursement arrangements (HRAs) in their benefits program.

Building on the foundation of the October 29, 2018, proposed rule, this final rule permits employers to offer a new “Individual Coverage HRA” (ICHRA) as an alternative to traditional group health coverage.

Effective January 1, 2020, employers may set up an HRA to reimburse an employee’s individual health care premiums for coverage they purchase in the private market or through a state exchange. As with any other HRA, an employer chooses how much to fund for each employee annually. Employees will be able to use ICHRA funds to pay the premium for individual insurance coverage purchased either on or off the public Marketplace or to pay for Medicare premiums.

Alternatively, the rule also allows employers that offer traditional group health coverage to offer an “Excepted Benefit HRA (EBHRA)” to reimburse employees for certain medical expenses, and excepted benefits*, including stand-alone dental or vision benefits or premiums for Short-Term Limited Duration Insurance, unless precluded by the state.

While providing additional flexibility for employers to structure their benefits in the best way for their employees, there are extensive rules and responsibilities for employers to comply with these new options.

For assistance with your Individual Coverage HRAs (ICHRAs) & Stand-Alone Excepted Benefit HRAs (SEBHRAs), please contact your OneDigital consultant.

Click here to download the Individual Coverage HRAs (ICHRAs) & Stand-Alone Excepted Benefit HRAs (SEBHRAs) Infobrief.

*Benefit plans not considered to be group health plans by the limited nature of their coverage. Examples include benefits that only cover certain types of charges, are secondary to a main line of insurance (like auto or workers compensation), benefits that don’t coordinate with a group health plan, policies covering only certain types of diseases, etc.

Share

Related News & Updates

Article

IRS Releases 2023 Benefit Plan Limits

10.19.2022

Article

IRS Issues Final Rule to Fix “Family Glitch”

10.12.2022