Compliance Confidence, No Headaches

Pay Transparency and Pay Equity Laws by State: Understanding How the Pieces Fit

Pay Transparency and Pay Equity Laws by State: Understanding How the Pieces Fit

In the ever-evolving landscape of employment laws, pay transparency has recently emerged as a significant topic of interest for employers and employees – review the state laws here.

What is Pay Transparency?

To combat disparities in pay that often negatively impact employees in protected classes, several states, cities, and counties continue to enact pay transparency laws. These laws seek to correct pay disparities by requiring employers to be more transparent about their pay practices at multiple points in the hiring and employment relationship.

The exact requirements of pay transparency laws vary but all require employers to include salary ranges or pay scales in their job postings and to provide salary information to employees about their position when they ask for it.

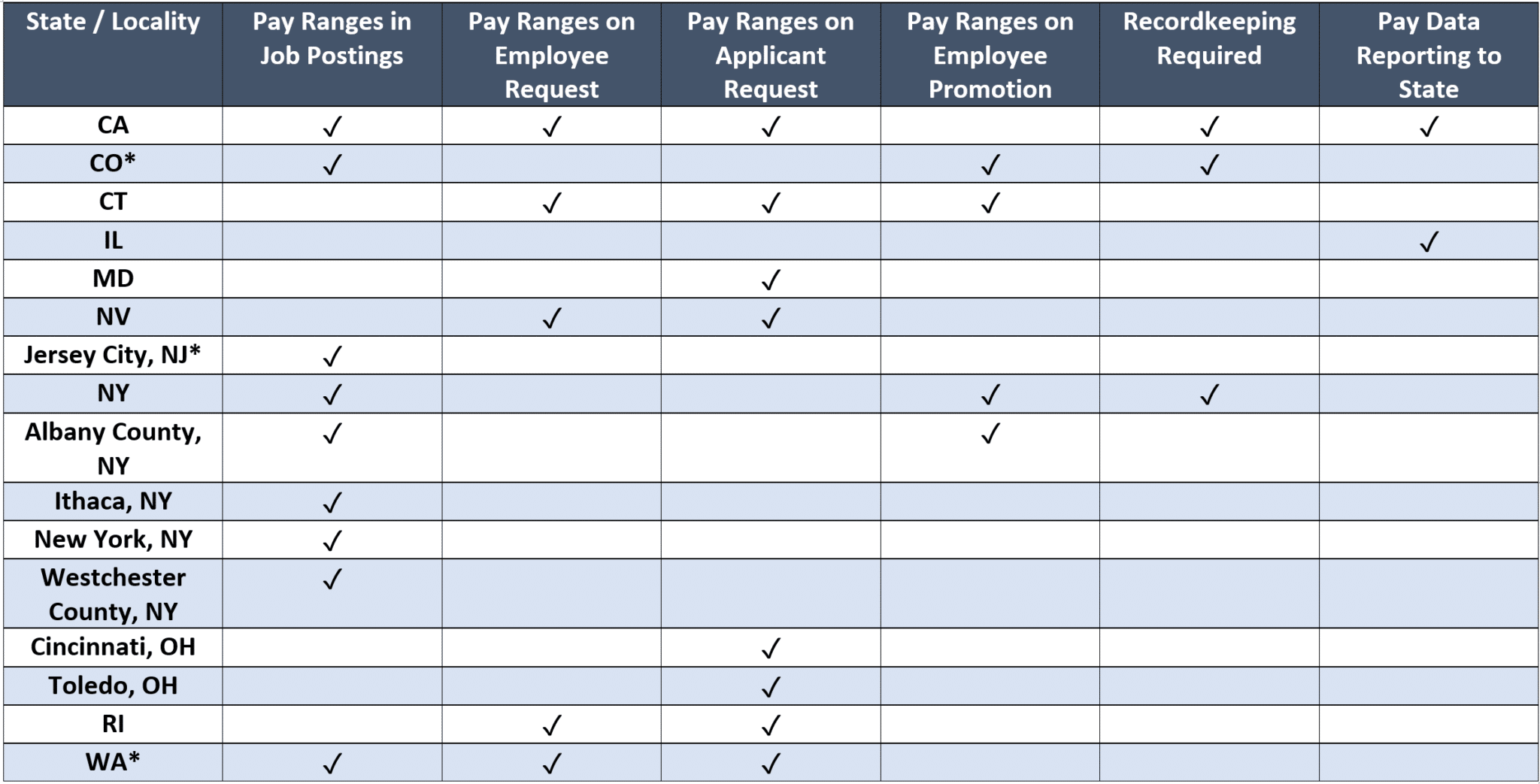

Over the past year, pay transparency laws went into effect across the country. The jurisdictions listed in the chart below are just the states that have enacted or are set to enact pay transparency laws.

It is estimated dozens of other states and localities contemplated pay transparency laws during this year’s legislative session.

As more employers find themselves hiring remote workers and expanding their employee footprint across various states, a broad range of employers will be impacted by transparency laws. Employers who are subject to these requirements have discovered; compliance means more than just inserting a pay range in a job posting. Often, remaining compliant requires going back to square one and taking a look at existing compensation practices.

Review the states and local jurisdictions that have enacted pay transparency laws requiring employers to disclose a wage or wage range to prospective candidates and/or current employees.

*Laws are stated for illustrative purposes only and are not exhaustive. Consult with legal counsel regarding the specific requirements in your applicable jurisdictions.

Your State Passed a Pay Transparency Law. Now What?

Compliance is not as simple as adding a salary range to job postings. Many of these laws also include document retention obligations and state pay equity data reporting. Some require job descriptions be provided at the time of the posting, if available.

Prior to disclosing pay ranges, employers should conduct an internal review and make any necessary modifications to existing compensation ranges. Employers should also be prepared to answer questions from applicants or employees about any perceived pay disparities.

Almost all of the pay transparency laws now in effect have consequences for noncompliance. Many include a private right of action for employees whose rights have been violated under the law.

In addition, there can be civil penalties with some reaching $10,000 per violation. Apart from the legal consequences, employers can also face employee relations issues if employees suspect there are pay disparities.

Due to how swiftly pay transparency laws are being enacted across the country, it is increasingly difficult to avoid compliance. They often apply to jobs that can be done anywhere in the country.

Colorado’s law, for example, applies to all remote job openings as long as the hiring employer has at least one employee in Colorado. Employers deliberately trying to avoid compliance in Colorado would be in violation of the law. With the rapid growth of remote work combined with labor shortages, avoiding compliance is not beneficial to employers.

Most pay transparency laws require employers to make a good faith estimate of what they will pay for the position. This could include but is not limited to,

- a full salary range,

- a market range, or

- a relevant internal peer range

Ultimately the salary range needs to be relevant and realistic for the position.

For guidance when building out your 2024 strategy, watch our compensation trends webinar and access the planning toolkit.

As an employer, it’s imperative to determine your organization’s compensation philosophy to ensure salary ranges align with corporate values and long-term goals. For more information, read: 3 Steps to Developing Your Organizational Salary Ranges: Getting Clear About Your Company’s Compensation Philosophy.

Share

Related News & Updates

On-Demand Webinar

End of Year Compliance Review [West Region]

12.15.2022