There’s been a flurry of activity upon the return of Congressional leaders from their August recess. Among many, four emerging healthcare alternatives are receiving the lion’s share of the spotlight.

1. Senate Health, Education, Labor, And Pensions (H.E.L.P.) Committee Stabilization Package

September started out with the fulfillment of Sen. Lamar Alexander’s promise that the H.E.L.P. Committee would hold bipartisan hearings to learn how Congress can improve affordability and availability of insurance coverage. The result of which will be the advancement of legislation to stabilize the marketplace.

Chairman Alexander (R-TN) and ranking member, Patty Murray (D-WA), have plenty of material to craft a stabilization package proposal to shore up the waning marketplace and that was the plan for the end of September. However, they’ve been asked to hold any further action as they are placing all the focus on the newest version of the Graham-Lindsay amendment to the American Health Care Act (AHCA).

While Senate Chairman, Mitch McConnell, states that this amendment will go to vote this week, before the Septemeber 30, 2017 deadline, there is still uncertainty. As with all prior amendments, obtaining the necessary 51 votes will be challenging. An additional Senate Finance hearing will take place on Monday, September 25 to review the impact of this amendment and whether it meets the budget reconciliation requirements. The question will be whether this has any effect on the Senators’ support for the bill.

2. The Problem Solvers Caucus

This long-time bipartisan group of House representatives answered the call for “common sense” legislation by pushing forward a plan that would include the following:

- A fully funded CSRs through an annual appropriations process;

- A dedicated stability fund;

- Adjusted employer mandate by raising the threshold for the mandatory offer of coverage, i.e. definition of an “applicable large employer” (ALE) from 50 to 500 and modifying the definition of “full-time employee” to 40 hours per week;

- A repeal of the medical device tax; and

- Technical and clear guidelines for states to innovate on their Exchange coverage through expansion of the ACA section 1332 waivers

3. New Amendment to the American Health Care Act (AHCA)

Senators create a new amendment that may provide one last opportunity to use the budget reconciliation action. Congress’ vote to use budget reconciliation for the fiscal year 2017 will expire on September 30. [Budget reconciliation allows the Senate to pass legislation with a simple majority, i.e. 51 votes, rather than a super majority, limits debate to 20 hours, and prevents discussion or amendments of anything extraneous or irrelevant. The trade-off is that it can only include items affecting the federal budget, e.g. revenue, expenses, or the debt limit, and can only be used once per fiscal year.]

This week, Senators Lindsay Graham (R-SC), Bill Cassidy (R-LA), Dean Heller (R-NV), and Ron Johnson (R-WI) introduced the newest amendment to the AHCA. It confirms much of the House-passed bill, like removing the penalties for the individual and employer mandates effective 2016, repealing premium tax credits and CSRs, and making improvements to Health Savings Accounts (HSAs). However, some of the following changes were implemented:

- Age restriction removed, previously only available to those under the age of 30, on the purchase of catastrophic health plans in 2019;

- Funds previously used for premium tax credits and subsidies re-purposed to create a market-based grant program for states. States may use these funds to do the following:

- help high-risk individuals, with no access to employer-sponsored coverage, to purchase coverage or reduce premiums;

- create programs with insurance carriers to stabilize premiums, promote participation and plan choice;

- provide funding assistance to reduce out-of-pocket costs for those with individual coverage; and

- provide health insurance coverage for Medicaid-eligible persons

- ACA’s annual contribution limit of $2,500 remains intact;

- ACA taxes left in place except for the medical device tax;

- Medicare Part D subsidy for employers restored;

- HSA monies can now be used to pay premiums for a high deductible health plan (HDHP) and allows reimbursement of expenses for children under the age of 27; and

- Individuals permitted to have an HDHP and pay for a primary care service arrangement costs, i.e. programs where a fixed fee is paid in exchange for covering primary care services only, like telemedicine programs, without losing all the function and tax-advantages of their HSA.

4. Medicare For All, i.e. Single Payer/Universal Healthcare

This plan comes to the forefront with a new bill introduced by Senator Bernie Sanders (D-VT). This program introduces a radical change from the current marketplace. It eliminates employer-sponsored coverage and expands Medicare to all individuals over a four-year period. The proposal enhances Medicare coverage to include dental, vision, hearing, palliative care, and long-term care in addition to health care services. There will be no networks, no out-of-pocket costs, i.e. deductibles and copays, and the government will negotiate with providers on the cost of medical goods and services.

Potential funding methods for this robust program include a 7.5% payroll tax to all employers, 4% household income tax, increase in taxes from employers and employees by elimination of pre-tax premium contributions, higher income tax and other taxes added to households earning more than $250,000, and additional taxes for those with net worth over $21 million.

So what happens now?

With this renewed energy in Congress, a new series of bills have been introduced that maintain the ACA, but provide improvements or fixes to help make it more workable and improve outcomes.

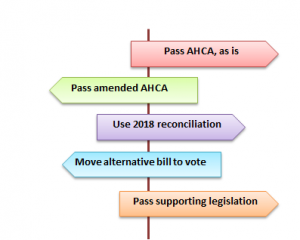

So what happens now? We’re really at a five-way cross on the road to healthcare reform.

- Budget Reconciliation Options

- Road 1 – Pass AHCA as is – Senate votes again on the AHCA with or without minor amendments

- Road 2 - Pass AHCA with new, GCHJ amendment that replaces the original language

- Road 3 – Abandon plans to use fiscal year 2018 budget reconciliation for tax reform and decide to use for healthcare reform

- Alternative Options

- Road 4 - Move an alternative repeal and replace bill to vote through regular order, like proposal from House Problem Solvers Caucus or one of a number of other bills introduced earlier this year

- Road 5 - Move radical market change legislation forward, like Medicare for All

- Road 6 – Work through regular order to pass supporting legislation to improve the ACA/li>

Visit our ACA Watch Page to stay up to date on healthcare developments.