Better Benefits, Lower Costs

Which Funding Model is Right for Your Employer-Sponsored Health Plan? It Depends on Your Appetite for Risk

Which Funding Model is Right for Your Employer-Sponsored Health Plan? It Depends on Your Appetite for Risk

For most full-time workers in the United States, access to health insurance is an expected, non-negotiable condition of employment.

Unfortunately, the cost of providing these benefits is becoming increasingly unsustainable for employers everywhere, with most employers facing higher-than-normal renewal increases this year due to inflation, labor shortages, and increased demand for care.

What Can Employers do to Combat Rising Health Care Costs?

There are several different strategies that businesses can use to fund and administer their health plans. Employers who are willing to learn about their options, think critically about the pros and cons of each, and adopt the funding model that is the best fit for the needs of their business and employees stand to realize significant savings.

Finding the right fit can have positive ramifications that go well beyond your company’s bottom line. Optimizing your health plan can result in better health outcomes for employees, reduced financial stress within your workforce, and elevated productivity, morale, and loyalty. For these reasons and more, it’s important to take the time to understand the primary health plan funding models and map them to the needs of your organization and population.

Understanding Different Health Plan Funding Models

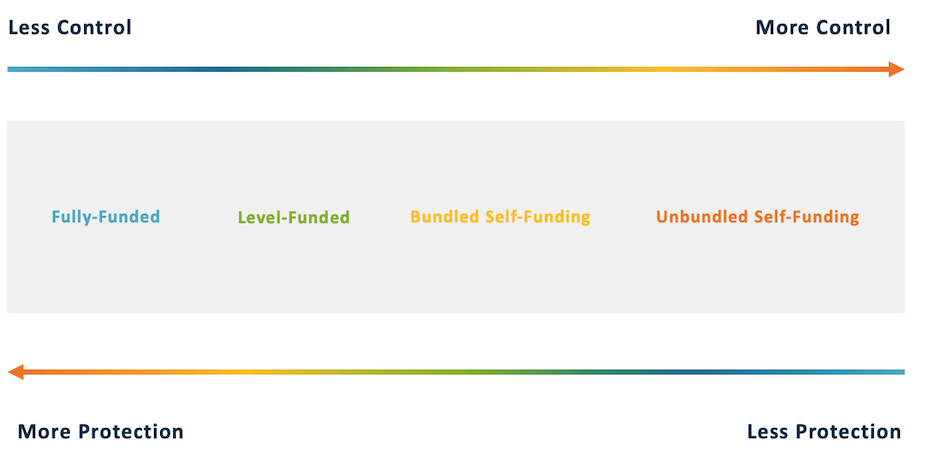

When weighing the pros and cons of different plan types, it is beneficial to conceptualize them as existing within a continuum. This continuum is defined by a central trade-off between plan protection and plan control.

Here, “protection” refers to protection from the financial risks that can result from higher-than-expected plan usage or catastrophic claims. High-protection levels tend to correlate to higher premium costs, more stable and predictable health expenditures, and less transparency into how an organization’s health dollars are being spent.

“Control” refers to the ability of plan sponsors to customize their plan design according to the needs of their organization, determine what is covered and how, and pick which health vendors and service providers they would like to work with. High-control plans tend to correlate to lower costs, a higher degree of financial risk (although this can be mitigated), and greater access to health spending information.

The three most common funding models for employer-sponsored health plans are:

1. Fully insured plans

2. Level-funded plans

3. Self-funded plans

These three models represent different levels of protection vs control, and it is critical for business and HR leaders to understand the pros and cons of each. An abridged version of these pros and cons are laid out below. A more detailed version of this piece can be found in the Cost Containment Playbook, along with dozens of actionable policy recommendations that employers can use to reduce their spending.

From least to most control: Fully insured health plans, level-funded health plans, “bundled” self-funded health plans, and “unbundled” self-funded health plans.

Fully insured health plans sit at the far end of the continuum, representing the highest degree of financial protection but the lowest degree of control. Plans that are fully insured offer employers predictable month to month expenses, and protection against higher than expected claims spend. However, they provide plan sponsors with limited opportunities for input, transparency, and customization. Fully insured health plans are by far the most conservative of the bunch, with organizations sacrificing control over their plan in exchange for maximum protection.

Level-funded health plans sit close to Fully insured plans on the protection-control spectrum, but are a little less rigid. Level-funded plans are often the first step that fully insured employers take on their way to becoming self-funded. Level-funded arrangements still have the benefit of predictable month-to-month expenses and protection against higher-than-expected utilization, but employers gain more transparency as to “where” their health plan dollars are going. In periods where plan usage is lower than expected, plan sponsors may receive a dividend from the carrier in the following plan year. In periods where the plan usage is higher, the employer is limited in liability but may see their costs increase in the following plan year.

Self-funded health plans represent the highest degree of control a plan sponsor can take, as well as the highest degree of financial responsibility. All mid-market and large self-funded plans have the following components: a medical administrator, a pharmacy benefit manager, reinsurance protection for catastrophic plans, and either purchased access to an existing health network or another mechanism that determines how claims will be paid. These components can be “bundled” with the same carrier, or “unbundled” with different vendors taking over one or two of the components.

Bundled self-funded arrangements are often viewed as a favorable next step after level funding, but employers may also transition straight from a fully insured plan. In a bundled arrangement, plan sponsors will partner with a major medical carrier to administer all components of their health plan. The employer takes on all the financial risk under their reinsurance limit, and the carrier takes on the administrative lift. Unbundled self-funded plans are at the farthest end of the risk-protection spectrum due to the level of control employers gain by moving fully away from the medical carrier arrangement. Unbundling allows plan sponsors to pick “best in class” providers to administer their health plans; this can result in some additional administrative lift on the employer’s end, but typically yields the highest level of savings.

Employers with unbundled plans have the option to pursue strategies like reference-based pricing, insurance group captives, and carved-out pharmacy benefit managers.

You can learn about these and other solutions in our Cost Containment Playbook. To discuss the above funding models and more, connect with a OneDigital workforce strategist.