One of the Affordable Care Act’s (ACA) revenue-generating provisions is a requirement that group health plans pay a designated amount annually, for a three-year period that started last year, known as the Transitional Reinsurance Fee. Congress established this fee to help stabilize premiums in the individual market that it feared would skyrocket with dire effects in the wake of ACA implementation.

The Transitional Reinsurance Fee Program requires health insurance issuers and self-insured group health plans to contribute for 2014, 2015 and 2016 benefit years in an amount to be determined by the U.S. Department of Health and Human Services (HHS). This does not apply to those who do not use a TPA for claims processing, claims adjudication or enrollment. The Transitional Reinsurance Fee was $63 per covered life for 2014, reduced to $44 per covered life this year, and is projected to drop to $28 per covered life for 2016.

Health plans (including most self-insured plans), other than those listed below, must report and pay the Transitional Reinsurance Fee according to a process and schedule HHS established last year. HHS requires plans to report, through a portal on www.pay.gov, annual enrollment figures by no later than November 16.

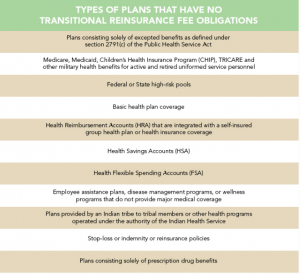

The following types of plans have no Transitional Reinsurance Fee obligations:

Self-insured employers must determine and report the applicable number of covered lives on whom they must pay a Transitional Reinsurance Fee as follows:Plans can pay the 2015 fee either in one lump sum by no later than January 15, 2016, or in one installment of $33.00 per covered life due no later than January 15, 2016, and another installment of $11.00 per covered life due no later than November 15, 2016.

- Actual count method - each covered life for each day of the first nine months of the year ÷ by number of days in first nine months

- Snapshot method – choose one or more corresponding days each of the first three calendar quarters of the year

- Count = add covered lives on those dates ÷ by number of days chosen

- Factor = add number of participants with self-only coverage on designated dates + 2.35 times the number of participants with other than self-only coverage; divide sum of covered lives on those dates by number of days chosen

- Form 5500 method

- Offering employee coverage only – add number of participants reported at beginning of year to the number reported at end of year and divide by two

- Offering employee and any other family coverage – add the total participants covered at the beginning of the plan year to the total participants covered at the end of the plan year

CMS has announced that it will provide a hotline to assist contributing entities in completing the 2015 ACA Transitional Reinsurance Program Annual Enrollment and Contributions Submission form. This hotline will be open during the dates and times specified below (all times ET). In addition, CMS will respond to questions sent to [email protected] and has web-based training available at https://www.regtap.info/ricontributions.php.

If you have any questions regarding the Transitional Reinsurance Fee Program, or any other aspect of the ACA, please contact your OneDigital advisor.