In June 2015, the IRS released draft forms for certain employers to use to meet their reporting obligations under the Affordable Care Act (ACA). The instructions confirmed that employer-sponsored health reimbursement arrangements (HRAs) are subject to the ACA’s annual reporting requirements, regardless of employer size. This was the first official guidance declaring that small employers with fully insured health plans indeed could have ACA reporting requirements.

The ACA includes annual IRS reporting requirements for health plans and applicable large employers (ALEs), i.e. those employers with 50 or more full-time and full-time equivalent employees. A 2013 IRS notice clarifies that HRAs are considered health plans. As such, they are responsible for complying with health plan requirements under the ACA.

Most understood that health insurance companies, employers with self-funded health plans and ALEs would need to report under Internal Revenue Code section 6055 or section 6056. IRS released Notice 2015-68 clarifying reporting requirements for employer-sponsored HRA plans. This came just in the nick of time for small employers who had begun to scramble after having learned they were suddenly subject to ACA reporting for their HRA plans, even though they were integrated with fully insured group health plans.

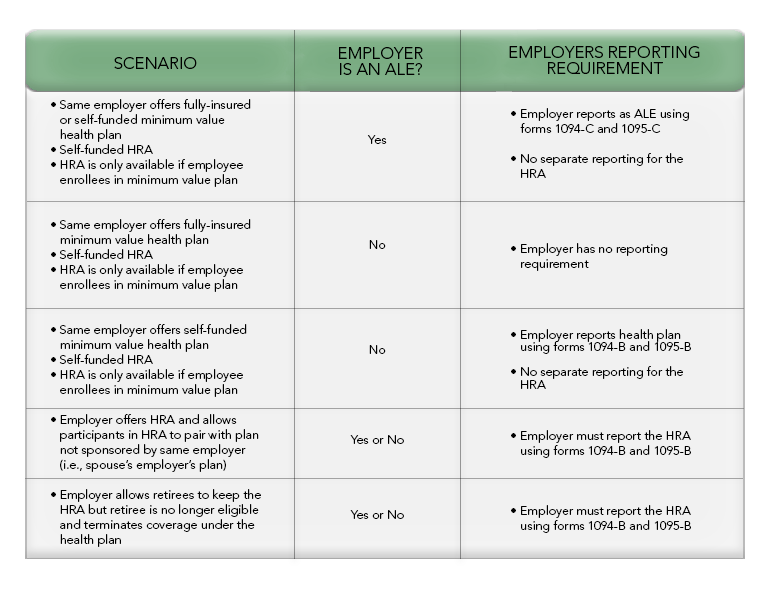

On September 17, 2015, IRS issued final reporting forms and instructions. The revised instructions state that when an employer offers a minimum value health plan coupled with an HRA plan, only one of the plans needs to report.

The following chart explains the reporting requirements in light of the guidance in the final instructions: