Client-Connected Innovation

The Key to Unlocking Value in a Hybrid Human-Digital Ecosystem

INDUSTRY, TECHNOLOGY • PUBLISHED 1.20.2022

Part 1

Changing Customer Expectations

It may be hard to imagine now, but there was a time not too long ago when individuals had to balance a checkbook to determine their available cash flow. Nowadays, consumers know better, having come to expect the modern experience of logging into an app or online account to see their current, pending and investment balances in real-time. Today, the health insurance and employee benefits industries are seeing a similar shift in mindset. Consumer expectations for how individuals research, select and procure most products today have reached new levels of sophistication, due in part from third-party experiences developed by digital leaders such as Amazon or Netflix.

With a wave of change in employee expectations, employers have placed a higher value on benefits programs to satisfy rising workforce needs and compete for scarce talent in the pandemic. All industry stakeholders — brokers, general agents, insurers, benefits providers, and tech platforms — have abruptly found themselves functioning virtually, and they are striving for more intelligent, more digitally enabled ways to do business and remain relevant. The insurance industry faces both great opportunity and significant risk as it transitions in response to powerful demographic, societal and technological forces.

Certainly, health care’s fragmented and siloed systems must be better connected — or even replaced — for all stakeholders to deliver a more effective experience. The end goal for health care and insurance organizations is to create more integrated, personalized, and relevant environments that offer both traditional and nontraditional products to their members. To realize the vision, firms are particularly focused on APIs, cloud-based services and stronger predictive analytics for personalization — priorities that overlap with the agendas of carriers and employers alike. No player in the industry is better suited to change the customer experience than brokers, due to their position, seated squarely in the center of the health care ecosystem.

Part 2

Guidance at the Center of the Ecosystem

Most leaders recognize that staying relevant in today's rapidly evolving business environment requires the use of technology to enable improved agility. It's not enough to conform to what's going on right now; the key is to be flexible in responding to what's emerging next – and anticipating what’s around the corner. The challenge is not to acknowledging the need for new technologies. It's doing something about it.

Self-initiated transformational change is far from straightforward in health care. Most insurance companies have records dating back decades, allowing them to accrue vast quantities of data, an arguably indispensable – and largely untapped – source of insights for developing new products and services.

Carriers typically have complex legacy systems that can be time-consuming and costly to update or replace and face significant regulatory pressures. If new solutions are ineffective or improperly implemented, the financial and reputational consequences could be disastrous. The lack of flexibility has prevented large-scale change and innovation within the health care ecosystem. In contrast, nearly every other industry has evolved at a pace and scale that at least meets or exceeds consumer expectations.

It is no surprise that some of the nation’s most innovative brands are also at the forefront of customer experience. Consumer-focused brands such as Apple, Disney, Zappos, and Amazon immediately come to mind when creating memorable experiences. Organizations investing in customer experience and industries such as health care must focus on the consumer journey to thrive in this era of rapid disruption. According to a recent Gartner study, the trend is expected to continue. The study illustrates that while only 36% of companies expected to compete primarily on customer experience in 2010, that percentage recently increased to 89%.

THE HOW ▼

So how can an insurance broker, an organization that sits squarely between carriers, employers and consumers, compete while simultaneously improving the current health care system and customer experience? Through client-connected innovation.

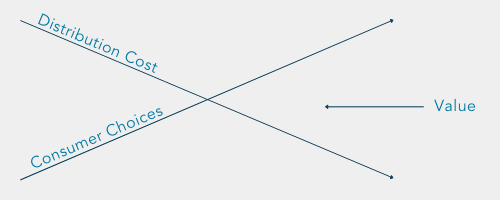

Nearly every system and process is digitized in some way. If a consumer wants to purchase health insurance independently from their employer, they can do so with two clicks of a button. The ability to custom-curate and scale the guidance that occurs at the intersection of the vast number of options available to consumers and the declining cost of distribution will distinguish brokers from the sea of sameness in the health care model.

The World Health Organization Innovation Group (WHIG) states that innovation "responds to unmet public health needs by creating new ways of thinking and learning" and "aims to add value in the form of improved efficiency, effectiveness, quality, sustainability and/or affordability." As a result, health care innovation spans a wide range of applications, including new procurement approaches, service delivery models, and medicines, surgical equipment, instruments, and diagnostics. For insurance providers, and brokers specifically, innovation is defined as bridging the human touch and digital touch, creating the hybrid client-connected innovation offering.

Currently, there are no other players in the health care industry better suited to deliver on this promise and opportunity to change the customer experience game than brokers, squarely due to where they sit in the center of the ecosystem.

Part 3

Bridging the Human and Digital Touch

While the health care industry has made significant strides in new offerings and solutions, such as patient virtual reality and aggregated health data apps, the pandemic continues to expose a lack of common data standards and customer interfaces to the world. Those challenges emphasized how true digital reinvention requires a strategic combination of data, a robust set of APIs to integrate data sets across organizations and domains, and the people with consulting chops who can work meaningfully with the results.

Lack of trust in health care remains an issue. Consumer and community trust in care providers and institutions is critical for optimal outcomes. Recent data from the Pharmaceutical Journal confirms, for example, that confidence empowers someone's willingness to get crucial medical care, preventive screenings, and mental health care, resulting in greater patient autonomy and shared decision making. Trust is also linked to improved patient experience, health outcomes, and the patient's perception of their care. When reflecting on the importance of trust in recent years, the pandemic underlined its importance, especially as confidence in vaccination, and in the ability of health care systems to both communicate and successfully deliver vaccination programs safely is top of mind for Americans. Whether speaking to a clinician, calling into a call center or checking a website to learn what to do, trust became invaluable in helping people achieve outcomes.

IMPORTANCE OF TRUST ▼

"One of the issues in our industry is that there is so much choice - there are so many things that both employers and employees need to choose. Whether it’s what doctor to go to, what medical plan to implement, or the overall benefit strategy, with so many choices, trust is a critical element to help guide employers, employees and their families through a complex environment."

We have come to learn that technology-led innovation alone will not suffice. Digital solutions built with integrated data must earn employers' and consumers' trust by ensuring it’s unambiguous, insightful, robust, transparent and private. The tech forward and thoughtfully human approach will be paramount to disrupt the customer experience in health care. This combination is more than just providing more tools and solutions – that has been happening for years. The solution must be rooted in human touch and digital touch that, when combined, creates a modern experience and hybrid interface to the point solution approach that has been taking place for years. This is where an insurance broker can flex their value within the health care industry.

Brokers represent the intersection of trust, strategy, delivery and tech-forward innovation.

For years, brokers have earned employers' trust across the country, leading them through large-scale changes, such as the Affordable Care Act, rising health care costs, and navigating a sea of solutions pointed towards complications associated with aging populations. Historically, achieving the human-lead, high-touch and complex environment has been the more challenging piece of the puzzle. By creating the digital delivery ecosystem and sharply focusing on the digital touch, brokers will guide at scale – the same insights, trust-backed relationships, now delivered through the modern experience that today's consumers expect and received through other industries. The ecosystem does not change, but the mechanics will.

| Human Touch → Digital Touch |

| People Advice → Applications |

| Partnerships → API Connections |

| Advice based on Gut Instinct → AI-served Data |

This approach to innovation, primarily known as a distributor or aggregator model, has been used successfully in countless other industries. Amazon, for example, has disrupted the retail model and now billions of users seek, purchase and subscribe to products and services. Amazon drove change as a distributor of products – the products did not change, just the delivery mechanism and how products are custom-curated and recommended to users. Similarly, brokers act as a connector between hundreds of insurance carriers, health-focused solutions and the individual, and the value will be developed when the human-based advice and insights can scale through technology.

Data interoperability is at the heart of most health care challenges today. To do better as a health system, we need knowledge and good, usable information to guide us. We also need new technology - meaning not just solutions - but new ways of doing things that incorporate user experience. When we crack the code on translating data from public and private sources and can deliver in a modern, user-centric format, it will give us the ability to flip the script on an industry.

Part 4

Innovation Is Both a Journey and a Destination

As geographic and market barriers that once prevented businesses from reaching their full potential have dissipated, a company's ability to innovate—to tap the fresh value-creating ideas of its employees as well as those of its partners, customers, suppliers, and other parties beyond its own boundaries—has risen to the top of the agenda. In essence, innovation has emerged as a key driver of company development, performance, and value. To be a successful leader in the digital economy, an organization must hit the trifecta: be profitable, be innovative, and deliver great customer experience. Accomplishing all three together will create a source of competitive advantage.

Coined as either a digital leader or laggard, leaders are those who are actively embracing their digital transformation and using new systems to change both the structure of their organizations and their products. Laggards are taking a narrower approach and applying new technology to improve what they are already doing. A recent survey conducted by Forrester Consulting on behalf of Ernst & Young LLP, showed that 65% of respondents from digitally mature organizations are focusing on innovation, compared to only 35% for digital laggards. What makes leaders stand out in their customer-centric approaches is their ability to equip employees with the tools they need, facilitate collaboration, and balance internal and external talent.

When it comes to innovation, laggards usually perceive digital technologies as a means to improve and speed up the communication processes they already have in place. Meanwhile, leaders are looking at digital transformation from a much wider perspective and exploring opportunities for convergence between various forms of technology. Digital leaders are aware of how to maintain a customer-centric approach that focuses on innovation and increasing revenue, rather than cost cutting. This approach to business transformation improves efficiency, while enabling the development of ideas that would not have been previously conceivable and opening significant innovation opportunities.

Why companies pursue transformation and how they achieve it are both equally important. While providing access to information is crucial, businesses will be at a substantial competitive disadvantage if they do not simultaneously provide guidance at a scale that enables businesses to create great places to work. That is what we are doing at OneDigital.

Part 5

Moving Forward

It's not unexpected that in our current digital environment, the concept of health care innovation is inextricably linked to digital transformation and digitalization. Being innovative is not just desired, but also vital in a world where disruptive and exciting new technologies are altering patient care experiences and outcomes. How can organizations in the health care ecosystem be innovative in the present day when so much is at stake? Pressures to realize greater efficiency, better patient outcomes, improved brand reputations and the ability to be destinations for top talent are all important in the competition equation. Many firms have realized that they must adopt cutting-edge digital health care technology to remain competitive in the eyes of both consumers and industry players.

As insurance carriers and brokers adopt more open and transparent data-sharing philosophies, advancements in experience can be fully realized. Greater transparency and a linked environment will enable more than just on-demand health insurance shopping, calibrated to deliver the aAmazon-esque experience consumers today have come to expect. It will also eventually deliver the end-to-end, self-service digital experience that we all want.

Fueled by enduring economic uncertainty, technology-driven disruptions and intensifying consumer expectations, the insurance industry has become a hotbed of digital innovation.

In response, organizations must embrace change and rethink business models to move toward a digitally enabled operating model that enhances customer, employee, partner and other stakeholder experiences.

As a result of OneDigital’s investments in innovation and technology, we will be able to provide a digitally enabled, analytically backed approach to health care, insurance and business consulting services for our customers.

These investments will lead to future products and solutions that will streamline antiquated processes that are riddled with opportunities for human error, allow us to operate at an accelerated speed, uncover and eliminate waste in spending and reinvest in benefit plan design that will set a new standard for the industry. These investments will enable us to create truly client-connected innovation, developing a hybrid model of tech and human fused experiences that will help our customers do their best work and live their best lives.

To learn more about OneDigital’s investments in technology, the latest products and solutions, contact your local OneDigital strategist or visit Bold Studio.