3 Actionable Ways to Get a Better Return on Investment (ROI) on Your Employee Benefits Program

Author

Article Summary

Rising healthcare costs and shifting employee expectations are widening the gap between benefits investment and perceived value. Learn three actionable strategies to improve employee engagement, personalize benefits, and maximize ROI through insight-driven design and communication.

Mind the Value Perception Gap in Benefits

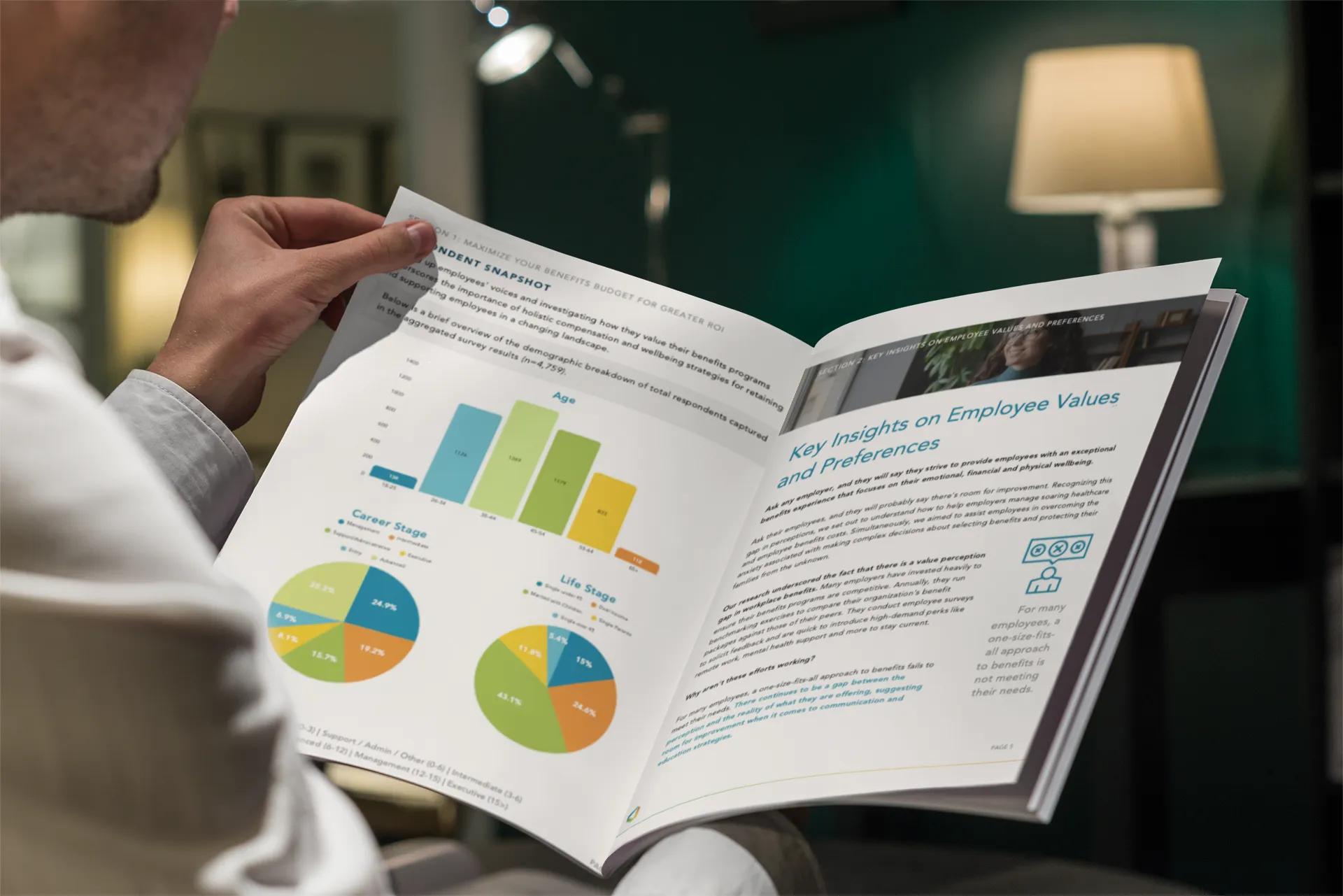

Employees increasingly want a more personalized, relevant benefits experience, yet many employers believe they are already meeting expectations. This disconnect forms a value perception gap, a costly challenge as healthcare and benefits expenses continue to rise.

Organizations invest heavily in benchmarking, employee surveys, and high-demand perks like flexible work arrangements and mental health resources. But offering competitive programs is only half the equation. What matters is how employees perceive the value and applicability of those programs.

The OneDigital Employee Value Perception Study shows that employees’ needs are evolving in unexpected ways. To improve ROI, leaders must design benefit strategies grounded in data, empathy, and clear communication, so employees understand and appreciate what is offered.

Below are three actionable strategies to bridge the gap in benefits perception:

1. Win Over Employees’ Hearts and Minds

Employees engage most with benefits that solve real-life challenges:

- Are they delaying medical care because of cost?

- Do they feel confident in their financial stability?

- Is financial stress affecting performance and wellbeing?

The OneDigital Employee Value Perception Study revealed widespread financial insecurity across life stages:

- 17% of respondents are considering taking a loan from their retirement account, with this figure rising to 27% among executives.

- Over 37% feel despondent due to debt.

- Nearly half would struggle to manage unexpected financial expenses.

2. Identify Where Employees Feel Disconnected

Employees often perceive their benefits differently than leadership expects. Our survey found across life stages, 53% of employees have concerns that their medical plan is not competitive with similar employers in their industry.

This mismatch highlights the need for insight-driven benefits communication and benchmarking for improved visibility.

OneDigital's EVP survey underscores a key truth: enhancing perception requires clarity over complexity.

3. Personalize Benefits for a Diverse Workforce

The multigenerational workforce has a wide variety of needs. OneDigital’s survey identified clear patterns by life stage:

- Married employees with children prioritized medical coverage and HSAs.

- Single parents prioritized life insurance, disability coverage, and dependent care FSAs.

- Early-career employees valued psychological safety, career development, and flexibility.

- Senior leaders prioritized financial planning and long-term security.

- Employees across all segments emphasized wages as the top driver of job satisfaction, even ranking it above health benefits.

For more insights, explore: 3 Surprising Findings from OneDigital’s Employee Value Perception Study.

Closing the Value Perception Gap

Closing the value perception gap is not about increasing spending. It is about:

- Spending smarter

- Aligning offerings with what employees value

- Improving communication

- Personalizing benefits so employees feel seen and supported

Organizations that integrate perception data, modernize communication, and tailor strategies to life-stage needs will build a more engaged, resilient workforce and achieve stronger returns on their benefits investment.

Ready to understand what your employees truly value? Discover how conducting your own Employee Value Perception Study can help uncover benefit priorities, improve communication, and align your programs with what matters most to your workforce.