No Headaches, Lower Costs

Economic Outlook for 2024: Growth, Inflation and the Rate Cut Debate

Economic Outlook for 2024: Growth, Inflation and the Rate Cut Debate

Looking back, 2023 will be remembered as a year of transition.

We’ve encountered many tumultuous events in the last decade, from the pandemic to the Russian invasion of Ukraine and the Israeli-Palestinian conflict. These external forces have not only meant profound shifts in U.S. monetary policy, but Americans continue to feel the impact on our own wallets, especially from the battle with inflation.

Yet we’ve sidestepped a deep recession that seemed imminent at times and remain cautiously optimistic about the future. What does the coming year have in store for us as we look forward? Here’s a glimpse of what we might expect in 2024.

U.S. Economic Outlook

- The U.S. will likely experience a “relatively soft” landing in 2024, avoiding a deeper recession and longer-lasting impacts. Inflation should get closer to the Federal Reserve’s long-term target of 2% and we expect continued resilience in the labor market.

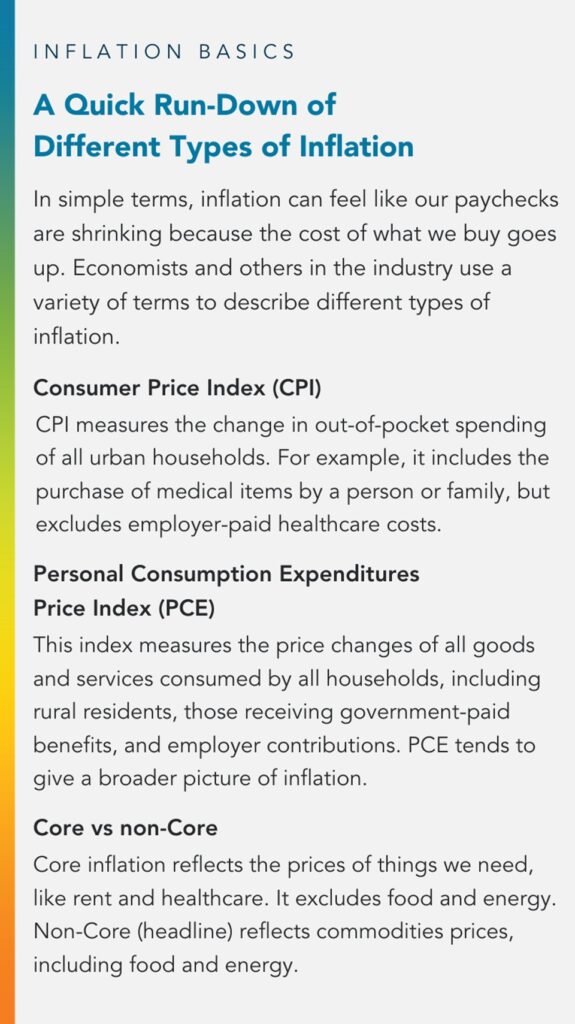

- We expect real gross domestic product (GDP) growth around 2%, slightly higher than the consensus estimate of 1-1.5%. Expect inflation to moderate further as the supply and demand of goods and services continue to balance. Personal Consumption Expenditure (PCE) and PCE Core (excluding food and energy) inflation have declined substantially after peaking and should further descend close to 2.5% in 2024.

- The unemployment rate tightened to 3.7%, which was below forecasts and at a four-month low. Labor participation ticked up 62.8% with a 0.4% growth in hourly earnings.

(Source: November 2023 payroll report)

These are great signs for the U.S. labor market, but they complicate the outlook for aggressive rate cuts by the Federal Reserve next year.

The unexpected strengthening of the labor market and the decrease in the unemployment rate will keep the imminent recession narrative at bay, especially with other data on economic activity nowhere close to recessionary.

The wage gains may indicate the persistence of inflation but are balanced by an increase in productivity. Increases in hourly compensation tend to increase unit labor costs, while increases in productivity tend to reduce them.

Hourly earnings gained 4% year over year. However, that’s combined with a 2.2% increase in productivity over the past 12 months, resulting in a decline in unit labor cost by 1.2%. This is consistent with the argument that transitory influence on wages and prices has been fading, and inflation would likely further recede in 2024 despite an extremely tight labor market.

U.S. Policy Uncertainty

Americans may breathe a sigh of relief when it comes to interest rates. The Fed is likely done with its rate hiking cycle to decelerate growth and control inflation. Now, the primary debate in 2024 is whether the Fed will keep the rate steady with the buoyant job market or set the table for rate cuts as the hard part of its battle to reduce inflation is almost won.

We expect the Fed to cut rates in 2024 once the target inflation (PCE) gets below the threshold of 2.5%. It was at 2.6% as of the November print, and the next release will come on Jan. 26. The Fed might hold the rate steady longer, until at least the second quarter of 2024.

The most likely outcome is that the Federal Open Market Committee (FOMC) could declare that the monetary policy is sufficiently restrictive. Based on indications from the FOMC, we expect rate cuts of at least 0.50% in 2024 until the Fed funds rate reaches 4.75 - 5%, compared to 5.25 - 5.50% now.

Potential Risks

Three risks remain at the top of our minds:

- The geopolitical conflicts around the world

- Election uncertainty

- A potential spike in oil prices that could set the flame of inflation back in the economy

Market Outlook

- A relatively soft landing should allow the cyclical bull market to persist with some moderation. The first half of 2024 could be choppier for the equity market as investors price in monetary policy changes, election uncertainty and a softer landing. However, a cyclical bear market with sustained drawdown is unlikely without a recession or an unprecedented economic/market event.

- Over the past few decades (before 2022), bonds have had low correlation with stocks and provided positive returns in nearly all recessions since 1952. Given the abysmal 2022, investors got spooked to allocate to bonds to diversify equity risks in their portfolios.

- With easing rising rates, bond yields are higher and the return from carry has improved. Interest rate fundamentals remain supportive, while the rates have the potential to fall from here.

- When it comes to the future of fixed income, inflation is obviously the game changer. With the Fed at the end of the hiking cycle and the expectation of inflation to decline further, the outlook of fixed income in 2024 looks positive.

- The stock market has already priced in a soft landing and many rate cuts in 2024. With inflation cooling off and higher real yields, bonds are likely to offer a better hedge against equity risks compared to a year ago.

Overall, we are hopeful yet prepared for a few more twists and turns in 2024, when it comes to the U.S. economic outlook and financial markets. Investors should remain attentive and continue to monitor the markets.