Understanding the Pros and Cons of This Health Care Cost Sharing Alternative

Growing in popularity since the implementation of the Affordable Care Act (ACA) in 2014, Health Care Sharing Ministries (HCSMs) provide individuals with a unique option to obtain assistance with healthcare expenses. These reimbursement programs are available to both individuals and employers and operate very differently than traditional insurance coverage. HCSMs may be a fit for certain individuals. Before entering into these arrangements, it’s important to understand the rules of each organization, how they operate, and the associated benefits and challenges.

Background

HCSMs began appearing in the 1990s. The majority of HCSMs began from a single organization, such as a local or global church or ministry, for the benefit of its own members. Approximately seven have open memberships, i.e. do not predicate membership on belonging to a specific church or organization.

The three largest open HCSMs are Christian Care Ministry (Medi-Share), Christian Health Care Ministries, and Samaritan Ministries. These three form the Alliance of Health Care Sharing Ministries representing nearly one million members.

Description

HCSM’s are religious organizations or non-profit/charitable organizations that organize and administer programs for members to help other members with their healthcare expenses. Most programs are offered to individuals and families but there are also programs for employers and organizations. HCSMs do not provide healthcare services nor are they insurance plans.

Participation Rules

Participation rules vary with each HCSM. Closed HCSMs are based upon membership with a given church or organization. For open HCSMs, participation is generally a personal attestation. Some examples of these are:

- Christian religious affiliation or shared set of beliefs

- Regular attendance at group worship

- Refraining from use of tobacco or illegal drugs

- Have a mailing address or access to the internet

- Refraining from sex outside of traditional Christian marriage between a man and a woman

Medical Expense Reimbursements

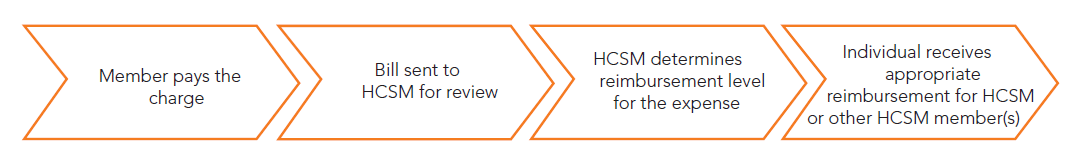

There are a few different reimbursement methods. Here is the typical reimbursement model:

Each HCSM plan contains its own list of eligible expenses. The member shares in some portion of the cost of each expense. HCSM plans may exclude preventative care, expenses for pre-existing conditions, certain types of therapies, and any expenses resulting from non-compliant activities and behaviors and may limit amounts payable on a per charge, per illness, or calendar year basis. Some HCSMs offer ways for members to help finance non-shareable expenses through special savings arrangements. Like insurance plans, the individual is ultimately responsible for all expense payments.

Contributions

Each HCSM requires monthly contributions. Amounts vary based on factors, such as number of family members, generosity of the reimbursement plan selected, and age. There is encouragement for individuals to contribute or donate more than these minimum monthly contributions.

Taxability and Interaction with Requirements of the Affordable Care Act (ACA)

Under the ACA, each individual is required to have minimum essential coverage, qualify for an exemption, or pay a penalty. HCSMs meeting certain criteria are exempt from the individual mandate (IRC Sec. 5000A). To qualify for exempt status, the HCSM must:

- be a tax-exempt organization under Code Sec. 501(c)(3) (a public charity);

- require that its members share a common set of ethical or religious beliefs, and share medical expenses among themselves in accordance with those beliefs and without regard to the State in which a member resides or is employed;

- retain their memberships even after they develop medical conditions;

- have been in existence at all times since December 31, 1999, and its members must have shared their medical expenses continuously and without interruption since at least December 31, 1999; and

- conduct an annual audit and make available to the public upon request

Treasury letter 2016-0051 (https://www.irs.gov/pub/irs-wd/16-0051.pdf) confirms that HCSMs are not minimum essential coverage and do not satisfy an offer of coverage for the purposes of the ACA’s employer mandate.

HCSM/Insurance Comparison

Plan Attributes |

Health Care Sharing Ministry |

Health Insurance |

| Must contain essential health benefits | X | |

| Offers plan design options | X | X |

| Must include state-mandated coverage | X | |

| Low monthly contributions | X | |

| Full coverage for pre-existing conditions | X | |

| Regulated by the Department of Insurance | X | |

| Governed by prompt pay regulations | X | |

| Maximum on maternity benefits | X | |

| Member negotiates discounts on bills | X |

DOWNLOAD THE INFOBRIEF: Health Care Sharing Ministries.

To learn more about Health Care Sharing Ministries reach out to your OneDigital representative today.