Better Benefits, Lower Costs

What is Pension Risk Transfer?

What is Pension Risk Transfer?

Your defined benefit (DB) plan provides employees with a valuable benefit, but managing the plan can get complicated quickly.

Rising interest rates have completely changed the DB plan landscape, as well as the solutions that make the most sense. Although it may be tempting to “take a break” from worrying about your DB plan, the current environment may present new opportunities for you and your retirement plan. Plan sponsors are turning to alternative options, like Pension Risk Transfer (PRT), to ensure their DB strategy is optimized for the current and future conditions and risk is managed to help meet their business goals.

What is Pension Risk Transfer?

By definition, Pension Risk Transfer is when a plan sponsor shifts the responsibility of paying its employees’ pensions to an insurance company, helping them manage the financial risks and ongoing costs associated with pension obligations. A plan sponsor may consider transferring the risk associated with their DB plans because it helps them reduce uncertainty, costs, and financial burden. The total annual cost of a pension plan can be hard to budget for due to variables in investment returns, interest rates, and the longevity of participants in the plan. When a plan sponsor transfers the responsibilities to an insurance company, they can better predict their future costs, mitigate market fluctuations, and ensure that its employees receive their pensions without putting the company’s finances at significant risk.

What are the types of Pension Risk Transfer?

There are three main ways in which a plan sponsor can achieve this:

Lump Sum Offer

The Plan Sponsor can offer lump sums to terminated vested participants. If they elect to take the offer, their benefit is paid out immediately and they are no longer part of the Plan.

- Reduces PBGC and administrative cost to the Plan

- Most cost-efficient way for Plan Sponsor to settle benefit with the participant

- Allows term-vested participants earlier access to their benefit

Retiree Annuity Buyout

The Plan Sponsor purchases a Group Annuity Contract from an insurance company to cover a subset of their retiree population (usually those with the smallest monthly benefits). The insurer then takes on the responsibility of paying pensions to that group of retirees.

- Reduces PBGC and Administrative Costs to the Plan

- Asset & Liability transfer to the insurer

Plan Termination

The Plan Sponsor has sufficient assets to pay out all benefits from a frozen Plan in the form of lump sums and a group annuity contract.

- 12–18-month process

- Filings with the PBGC and IRS

- Notices to Participants and Election Packages

- Culminates with a full risk transfer of both assets and liabilities off the Plan Sponsor’s Balance Sheet to an insurance carrier.

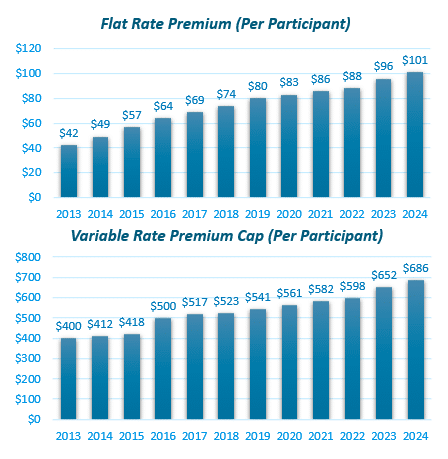

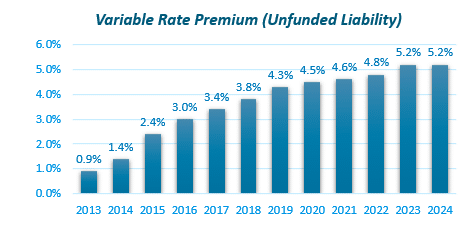

Over the past decade, the Pension Benefit Guaranty Corporation (PBGC) premiums have risen significantly, which has increased the cost for Plan Sponsors to continue to administer benefits from the Plan.

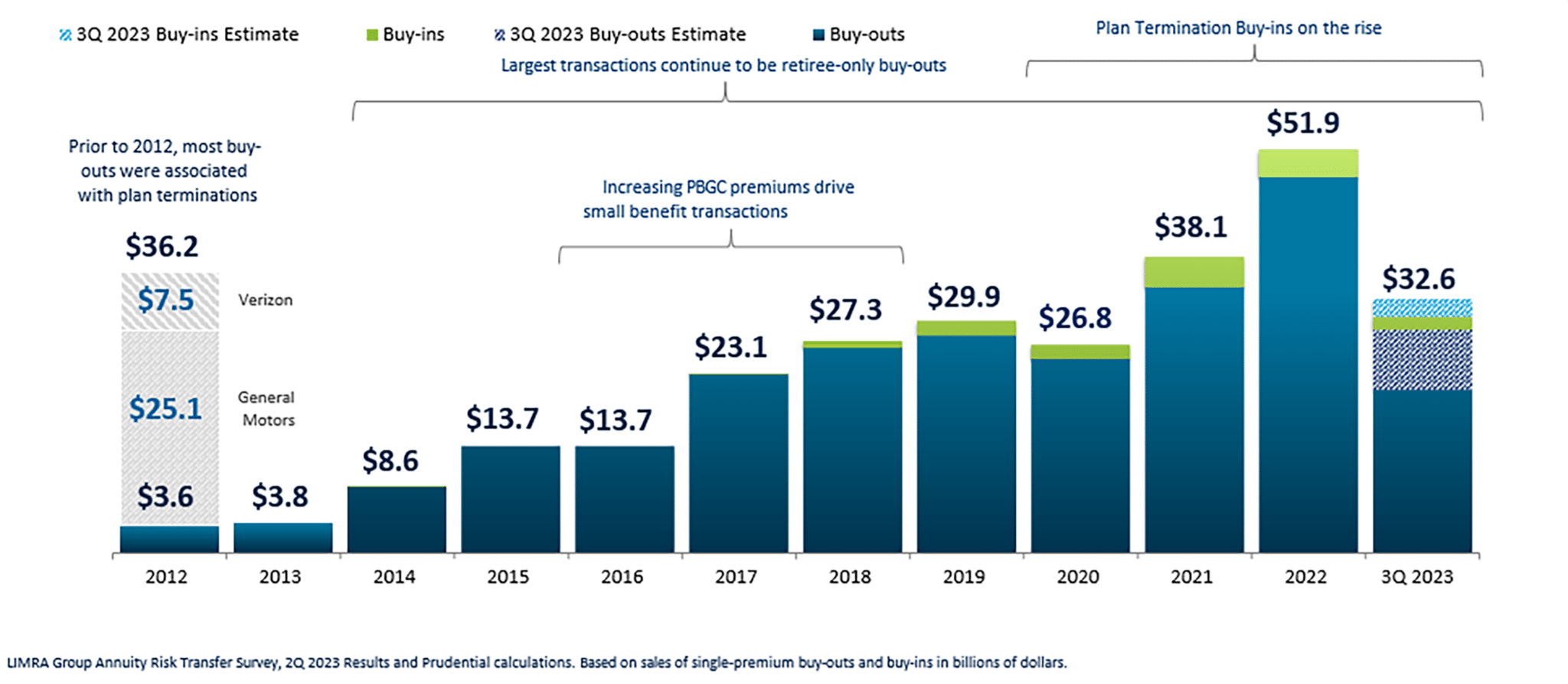

These rising costs have driven a sharp rise in Pension Risk Transfer via Retiree Buyouts and Full Plan Terminations. The graph below represents the total amount of group annuity contracts purchased by US Pension Plans over the past decade.

Verizon, one of the largest Defined Benefit Plan Sponsors in the US, recently completed a transaction to annuitize 56,000 retirees from their Plan by purchasing a Single Premium Group Annuity Contract for $5.9M from Prudential Insurance Co. and RGA Reinsurance Co. This is the largest Pension Risk Transfer (PRT) transaction thus far in 2024, and continues the huge upswing in PRT sales seen in recent years. Plan Sponsors of all sizes continue to benefit from executing similar transactions with the goal of reducing PBGC premiums, administrative costs, and balance sheet risk.

What’s Next if Pension Risk Transfer is on the Horizon?

These phases will help guide plan sponsors through the process of transferring pension responsibilities effectively:

-

-

-

- Evaluate Feasibility – assess the pension plan’s financial health and consider the potential benefits and risks of transfer. It is important to define the goals and objectives and to gain internal commitment during this phase.

- Decision – select the advisor who will help you receive indicative pricing and capital commitments from various insurers and refine your goals/objectives. Choose between a buyout or a buy-in, based on the company’s objectives and risk tolerance.

- Structure + Select Insurer – finalize structure and terms and determine the insurer you’ll be moving forward with. Obtain regulatory approval, as needed, and take part in a fiduciary review.

- Execution - execute the chosen strategy, which may involve transferring assets and data to the insurer. It is important to communicate with participants and investors during this phase.

- Monitor – continuously assessing the performance and financial impact of the pension risk transfer to ensure it aligns with the company’s goals.

-

-

OneDigital’s Pension Risk Transfer (PRT) Team has the expertise to help Plan Sponsors identify PRT opportunities and has decades of experience negotiating contract pricing with insurance carriers. To learn more, contact our team here.

For the latest updates you need to know, watch Pressing Defined Benefit Plan Issues for 2024.

Investment advice offered through OneDigital Investment Advisors LLC, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.