Markets in Focus: 2026: Staying Smart - Navigating Market Complexities

Author

Article Summary

2026 market outlook: Expect broader equity leadership, ongoing AI impact, policy-driven volatility, and continued uncertainty across asset classes.

As we enter 2026, it’s important to recognize that 2025 marked another year of strong performance across most asset classes, continuing a multi-year trend of robust market returns.

In such environments, it’s common for investors to experience heightened optimism, with some believing the rally will persist indefinitely, while others grow apprehensive that markets may be nearing a peak. Both extremes—excessive confidence and undue fear—can pose risks to sound decision-making.

The core principles of disciplined investing remain just as crucial after periods of significant market gains as they do following selloffs. Regardless of recent performance, maintaining focus on long-term objectives and sticking to a well-considered investment strategy is vital. Letting short-term emotions dictate portfolio changes can be detrimental, especially given how quickly market conditions can shift. For example, recent headlines about the United States’ involvement in Venezuela have generated considerable attention, but market reactions have been far from straightforward—demonstrating that news events do not always translate into clear or predictable moves in asset prices.

With these principles at the forefront, our outlook for 2026 emphasizes the importance of staying grounded: continue to expect uncertainty and volatility, and periodically review your portfolio to ensure it aligns with your intended risk profile and goals. Rather than making drastic changes in response to headlines, the prudent course is to recalibrate holdings as needed to remain consistent with your strategic plan.

Looking ahead, we identify three major themes likely to shape investment conversations in 2026, along with three key risks and three recommended actions to help investors remain focused in the face of ongoing market fluctuations.

Themes That May Shape 2026

Theme 1: Equity leadership may broaden beyond the “Magnificent 7.”

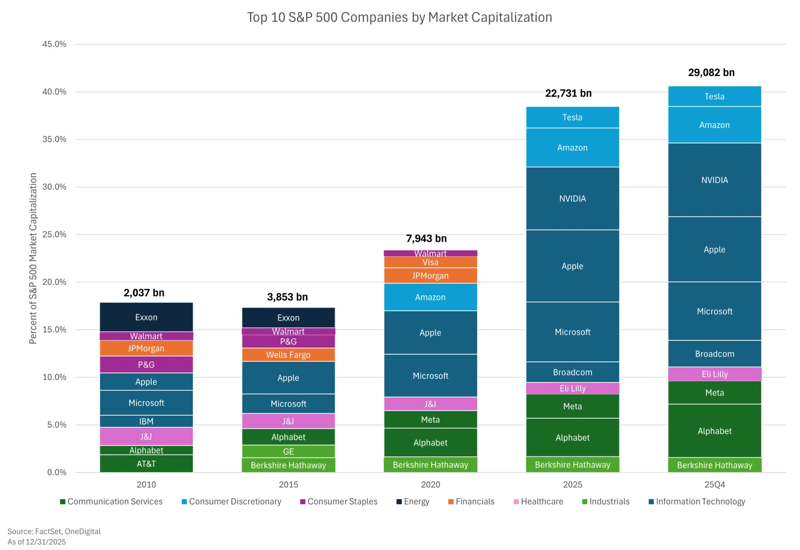

In recent years, the performance of the U.S. stock market has been heavily influenced by a small group of well-known companies, often referred to as the “Magnificent 7”: Alphabet (GOOG & GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA).[1] This group has driven much of the market’s returns, resulting in greater market concentration than many investors may realize.

Looking ahead, we may see a broader range of companies leading market gains. Instead of relying on a select few, returns could increasingly come from a wider variety of businesses as other sectors “catch up.” This broadening of market leadership is generally a healthy development.

Why is this important? When market leadership is concentrated, broad market indexes can behave more like narrow bets, potentially exposing investors to higher risk. If leadership expands, diversification becomes more effective, as more companies and sectors contribute to overall returns. This is why we are focusing on both the risks of concentration and the potential benefits of diversification as we approach 2026.

The key takeaway isn’t to bet against the Magnificent 7, but rather to recognize that a diversified portfolio may have more opportunities for success if market leadership becomes less concentrated. In other words, even though there is more concentration in large cap indices these days, you are still getting exposure to hundreds of other companies. This highlights the importance of staying committed to a long-term investment plan.

Theme 2: AI remains important, but the focus shifts from hype to real-world ROI

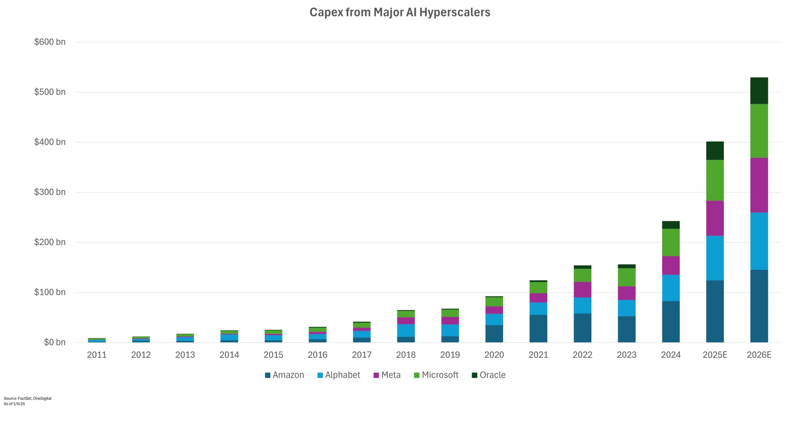

Artificial intelligence will likely remain a defining theme in 2026, but we expect the conversation to shift. Markets have already priced in a lot of optimism. The next chapter is less about headlines and more about results: where does AI actually improve productivity, lower costs, or increase revenue?

BlackRock’s Investment Institute, for example, points to AI-related capital spending as a meaningful support for growth, while also highlighting that investors are watching whether that spending translates into real returns.[2] That “capex-to-ROI” question matters because it’s a bridge between excitement and fundamentals. Spending is easy to measure; value creation takes time, and it’s rarely evenly distributed.

Three real-world examples illustrate what we mean:

- Healthcare workflow: AI tools can help reduce administrative workload, streamline documentation, and improve how clinicians access information. The goal is not to replace clinicians, but to make time and decision-making more efficient.

- Manufacturing automation: AI-driven quality control and predictive maintenance can reduce downtime and improve output. In many industries, small improvements in efficiency compound quickly over time.

- OneDigital: Within our company, AI tools are being developed in-house to ensure that employees have the best resources available to do their jobs. We now have 11 specialized “AI Coworkers” that can help us with tasks like reviewing SEC documents, comparing Property & Casualty quotes, improving the efficiency of our operations team, or even comparing in-house employee benefit offerings during open enrollment.

Our stance is optimistic but measured. AI may continue to support productivity and investment, but the winners may be less obvious than the headlines suggest. In a market where expectations are high, fundamentals matter more. Ultimately, sustained success will depend on the tangible impact AI delivers to businesses and the broader economy.

Theme 3: Policy uncertainty elevates volatility

In 2026, markets may be influenced as much by policy choices as by the traditional business cycle. Trade policy and fiscal decisions can affect both growth and inflation, which in turn may impact how investors view interest rates and corporate earnings.

The future leadership of the Federal Reserve, with Jerome Powell’s term as Chairman scheduled to end in May 2026, is an important event that markets will be monitoring. President Trump is expected to announce a successor early in the year, and there is some uncertainty regarding how the new chairman may approach decision-making.

This is also a U.S. midterm election year, and investors should be prepared for political headlines to generate volatility. In a highly polarized environment, the daily news flow can swing sentiment quickly, even if it doesn’t change long-term fundamentals.

Three risks we’re watching

To be clear, risks are not predictions; they are indicators we monitor. Our objective in tracking these risks is not to react to headlines, but to assess whether changing conditions could influence market volatility and investor expectations over the long term.

Risk 1: Inflation re-acceleration (or inflation that stays sticky)

While inflation has cooled significantly from its peak, the risk remains present. A resurgence in inflation—whether driven by robust demand, supply limitations, or policy decisions—could keep interest rates elevated and increase market volatility.

Key indicators we’re monitoring include CPI and PCE inflation trends, consumer spending patterns, and the labor market, with particular attention to whether unemployment remains stable or declines rapidly. [5][6][7][8]

If inflation rises while economic growth remains strong, markets may become concerned about the prospect of sustained higher interest rates. Conversely, if inflation falls but the job market weakens sharply, worries may shift toward slowing growth. In either scenario, these developments have the potential to exert significant influence on overall market dynamics.

Risk 2: Geopolitical and policy shocks

Geopolitical events can change risk sentiment quickly, even when the long-term economic impact is uncertain. For example, the war in Ukraine remains an ongoing global risk factor and a source of market-moving headlines.[9]

Geopolitical uncertainty isn’t limited to one region. We have seen continued tension in the Middle East involving Israel, Palestine, and Iran, amongst others. And recent events in Venezuela, where U.S. forces arrested Venezuelan President Nicolás Maduro, was a major global headline to start the year, with international legal and diplomatic questions receiving significant attention.[10]

Rather than being rare disruptions, geopolitical developments are a constant feature of global markets—making it difficult to anticipate both their timing and their ultimate impact on investor sentiment and asset prices.

Risk 3: Concentration and valuation risk—especially if AI expectations disappoint

When a small group of companies drives a large portion of market returns, expectations can become demanding. In that environment, markets become more sensitive to disappointment: slower revenue growth, weaker margins, or earnings that fail to keep pace with elevated expectations.[2]

This risk intersects with AI. It’s not that AI “stops being important.” It’s that investor expectations can run ahead of business realities, and markets can re-price quickly if results lag. The “capex-to-ROI” question is a simple way to track that gap between investment and outcomes.[2]

What we’re watching: whether the largest technology companies continue to deliver revenue and profit growth consistent with valuations; whether earnings expectations keep rising (and whether companies meet them); and whether heavy capital spending translates into measurable returns over time. If not, markets will have a hard time sustaining positive momentum in 2026.

Three actions investors can take (without making dramatic changes)

Even in uncertain years, the most effective investor behaviors are usually simple and repeatable. Here are three actions that can help investors stay aligned with long-term goals:

- Reset to target weights. If markets moved your portfolio away from your intended allocation, rebalancing can bring risk back in line. For example, if your target was 60/40 and strong stock performance pushed you closer to 70/30, resetting to targets helps restore the risk level you originally chose. This isn’t about “timing” but about maintaining the plan you started with. Even if there are tax consequences, it is often a prudent move to make.

- Stay diversified & avoid narrow bets. Dispersion can reward selectivity, but it can also punish portfolios that are too concentrated. If leadership broadens beyond the Magnificent 7, diversification may improve returns. Even if leadership stays narrow in 2026, diversification remains a valuable risk-management tool.

- Don’t let uncertainty distract you. Your plan is built for uncertainty. Markets will always have risks, and headlines will always be loud at times. The goal is not to avoid volatility. Instead, it’s to make sure volatility doesn’t cause decisions that weaken long-term outcomes. Rededicate yourself to your plan and have confidence.

- Engaging with an advisor you trust can be invaluable in helping investors accomplish these goals. Advisors can provide objective guidance, helping you stick to your plan during turbulent times and navigate complex decisions such as rebalancing or maintaining diversification. Their expertise can ensure that your strategies remain aligned with your long-term objectives, giving you confidence even when markets are unpredictable.

Conclusion: A plan built for uncertainty

We do not believe that investors need to make significant changes to their strategies in order to navigate 2026. However, investors should anticipate a landscape marked by uncertainty and volatility. The appropriate response is to remain disciplined and adhere to the established investment plan.

OneDigital advisors are supported by a dedicated team of investment professionals focused on manager oversight, due diligence, and ongoing monitoring. That structure allows advisors to stay focused on what matters most: helping clients clarify goals, align portfolios to risk tolerance, and stay disciplined through changing market conditions.

If you’re unsure whether your current allocation still matches your intended risk level, now is a good time to review it with your advisor. In a year where outcomes are uncertain, and headlines may be loud; the most important advantage is often the simplest one: a plan you can follow.

Want to read more about how you can better prepare your retirement plan? Check out this blog post, “The Modern 401(k): Meeting the Evolving Needs of Today’s Workforce”

Sources:

[1]U.S. News & World Report, “What are Magnificent Seven Stocks?”

[2]BlackRock Investment Institute, “2026 Investment Outlook”

[3]J.P. Morgan Asset Management, “2026 Year-Ahead Investment Outlook (PDF)”

[4]Reuters, “Fed Faces Turbulent 2026 as Powell’s Term Ends, Independence Tested”

[5]U.S. Bureau of Labor Statistics, “CPI Home”

[6]U.S. Bureau of Economic Analysis, “Personal Consumption Expenditures Price Index”

[7]U.S. Bureau of Economic Analysis, “Consumer Spending (Personal Consumption Expenditures)”

[8]FRED (Federal Reserve Bank of St. Louis), “Unemployment Rate (UNRATE)”

[9]Council on Foreign Relations, “Global Conflict Tracker: War in Ukraine”

[10]Reuters, “U.S. operation to capture Maduro (Jan 3, 2026)”

___________

Investment advice offered through OneDigital Investment Advisors LLC. The materials and the information provided are not designed or intended to be applicable to any person's individual circumstances. These statements do not constitute an offer or solicitation in any jurisdiction. Any reference to a specific company is not a recommendation to buy, sell, or hold any security. Any economic forecasts in this commentary are merely opinion, and any referenced performance data is historical. Past performance is no guarantee of future results. All investment involved risk of loss. Some information has been obtained by sources we believe to be reliable. OneDigital Investment Advisors LLC makes no representations as to the accuracy or validity of this information. Additionally, OneDigital Investment Advisors does not have any obligation to provide revised investment commentary in the event of changed circumstances. Views and Opinions expressed herein are provided as of January 12, 2025. Market Data provided by FactSet as of 12/31/2025.

ID: 00428988