Hub

OneDigital Breakroom: Health, Benefits, and Financial Resources

Simplify Benefits. Engage Employees. Drive Retention.

Year-Round Open Enrollment Resources For Employers

Employee Value Perception Study

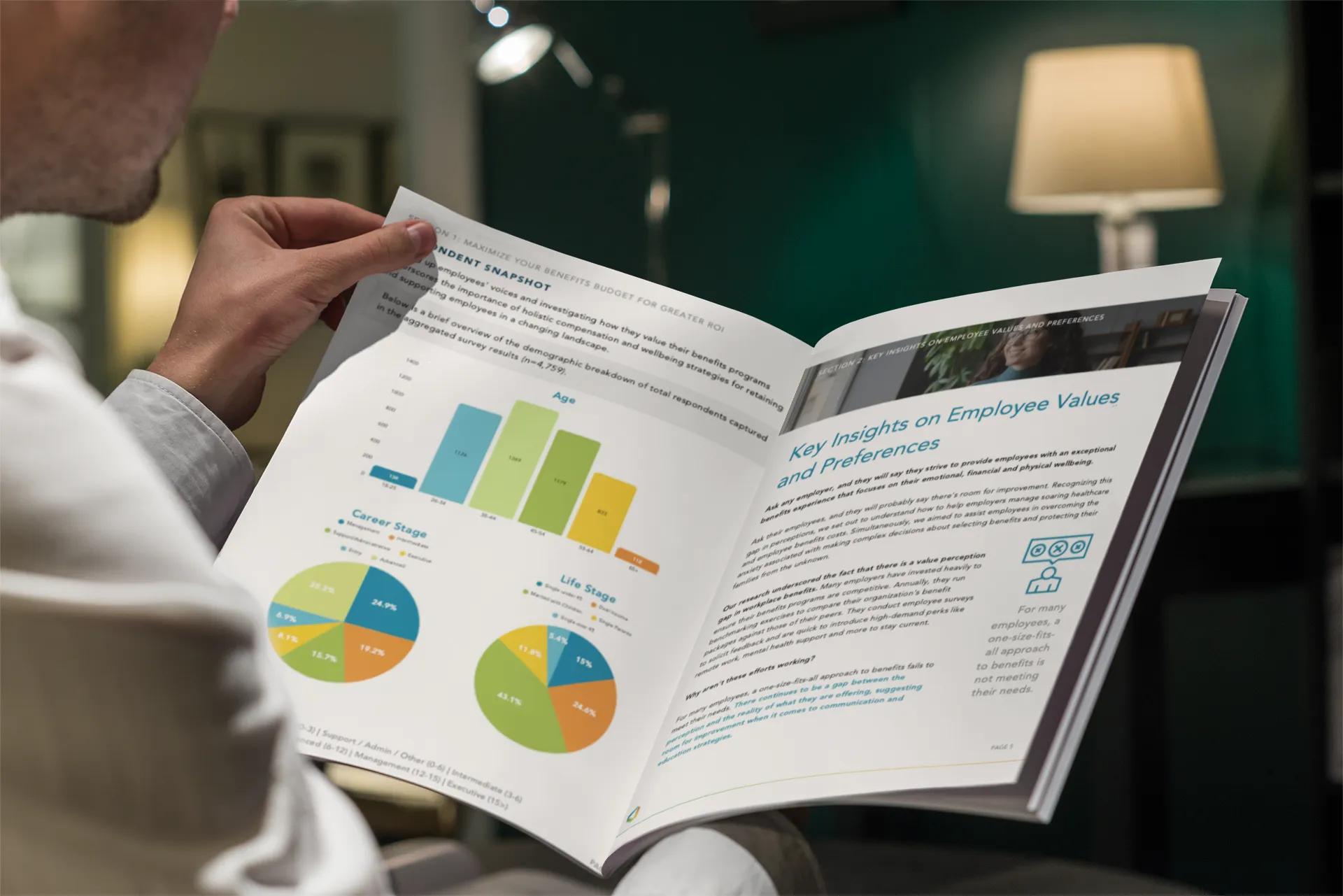

Our Employee Value Perception study helps you understand what your workforce values—guiding smarter total rewards decisions and creating a more engaged, satisfied team.

Key Benefits:

Here's how one employer improved employee engagement and delivered measurable results through a simplified rollout and smarter communication.

86%

of employees used the tools for benefits recommendationsThis showed strong interest in the employee population seeking to make informed choices.

55%

Revisited the open enrollment platformThe ability to explore options on their own time reduced confusion, the burden on HR, and reinforced confidence in employee’s selections.

21%

Accessed resources outside of work hoursThis data suggests that employees were able to involve family in their benefits selection process, a benefit of the self-serve portal.

< 3 Days

of onboardingWith higher enrollment in supplemental health benefits than the industry average, and a shorter onboarding timeline, it suggests significant time savings for both employees and program managers.

COMPLIANCE INSIGHTS

The new One Big Beautiful Bill Act (OBBBA) is reshaping the landscape of employee benefits, from compliance requirements to funding strategies. Stay ahead of the changes with this update so your organization can adapt quickly and protect both your business and your people.

Whether you’re upgrading your benefits program or launching new initiatives, here are the key questions employers ask.

Most employers offer a 2–4-week open enrollment period, which gives employees enough time to review their options and make thoughtful decisions. While the Affordable Care Act (ACA) requires at least 14 days, many HR teams find that a slightly longer window helps improve participation, reduces last-minute scrambling, and leads to better overall enrollment outcomes.

Eligibility generally falls into two main groups:

Employees:

Anyone who meets your internal eligibility rules: usually full-time employees working a minimum number of hours can enroll, change plans, or drop coverage during open enrollment.

Dependents:

Most plans allow employees to add or update coverage for:

Open enrollment is the one time each year when employees can make benefit changes without a qualifying event. If someone misses the window:

Medicaid works differently as it’s open year-round, and eligibility varies by state, focusing on low-income adults, children, pregnant individuals, and older adults.

A smoother enrollment experience leads to higher participation and fewer employee questions. A few practical ways to simplify the process include:

The goal: make benefits feel less overwhelming and more relevant to everyday needs.

Today’s employees expect a well-rounded benefits package that supports financial security, wellness, and work-life balance. In addition to medical, FSA, and HSA options, many employers consider offering:

Core Benefits:

Optional Add-Ons Employees Often Value:

Offering a broad mix allows employees to personalize their coverage based on life stage and budget.

ecause open enrollment includes multiple moving parts, compliance needs to be intentional. To stay on track:

Staying organized reduces risk, and helps employees make confident, informed choices.

A qualifying life event is a major change that allows someone to update their benefits outside the annual open enrollment window. Common QLEs include:

A QLE triggers a Special Enrollment Period, usually lasting 30–60 days, during which employees can make new elections or adjust existing coverage.

Employers are increasingly using AI tools to make open enrollment smoother, faster, and more personalized. AI can:

AI is not here to replace human support but rather enhance it. The result is a more confident, well-informed employee experience with fewer administrative headaches.

Whether to offer active or passive open enrollment depends on your goals. An active open enrollment requires employees to re-select their benefits each year and it is a good option if you're introducing new plans, changing costs, or encouraging employees to rethink their coverage. A passive open enrollment automatically rolls over existing elections and works well when your plans remain stable, and you want to reduce admin work.

Many employers choose a hybrid approach, requiring active elections for certain benefits, while allowing others to renew automatically.

Most organizations start planning three to six months before their open enrollment period begins. Starting early allows time to review plan changes, finalize rates, coordinate vendors, prepare communications, and train managers or benefits champions.

A longer runway also helps you build a clear communication plan so employees understand what’s changing and what actions they need to take and so your team can get ahead of key compliance requirements and deadlines. Preparing early leads to fewer surprises, smoother execution, and higher employee engagement.

Get Support This Open Enrollment

Every workforce is unique and your benefits strategy should be too. Connect with a OneDigital consultant to uncover tailored solutions that help you control costs, boost employee engagement, and simplify the enrollment experience.

Keeping up with federal policy changes doesn’t have to be complicated. The Federal Hub delivers timely compliance updates so employers and employees' alike can stay informed, make confident decisions, and avoid costly mistakes.