No Headaches, Lower Costs

Putting the Markets Into Perspective

Putting the Markets Into Perspective

If you’re tuned into the news, then you already know the markets have been very jittery the last few weeks. The outlook has changed from hopeful to concerning in a matter of months.

As financial advisors, our clients have questions about what’s happening, what to do about it, and how it affects their individual situations. One group—people in or nearing retirement—have been the most vocal, and rightfully so.

Since February 2020, some 2.6 million more Americans than expected retired, according to a PBS News Hour report. Now, with inflation and costs growing, they’re wondering if they have enough saved and how to limit the impacts of market volatility on a fixed income.

Here are some of the questions we’ve been getting from them, which may provide some perspective on what to remember during today’s market volatility.

Q: I keep hearing bad news when it comes to the markets. What’s going on?

After a few years of predominantly positive returns, the market has been jumpy the last few months. It’s been a while, and many people have forgotten what it can feel like when things trend downward for more than a short period.

There are many factors at play right now. And, even though it feels worrisome, here’s the bottom line: This current economic and market environment is different but not necessarily unique. Investors across all spectrums are having similar experiences.

- Stock sell-offs: For equity investors, double-digit sell-offs are a normal part of the long-term financial plan. While periods of shrinking account balances make us uncomfortable, they are part of equity investing.

- Bonds: However, for those who implemented a meaningful or even heavy bond allocation in our portfolios with the desire to reduce risk, this is a new experience. We’ve not seen our bond allocation exhibit this kind of volatility. To read more about what’s happening with bonds, visit the Markets In Focus – May Update.

- Inflation: It’s been decades since the U.S. experienced this type of inflation, and U.S. investors haven’t seen these type of negative bond returns in a long time. If fact, the last time we saw negative bond returns anywhere near this magnitude was from late 1980 to early 1981.

Q: It feels like a different world from where we were at the end of last year. What changed?

Ironic as it may sound, one of our investment team’s greatest concerns six months ago was that interest rates would stay too low for too long. A 10-year treasury yield of under 2%, which was the case all of last year, provides neither meaningful return nor ample power to act as the portfolio diversifier it had previously played until this year’s action.

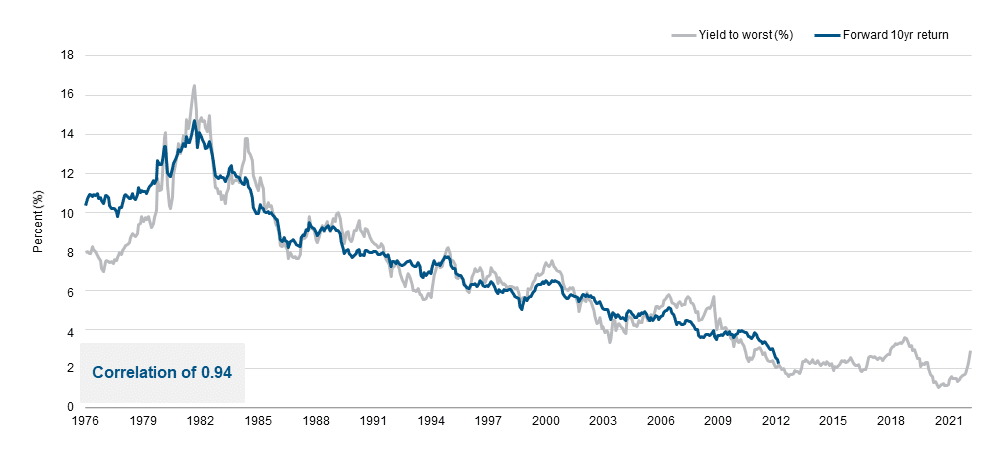

A traditional bond allocation was slated to produce between 2.5-3.0% annual return over the long run at the beginning of 2022. Bonds returns—unlike stocks—are largely math at the end of the day, and starting yields give a great indication of future returns.

Source: Bloomberg, PIMCO. As of March 31, 2022.

So, even if it’s more painful in the short term, it is a NEEDED rise in rates for retirees and all investors.

Q: What does that mean for retirees?

Retirees would have faced an unwelcomed decision if rates stayed as low as they were: Either maintain a lower risk profile and very low rates of return, OR take on additional risk via equities in hopes of producing enough return to meet retirement income needs. Annual average returns of 2.5% from bond allocations over 10, 15 or 20+ years in retirement make meeting retirement income needs very tough.

With the recent increase in interest rates, a traditional bond allocation could potentially act as a diversifier to equities and may produce long-term returns north of 4%. Additionally, by selectively mixing in additional bond sectors, obtaining yields north of 5% is achievable.

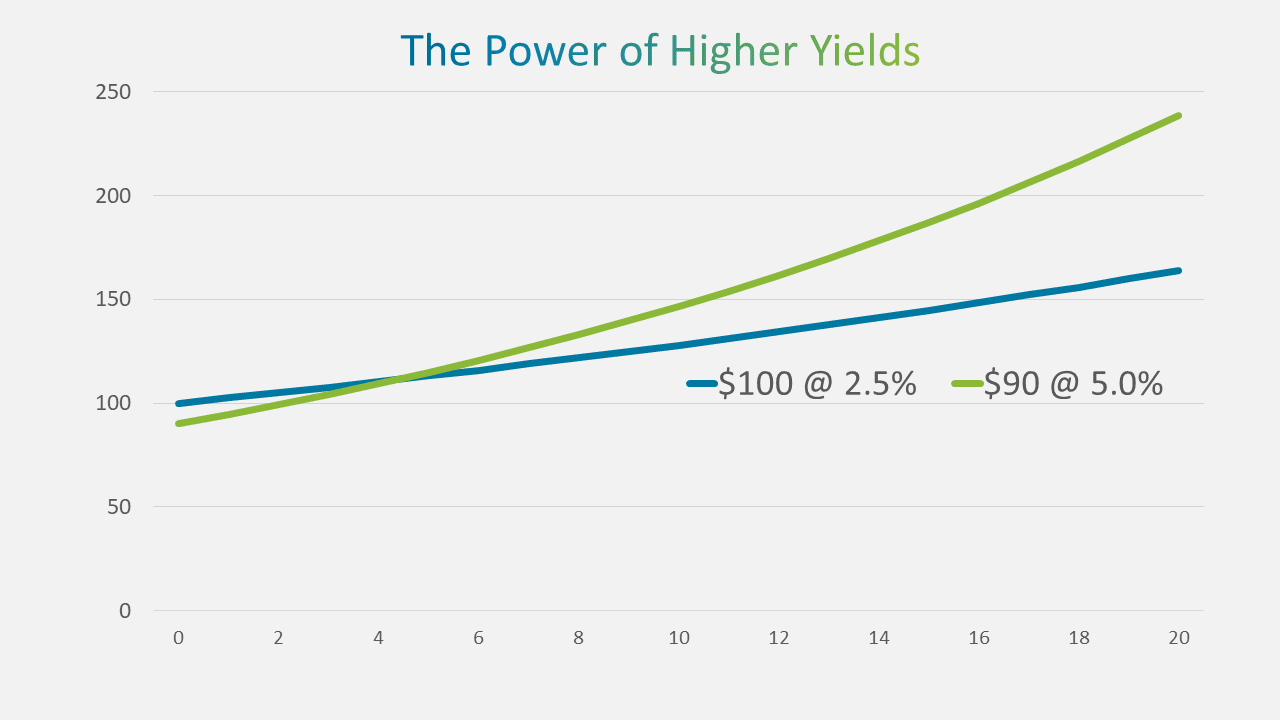

As inflation comes back under control, and it will happen, those are the magnitude of yields many retirees need to meet their income goals in retirement. Think of it this way, which option should you choose?

- Start with $100 and make a 2.5% return a year

- Start with $90 and make a 5% return a year

The answer obviously depends on your time frame. If it’s only a single year, then take the first option. However, the second option almost catches the first by the end of year four and provides superior results shortly thereafter.

This is a simplified example and yields won’t stay consistent through time. However, the mathematical concepts used here form the base of why we are more optimistic today about meeting retirement income needs going forward than we were just six months ago.

Q: Why does it feel so painful?

We were hoping for a gentle pace in the rise of rates, one taking place over a few years. Unfortunately, high inflation has caused the proverbial band-aid to be ripped off. We desperately needed rising rates, and it creates a very painful short-term experience.

However, for those who will continue to embrace their long-term financial gameplan, this short-term pain mathematically leads to better results for long-term investors. That’s true for those far away from retirement as well as those near retirement.

Final Thoughts

Although the pain and concerns you’re feeling are real, there are some things you can do to lower the financial stress right now.

Click here to read Six Tips From Financial Advisors to Make Sure You’re Ready for What’s Ahead.

Past performance is no guarantee of future results. All investments are subject to risk of loss, and and any investment strategy may lose value. Any economic forecasts made in this commentary are merely opinion, and any referenced performance data is historical. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. The materials and the information are not designed or intended to be applicable to any person's individual circumstances. These statements do not constitute an offer or solicitation in any jurisdiction. If you are seeking investment advice or recommendations, please contact your financial professional.

Investment advice offered through OneDigital Investment Advisors, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.