Though we just turned the page on 2012, January 1, 2014 will be here before we know it and that will mean a new insurance option for individuals and small businesses in Connecticut – the Connecticut Health Insurance Exchange.

By December 14, 2012, each state was charged with declaring to Health and Human Services their approach to offering an insurance Exchange. There were three possible approaches:

- State Exchange (19 states): Build and manage an Exchange at the State level

- Partnership Exchange (9 states): Work in concert with the Federal government to provide an Exchange

- Federal Exchange (22 states): Forgo building or partnering an Exchange and offer the Federal Exchange option

Connecticut is one of the states that is leading the way in the development and implementation of a state-based Exchange.

What is an Exchange?

An Exchange is an online “store” organized for the purpose of providing insurance options to individuals and small groups. The Exchange web portal will allow someone to compare health insurance plans and rates, determine their eligibility for any subsidy, and receive enrollment assistance via a call center.

In addition, there will be certified “Navigators” who will be available in communities to facilitate the education and enrollment of individuals.

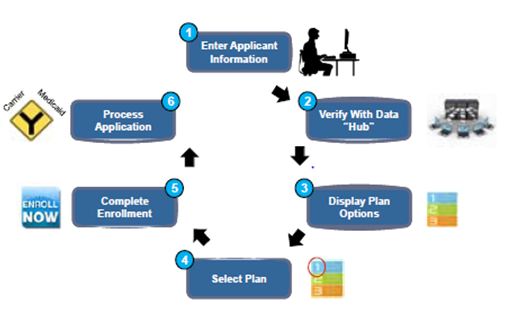

How will it work?

The following diagram outlines the intended process for the functioning Exchange:

How do the subsidies work?

A foundational provision of Healthcare Reform is to provide subsidies to the lower income population. Effective January 1, 2014, eligibility for Medicaid will be expanded to a threshold of 133% of the Federal Poverty Level. In addition, subsidized coverage through the Exchange will be available to individuals whose household income is between 134% and 400% of the Federal Poverty Level. Qualification for subsidy will be determined by the Exchange application process.

What about carriers?

As of January 4, 2013, all interested insurance carriers were required to provide a letter of intent on their interest in providing coverage through the Exchange. The medical carriers that responded are: Aetna, Anthem, ConnectiCare, Healthy CT and United Healthcare.

What about plan designs and rates?

The CT Health Insurance Exchange has recently defined specific coverage categories that will be required of all plans offered through the Exchange. There will be four plan designations–Bronze, Silver, Gold and Platinum. These plans will provide choices regarding coverage and price. Now that the selected carriers have responded, they will need to provide their rate filings via the Department of Insurance for approval. It is likely that final rate and plan information won’t be available until September 1.

What is SHOP?

In addition to individuals, the Exchange will also offer small businesses the ability to purchase coverage via the Small Employer Health Options (SHOP) Exchange. Employers with 50 fulltime employees or less will be eligible. The employer will need to contribute a minimum of 50% of the cost of the individual rate and maintain 75% participation (excluding spousal waivers).

When can I evaluate the Exchange options?

Open enrollment for January 1, 2014 will begin on October 1, 2013 and the Exchange is committed to meeting this date.

We will look to provide periodic updates as the year proceeds to keep you apprised of the Exchange. Should you have any questions regarding the Exchange please contact us at 860-409-7200.

Source material and graphic: The CT Health Insurance Exchange