In a climate of heightened structural risk and perennial economic uncertainty, the ability to diagnose and manage people-related challenges can make the difference between value creation and value erosion.

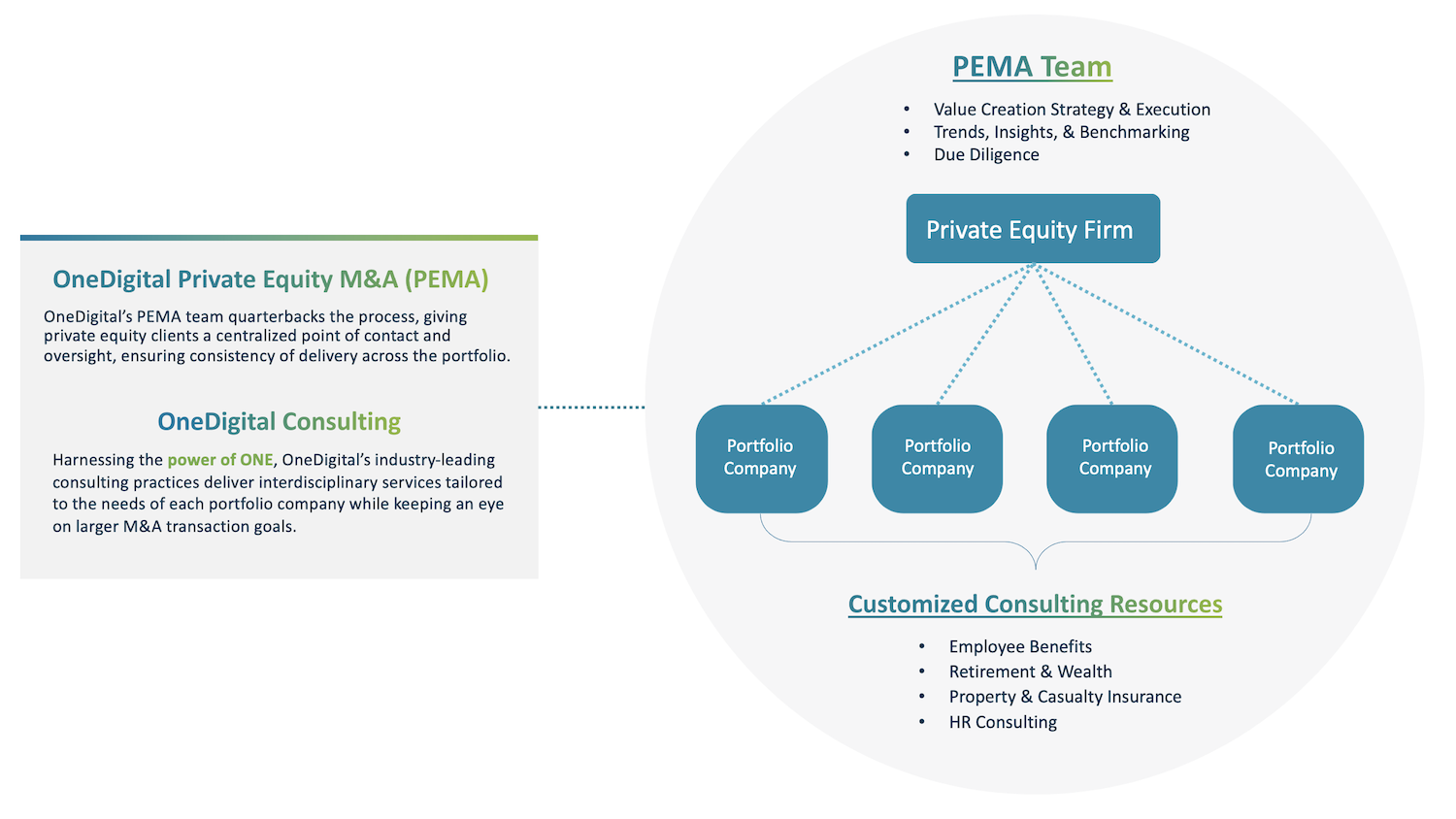

The OneDigital Private Equity and M&A Difference

Achieving your M&A goals requires a team that treats workforce optimization and risk management like a science, and nobody is better positioned in that regard than OneDigital Private Equity and M&A. To drive long-term value throughout the investment life cycle, we apply:

1. Our rigorous due diligence process,

2. Our interdisciplinary consulting expertise, and

3. A unique aptitude for assessing change management needs through a human capital lens.

10 Ways We Add Value

1. Transactional Support (M&A)

Due diligence services, transaction liability insurance, and integration readiness assessments.

2. Risk Assessment & Mitigation

Safety and loss control, claims consulting, technology and analytics, and brokerage services.

3. Change Management Consulting

Post-merger and acquisition support, future risk diagnosis and mitigation, long-term integration planning.

4. Aggregated Portfolio Programs

Coalition management support, stop loss aggregation, and insurance captive solutions.

5. Portfolio Review & Benchmarking

Cross-portfolio benchmarking and analysis, custom company strategies, and industry and size inclusive.

6. Cost Optimization Strategies

Health plan and pharmacy cost containment, benefits and compensation benchmarking, and PEO implementation.

7. Executive Benefit Programs

Flexible and cost-efficient executive benefits packages, long-term financial plans for key employees.

8. Workforce Management Strategies

Workplace culture optimization, wellbeing policy implementation, and DEI&B support.

9. Talent Insights & Diagnostics

Holistic competitive analysis, customized retention advice, and human capital growth planning.

10. HR Processes Assessments

HR technology assessment and advising, fractional HR support, and total rewards optimization.