On March 6, 2017, Republican House of Representatives leadership finalized the American Health Care Act—a new budget reconciliation bill to repeal and replace the Affordable Care Act (ACA). Committee work on this legislation is set to begin this week where they’ll discuss and mark-up the bill with any changes.

Many employers are breathing a little sigh of relief as a leaked provision, the employer exclusion, is absent from the newest budget reconciliation bill. If enacted, the new law would not repeal the ACA entirely, although it would make significant changes to key provisions.

The bill is a special budget reconciliation bill that carries a more favorable voting process in the Senate, i.e. a simple majority to pass – 51 votes – rather than the 60 votes needed to pass under regular order. The trade-off is that it may only include items that affect the federal budget, e.g. revenue, spending, or the debt limit.

As a result, the bill includes repeal and replace of certain taxes and penalties but doesn’t address other areas centering around insurance plans and their provisions. For example, while it repeals the penalties for both the individual and employer mandates, it does not actually repeal the mandate itself. These will be items that will be addressed through regulatory actions or other legislation. Another item of note is that most provisions, other than the repeal of the mandate penalties, won’t be effective until 2018, 2019 or 2020.

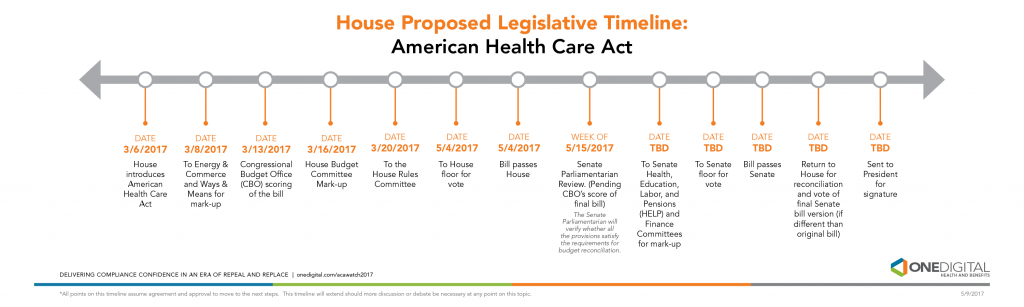

House Proposed Legislative Timeline

We have prepared this legislative chronology for you to better understand the aggressive timeline proposed by the House to move the bill through both Chambers. The American Health Care Act could be sent to the President for signature in mid-April.

Bill review and mark-up begins today in the House Energy and Commerce Committee and the House Ways and Means Committee. Once that’s complete, it will go to the House Budget Committee and from there to the House floor for a vote. The target date is the week of March 20. If passed as is, it will move on to the Senate where it will go for mark-up with the Senate’s Finance and Health, Education, Labor, and Pensions (HELP) Committees and then on to a vote. The timeline may drift if consensus if they do not find consensus at any point on the timeline.

In the interim, individuals and employers should hold tight, continue to comply with the current law and check out our ACA Watch 2017 page as events unfold.

Update as of March 9

Both House Committee completed their mark-ups:

- Ways and Means Committee completed their mark-up of the tax provisions early this morning

- Energy and Commerce Committee completed their mark-up of the Medicaid and spending provisions this afternoon

From here it moves to the House Budget Committee and is scheduled for review on Wednesday, March 15. It appears that this Committee will have the official scoring from the Congressional Budget Office (CBO). The CBO provides Congress with nonpartisan analyses for economic and budget decisions and with estimates required for the Congressional budget process.