No Headaches, Lower Costs

The Top 4 Social Security Questions Answered

The Top 4 Social Security Questions Answered

Almost 67 million Americans per month will receive a Social Security benefit in 2023, totaling around $1.4 trillion paid.

Social Security is a federal program in the U.S. that provides retirement benefits and disability income to qualified individuals. This includes their spouses, children, and survivors. It is one of the most important sources of income for many Americans, especially retirement-aged adults and people with disabilities.

Because Social Security is such an essential part of many lives, there can often be a lot of confusion surrounding it. Let us break down some of the most common questions surrounding Social Security.

1. How Does It Work?

Money for the program is funded through taxes that employees and employers pay on their income. Subsequently, that money collected through taxes is used to fund Social Security trust funds (which are invested in U.S. Treasury securities) and pay benefits to current beneficiaries.

2. Who Is Eligible?

Retirees

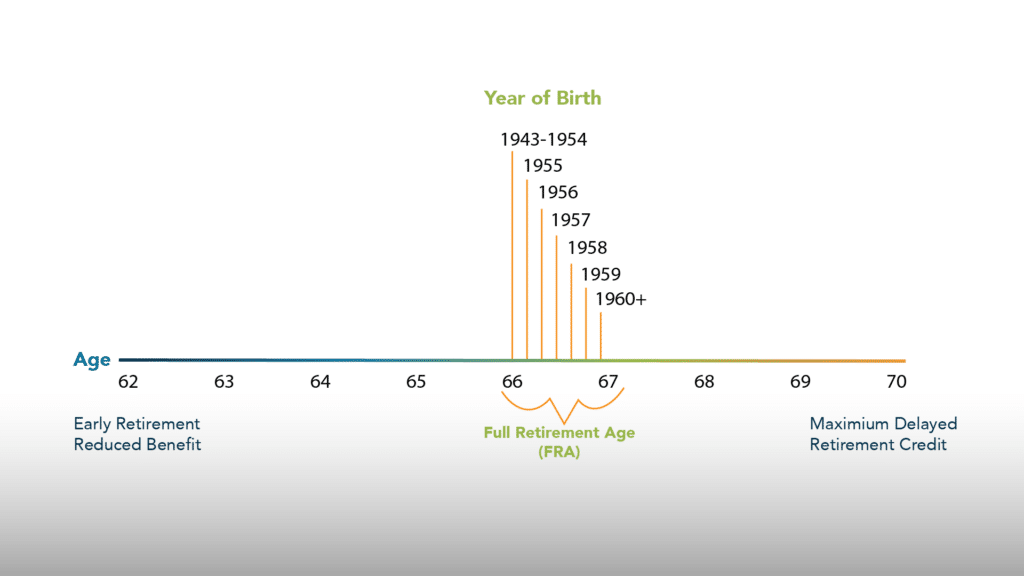

You must work and pay Social Security taxes for ten years, or 40 credits, to be eligible for Social Security benefits. Depending on your earnings, you can earn up to four credits per year. You can claim benefits as early as 62 with reduced benefits. Additionally, your FRA varies depending on your year of birth.

You can also delay your benefits until you reach age 70 to get a higher monthly amount.

Individuals With Disabilities

Social Security is more than a retirement program as it provides workers benefits when they face a disability that prohibits them from working. Some requirements must be met when filing for Social Security for a disability, and you must also have enough work credits based on your age.

Survivor Benefits

A surviving spouse, surviving divorced spouse, unmarried child, or dependent parent of workers who passed (and had enough work credits) can receive benefits on their behalf. In this case, the amount of benefits a family member receives depends on:

- Age

- Relationship to the deceased

- Earning history.

3. How Do They Calculate My Benefits?

Your Social Security benefits will be calculated based on your primary insurance amount (PIA). Your PIA is the average of your highest 35 years of earnings (adjusted for inflation). Any year with no earnings will count as zero if you have less than 35 years of earnings. To increase your PIA, you can replace a zero or low-income year with a higher one, even if you work part-time through retirement.

PIA is then multiplied by a percentage based on the type and timing of your benefit. For instance, if you were to claim your benefits at your FRA, you would get 100% of your PIA. However, if you were to claim them at an earlier age, the benefits would be reduced by a certain percentage.

Moreover, a limit of benefits does exist. That limit depends on the age which you retire.

4. How Do I Apply?

It is recommended to apply three months before you want your benefits to start, and you can do so online, in person at your local Social Security office, or by phone. To apply, you will need to provide necessary personal information such as,

- Your birth certificate

- Social Security number

- Proof of citizenship/lawful status

- Proof of income

- Bank account information

You can create an online account through My Social Security portal to check your earnings and manage your benefits. Ultimately, Social Security is a vital program that provides income and protection to millions of individuals. Understanding how it works and what it means for you is crucial for making informed decisions about your future and present.

If you still have lingering questions, watch The Social Security Myth Busting Guide for additional answers. For more information and resources on a variety of financial topics, visit our Financial Academy.

Investment advice offered through OneDigital Investment Advisors LLC, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.