There are a number of major changes for Connecticut small businesses that take effect in 2014 as a result of Health Care Reform.

Rating System Restructuring

One of the biggest changes for small businesses is the restructuring of the rating system. Rates for a particular plan used to be based on location, group size, gender and age, with five-year age bands. As of January 1, 2014, the rates for a particular plan are based on location and age. In prior years, depending on where your employer is located, a 46 year-old female with a family would have the same rates as a 49 year-old female with a family. Now, per the new Federal Rating Methodology, those rates will be different since there are no more five-year age bands.

Family Size Matters

The number of family members on the plan will now be considered in the calculation of plan rates. For example, a 46 year-old with a spouse and three children could pay considerably more than a 46 year-old with a spouse and one child. The number of children in an employee’s family, their ages, as well as the age of their spouse—are all deciding factors in calculating the monthly premium.

Gender is No Longer a Consideration

A 46 year-old female and a 46 year-old male at the same company will now have the exact same rate. We used to see drastic differences between male and female rates— especially in the years that a woman was within her childbearing years.

Age Curve Compression

Per Federal requirements, the age curve must now be compressed to a ratio of 3:1. Rates used to have a ratio of 6.5:1 for employees from age 21-65. With the gender factor eliminated, as well as adding in the ratio compression, this can mean that a 22 year-old male who has a relatively inexpensive plan will now face a hefty increase for 2014. On the other end of the spectrum this can cause a 65 year-old’s rates to decrease slightly.

All of these reasons mean that there will be significant pricing swings for employees in 2014. As a side note—in Connecticut we do not we do not have to worry about tobacco use for each family member in order to calculate member rates.

Calculating Rates—A Primer

With a new year comes new information that you will need to procure from employees who elect your organization’s insurance coverage. Prior to 2014, when you hired a new employee you would pull out your rate grid, go down the left side of the sheet, select the age and gender of the employee, then slide to the right and choose the monthly rate for either Employee Only, Employee Plus Spouse, Employee Plus Child(ren) or Family. As of January 1st, 2014, not only do you need the employee’s date of birth, but you also need the date of birth for each member of the family that the employee intends to enroll.

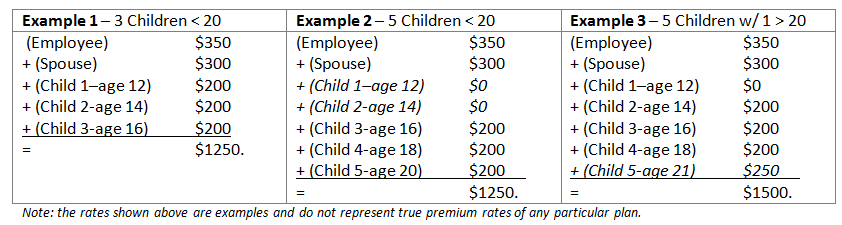

Per Ex. 1 below, if John Smith has a wife and three children, employers will have to look at the rate grid for his age and get his rate, and then go to his wife’s age and get her rate, and then each of the children get their rates. As long as the children are 20 years-old or less, the rate will be the same for each child. Next, add each of these rates together. In Ex. 2., if the employee has five children under the age of 21, he will pay the same monthly rate as if he has three children because only the three oldest children under 21 years of age are charged.

But of course—it’s not always that simple. What if one of those children is over 20 years old? Ex. 3 shows that he will have to pay for that dependent as if he or she is an adult. Now, John Smith has to pay for four children. Prior to 2014, if a child came off of an employee’s plan because the child got a job with their own insurance and the employee still had one or two other children on their plan, the rate didn’t change because it was a Family Plan or an Employee Plus Child(ren) plan. Now these types of events can potentially change the rate.

How does one stay abreast of the multitude of changes that have gone into effect since the beginning of 2014? Employers must have a broker that they see as a trusted advisor. Here at OneDigital, we strive each day to earn that trust. For more information about how ACA changes in 2014 might impact your small business, please call a OneDigital Advisor at 800-364-7575.