Healthy People, Lower Costs

Compound Interest May Be the Most Important Thing to Learn in Personal Finance

Compound Interest May Be the Most Important Thing to Learn in Personal Finance

Only three out of seven American adults are financially literate.

For me, it’s simple. Knowledge is power. Teaching someone the simple concepts of saving and budgeting, the difference between Roth and Traditional 401k/IRAs, or the benefits of estate planning, can help empower them to make better choices about their finances. As an advisor, it makes a big difference when the client understands why we are making the decisions at hand. The more knowledge we can share about various financial topics, the more engaged they become. Then the more engaged they remain with their financial plan; it can lead to better outcomes over time and ultimately help alleviate the stress along the way. If there is one thing you can learn during Financial Literacy Month is the fantastic benefits of compound interest and how it can lead to a better financial future.

What is Compound Interest

Albert Einstein once said, “compound interest is the eighth wonder of the world.” Another one of my favorite quotes on the subject is Benjamin Franklin’s “money makes money. And the money that money makes, makes money.”

Simply put, if you start with $10,000 and it grows by 10% in one year, you would now have $11,000. That in itself is great, but enter compound interest and suddenly realize you now have $11,000 earning returns. If you happen to experience that same 10% growth again in year 2, you suddenly have $1,100 of growth and not up to $12,100. Let that compounding party continue over 25 years and you would have $120,000…and that is all based on the originally $10,000 investment alone. It’s like setting a snow ball on the top of a mountain and letting it roll off, the longer you let that snowball roll, the larger it will become.

Time

Regarding time the basics are if you leave it alone, it will grow. Whether it's the dividends or the capital gains or whatever you're earning and reinvesting back into that, it’s going to help. Sometimes it may have to do with market performance and other things that are out of your control, but essentially the larger the timeline, the most significant the benefit can be.

If you're trying to time the market, in my experience, that has never really worked in the investor's favor. So just leaving it alone, time, patience, and consistency is the only way to maintain that compound effect.

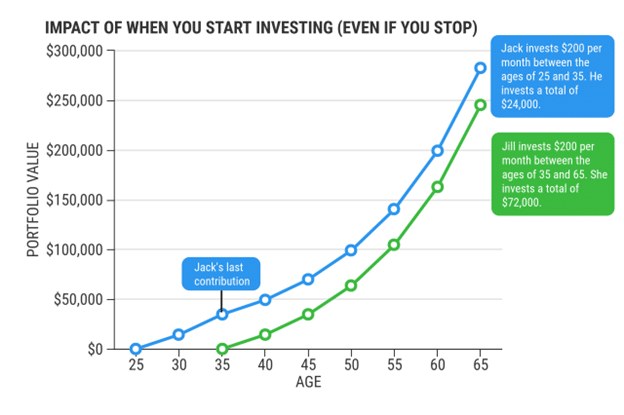

The earlier you’re able to start and stay is valuable for younger investors. Start now, do not wait. Many younger investors think, “I can invest later when I have more.” But, they do not realize that the value of compound is in their favor the longer they are invested, even if a smaller amount is invested over time. The chart below shows how a $200 a month investment over ten years can out-earn a $200 a month investment over 30 years (with the same rate of return), all depending on how early those investments were made. The graph below clearly shows the benefits of compound interest for all investors and how important it is to start early.

For illustrative purposes only.

Consistency

Stick with the plan. If you want your money to earn money, you can't be taking it out by going shopping or buying a new car etc. You must be diligent about your plan and know your end goal. It’s about being consistent with your goals over an extended period of time.

People are hesitant to make a plan because they think they “can't stick to it,” or feel like they don’t have enough money. I've encountered people who say, “I can't save because I don't have money, I’m paycheck to paycheck”. When you sit down with them and run through a budget it’s so interesting what you’ll find just by asking simple questions about their lifestyle.

Certain behaviors can help improve your budget. For one, the immediate gratification of having the extra Starbucks versus skipping the extras. Having better financial habits with a longer-term focus can play a significant role by re-framing how you think about your money. It’s based on emotions, not logic.

Making a consistent plan to regularly put money back into your investment accounts instead of buying the extra Starbucks each week can make a huge difference in savings outcomes.

Patience

With patience, it comes down to behavioral finance. One bias that comes to mind is Present Bias. It is a tendency to settle for a smaller reward or value now rather than wait for something better or greater in the future.

In 1972, Stanford University conducted an experiment called “The Stanford Marshmallow Experiment." The study tested delayed gratification where they had children choose between having one marshmallow now or two marshmallows in the future. The same concept applies to you as an investor. If you are willing to delay your gratification and save your money and invest, you could have two marshmallows instead of one if you are willing to wait.

Takeaways on Compound Interest

Compound interest can not only help you at retirement age, but it can give you the freedom and flexibility to make decisions that would not be available if you were not to take advantage of its many benefits. Implementing the concepts of time, patience, and consistency into your behavioral finances are some of the most important steps you can take on the road to financial freedom. We hope you can take this one piece of advice and put it into your financial literacy toolbelt and tell your friends what compounding can do.

Remember, future success isn’t about timing the market…it’s about time spent in the market.

For more on saving for retirement, visit the OneDigital Financial Academy.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.