Is It Time to Update Your ERISA and Cafeteria Plan Document?

Author

Article Summary

Our team of compliance experts has identified several important plan documents to focus on to help ease any challenges with remaining compliant. They’ve also included a comprehensive list of situations that might trigger an update, helping your organization maintain the necessary documents.

Maintaining current plan documents is an integral part of being ERISA compliant.

Our team of compliance experts has identified several essential plan documents to focus on to help ease any challenges with remaining compliant. They’ve also included a comprehensive list of situations that might trigger an update, helping your organization maintain the necessary documents.

Two documents to keep an eye on are Wrap Documents and Section 125 Premium Only Plan (POP) documents. Although these documents do not apply to all employers, employers who have them should keep them current.

- A Wrap Document “wraps” around an employer’s insurance policies and coverage certificates, and adds the language necessary to comply with Employee Retirement Income Security Act of 1974 (ERISA) requirements.

- A Section 125 Plan Document, or POP Plan Document is a document that allows employers to take certain premium deductions for employees on a pre-tax basis.

If an employer has one, or both of these plan documents, they should be reviewed annually to ensure there have been no changes that would require the document to be updated.

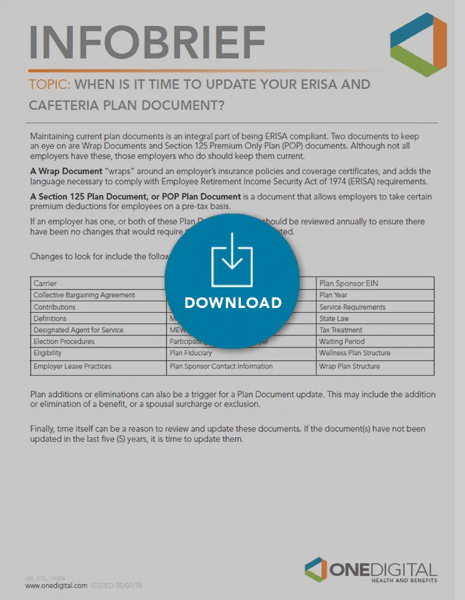

The following is a list of changes to look for:

| Carrier | Funding Arrangement | Plan Sponsor EIN |

| Collective Bargaining Agreement | Group Control Status | Plan Year |

| Contributions | HIPAA Privacy/Security Officer | Service Requirements |

| Definitions | Measurement Periods | State Law |

| Designated Agent for Service | MEWA or PEO Status | Tax Treatment |

| Election Procedures | Participating Affiliated Employer | Waiting Period |

| Eligibility | Plan Fiduciary | Wellness Plan Structure |

| Employer Leave Practices | Plan Sponsor Contact Information | Wrap Plan Structure |

Plan additions or eliminations can also be a trigger for a plan document update. This includes the addition or elimination of a benefit, or a spousal surcharge or exclusion.

Finally, time itself can be a reason to review and update these documents. If the document(s) have not been updated in the last five years, it is time to update them.

DOWNLOAD THE INFOBRIEF: When Is It Time to Update Your ERISA and Cafeteria Plan Document?

For more information regarding best practices for updating plan documents or other questions related to ERISA compliance, reach out to your OneDigital representative today.