Retirement Plan Administration

A shifting regulatory environment may have your team feeling stressed and unprepared.

How is your company addressing this workforce crisis?

A mismanaged retirement plan can result in testing and audit failures and lead to unforeseeable expenses potentially impacting your company's financial stability.

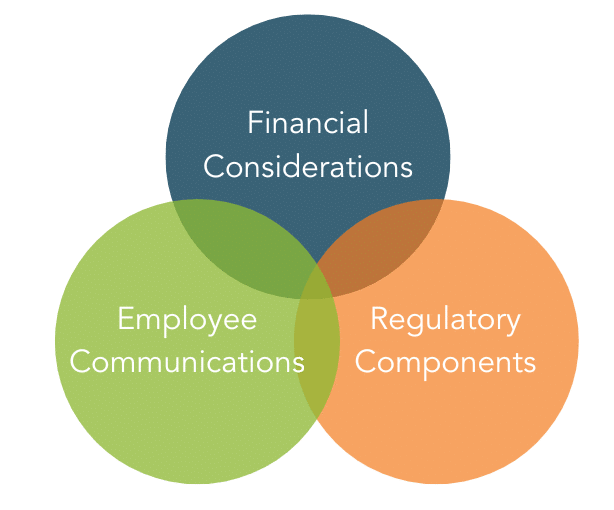

In partnership with a team of qualified plan administrators, leading companies align plan provisions with organizational objectives by integrating financial considerations, employee communications and regulatory components into a unified strategy.

OneDigital offers a range of third-party administration services customized to proactively design and administer a plan that supports employees appropriately and remains audit-ready.

Full-Service Plan Administration

OneDigital Retirement Plan Administration specialists manage impacts and stress associated with managing a retirement plan in a shifting regulatory environment.

PLAN DESIGN STRATEGIES

Improve effectiveness and alignment with workforce demographics.

REDUCED HR BURDEN

Delegate day-to-day operations, including required communication, filings and processes.

EFFECTIVENESS & COST

Understand the implications of the proposed changes on your workforce and budget.

TESTING & AUDIT OVERSIGHT

Reduce stress and minimize responsibility, liability and risk of unexpected expenses.

Employer Resources

Be Prepared for Your Retirement Plan Audit

Avoid potential regulatory fines by getting guidance around who is eligible, required documentation and more before your next retirement plan audit.

How to Understand Retirement Plan Benchmarking as a Plan Sponsor

Learn the potential benefits of benchmarking your retirement plan on a regular basis.

OneDigital | RETIREMENT PLAN ADMINISTRATION

Is your team audit ready?

Companies of all sizes are required to complete testing for their qualified retirement plans. Reduce stress and likelihood of surprises by engaging with our team of qualified retirement plan administrators to ensure plan health. Contact OneDigital to talk with a dedicated member of our Retirement Plan Administration team today.