Lower Costs

Q1 2023 Markets In Focus: A Look Back at 2022 and What It Means For the Road Ahead

Q1 2023 Markets In Focus: A Look Back at 2022 and What It Means For the Road Ahead

Looking back, 2022 will be remembered as a very difficult year for investors.

It was only the second time since 1975 that both equity and bond indices experienced a negative return. Fixed income simply didn’t work as a diversifier to equity. The Bloomberg U.S. Aggregate Bond index experienced its worst year ever, declining by around 13%. And the Standard and Poor’s 500 index (S&P 500) was lower by 18.1% with ten of the 11 sectors ending the year negative—only the energy sector produced a positive return.

While the year won’t be easy to forget, most investors likely wish they could.

Will 2023 be a repeat of last year, or is the worst behind us? Will geopolitical tensions ease and inflation return to normal levels? There are a lot of uncertainties right now, and arguments can be made on either side whether we will see a recovery or further pain in markets.

Geopolitical Landscape

The biggest headline from the beginning of 2022 was the Russian invasion of Ukraine in early March. Not only has it been a humanitarian disaster, but it has also had severe impacts on the global economy. Energy prices rose dramatically as Russia—a key global supplier of oil, gas, and coal—faced sanctions from countries around the world for their actions. Food prices were also impacted because Russia and Ukraine are two of the largest wheat exporters in the world.

If Europe falls into recession in 2023, a large contributor will be related to rising energy prices, which have taken away money that households would likely spend elsewhere. Europe had the benefit of a mild autumn and built up its gas reserves. However, it remains susceptible to a bitterly cold winter that could further increase prices and lead to energy rationing.

China also remains a large question mark because of the changes in how it’s facing the COVID-19 pandemic. The Chinese government has made a dramatic shift from a zero-COVID policy with harsh lockdowns and quarantine periods, to a “living with COVID” policy that is cautiously reopening the economy. China’s reluctance to adopt vaccines from the West has led to low vaccination rates that may cause more spread of the virus. And the Chinese healthcare system is less comprehensive than Europe and North America, with the potential to become overwhelmed by increased spread.

The bright side to China’s reopening is the probability that further easing of supply chain disruptions should help lower goods inflation. The downside is that China may have increased demand for energy coming out of lockdown, which could put even more pressure on energy prices.

It’s expected that global political tensions may decrease in 2023, which should reduce market uncertainty and help calm investors’ nerves. Even with the outcome of the Russia-Ukraine conflict in question, the likelihood of increased tensions with China are falling. The economic incentives are high for cooperation, as the Chinese economy still depends heavily on demand from the rest of the world for its goods, and vice versa.

Inflation, Jobs, and The Fed

The hopes that the post-pandemic inflation would be a transitory phenomenon faded throughout 2022.

-

-

The prices we pay

The personal consumption expenditures (PCE) price index is a measure of the prices that people pay for goods and services. November’s core PCE was 4.7%, much higher than the Federal Reserve’s target of 2%. It has come down from the high of 5.4% early last year, as supply chain issues decrease, and Americans shifted from spending money on goods to services. The slow pace of inflation’s retreat has caused the Fed to hike interest rates much more aggressively than they had planned.

-

Interest rates

Heading into last year, the interest rate was projected to be 0.9% at the end of 2022. Right now, it’s 4.38% and is expected to rise above the 5% mark early this year. The pace of increases was astonishing, and never before has the Fed increased rates as quickly as they did last year. In all, there were seven hikes, including an unprecedented four consecutive hikes of 0.75% and then a 0.50% increase in December.

-

The question heading into 2023 is whether the Fed can engineer a soft landing, where the goal is to tame inflation back to an acceptable range without harming the economy so much that it forces a recession. While global supply chains improved over the past 12 months, the shift of U.S. consumers to services is adding pressure to the jobs market.

This is pushing wages higher and threatens to cause a wage-price spiral where inflation leads to higher wage growth, which increases demand and causes more inflation.

The Fed’s job of creating a soft landing may be easier this time. One reason why? A tighter jobs market caused by unfilled positions.

In the past, tight jobs markets and wage inflation were caused by over-hiring. Once economic growth slowed, many companies had to right-size by reducing their workforce.

This time it’s different. Job openings surged coming out of the pandemic as employers tried to keep up with the fastest economic recovery ever seen, all while competing with a work environment that involved possible exposure to COVID-19 and attractive unemployment benefits that, in some cases, incentivized workers to stay home.

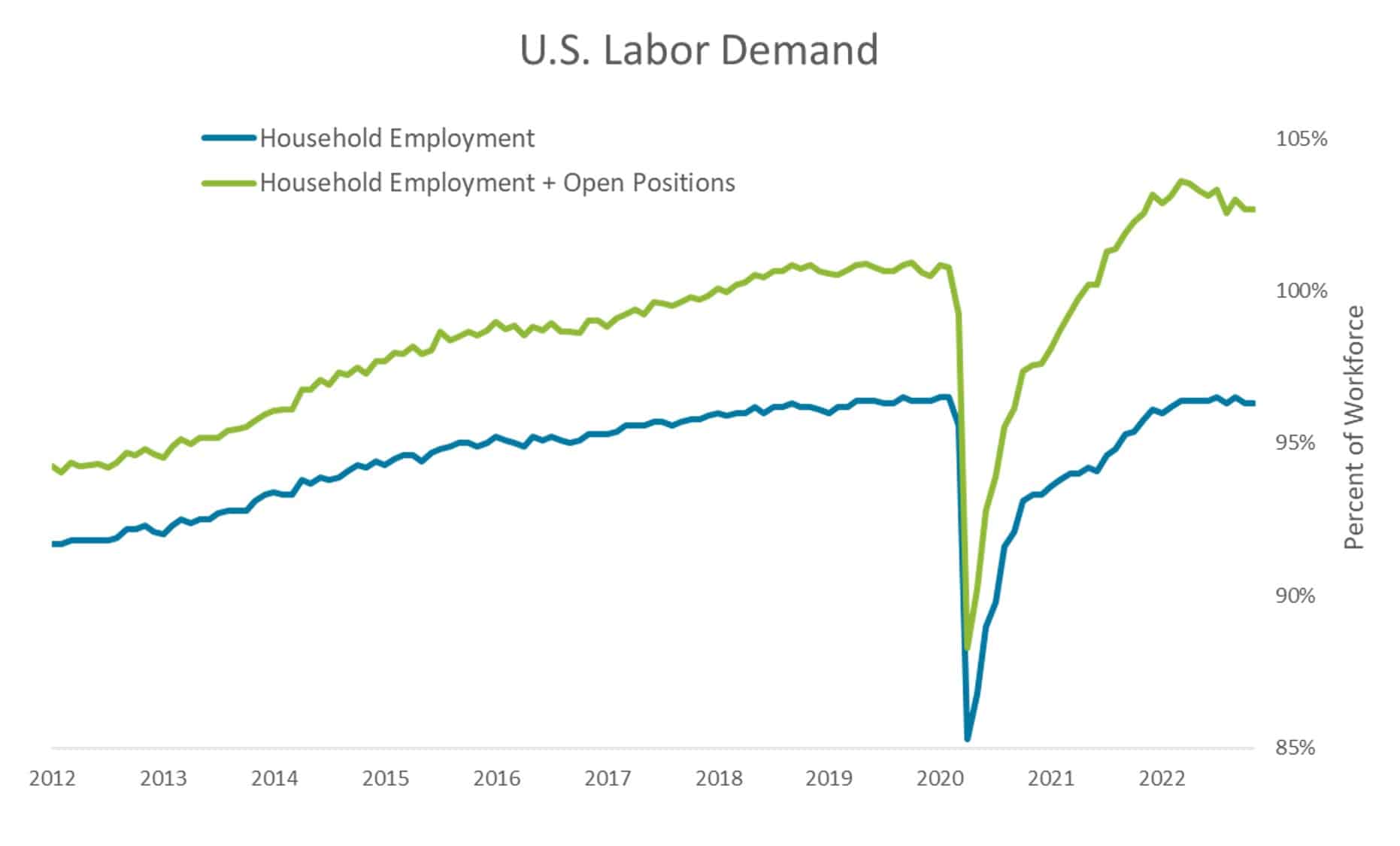

Household employment is now at the same level as it was prior to the pandemic, but the number of job openings was historically high last year, according to the economic data from the St. Louis Fed. The amount of job openings has been declining, and the gap between available jobs and workers has come down since it peaked in the second quarter of 2022. As openings continue to decrease, it should naturally take some of the wage pressure off.

As the economy slows, there will be some pain in the jobs market. In fact, we’re already seeing it in industries such as tech and real estate, which may have over-hired. Yet the process of eliminating open positions instead of laying existing workers off should dull some of the some of the impact of a slowing economy on the jobs market.

U.S. Consumers

The U.S. consumer stats remained strong for most of 2022, but some cracks began to form toward the end of the year. The November retail sales report showed the largest decline of the year, falling 0.6% from the previous month. Most of the pullback in sales came from holiday-related purchases, home projects, and automobile sales.

The personal savings rate also declined throughout 2022, falling to 2.4% in November, the lowest level in more than 17 years and down from 7.5% at the end of 2021. U.S. consumer reliance on credit cards also increased, with the total balance in the U.S. increasing 17% in 2022 to $938 billion. The U.S. consumer isn’t in a poor condition yet, but it’s certainly not a strong as it was 12 months ago. Consumer sentiment surveys at the end of the year are lower than normal, but have recovered, likely from declining energy prices.

One part of the economy that has been hit quickly from the Fed action has been housing, with interest rates more than doubling to around 7% in 2022. Fortunately, only about 5% of U.S. mortgages today are adjustable-rate loans, far fewer than we saw in 2007 prior to the housing market collapse when more than 20% of loans were adjustable. While home prices remain elevated, the number of existing homes sold and new homes constructed is down because affordability has declined.

The Market and 2023 Outlook

Last year marked just the tenth time in the past 86 years that the S&P 500 was down double digits. Valuations improved on U.S. large cap stock, with forward price-to-earnings ratios dropping below the 25-year average for the first time since the pandemic. This creates a setting for a possible market recovery in 2023, but a lot of uncertainty remains.

Consumer confidence tends to have an inverse relationship with forward returns. The past eight times sentiment peaked, the average S&P 500 return over the next 12 months was 4.1%. The past eight times it bottomed, the average return over the next 12 months was 24.9%. The trough that consumer sentiment reached last summer was lower than November 2008.

And there is further reason to take heart. Since 1936, there have only been three times of repeated negative calendar years for the S&P 500: the first years of World War II, the oil crisis of the 1970s, and the tech bubble burst of the early 2000s. Additionally, with the increase in interest rates, bonds now offer capacity to play a diversification role again. Rates have room to move down if the economy sours, leading to potential capital appreciation. True, if inflation remains stubborn rates could continue to rise in 2023 but, should the Fed be successful, even if triggering a recession, a balanced portfolio is likely to perform better this year than last.

For more information about interest rates, jobs, and the economy, visit the Markets in Focus page for more news and commentary from 2022.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.

Any economic forecasts made in this commentary are merely opinion, and any referenced performance data is historical. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. All investments are subject to risk of loss, and any investment strategy may lose value. Past performance is no guarantee of future results.