Compliance Confidence

Distribution Instructions for ERISA Documents

Distribution Instructions for ERISA Documents

Most employers sponsoring group health and welfare plans are required to comply with the minimum reporting, disclosure and fiduciary standards set by the Employee Retirement Income Security Act of 1974 (ERISA).

Among other things, ERISA requires plan sponsors to communicate important plan information to participants of the plan. Employers can meet this requirement by creating an ERISA wrap plan document and summary plan description (SPD). An ERISA wrap plan document “wraps” around already existing documents, such as insurance policies, coverage certificates, and other third-party contracts, and adds the necessary provisions required to comply with ERISA.

While it is important that ERISA plans have a compliant written document to communicate plan information, plan sponsors also need to understand their disclosure requirements under ERISA. Below describes key aspects of distribution.

Who needs to receive the document(s):

- Plan participants

- Former employees that are covered under the plan

- COBRA qualified beneficiaries

- Alternate recipients under QMCSO

What Must be Distributed:

The wrap plan document is a comprehensive written document describing the operation and administration of the employer's plan. It informs plan participants about the benefits they may be eligible for under the plan and provides the terms to be used by the plan administrator in administering the plan and decision-making when it comes to plan operations. The plan document is often written in legalese and may be difficult for the participants to read and understand. It is not required to be distributed to the participants unless requested.

The summary plan description (SPD) is simply a summary of the plan document required to be written in such a way that plan participants can understand the terms of the plan. Unlike the plan document, the SPD is required to be distributed to plan participants. See above about who needs to receive the ERISA document.

Note: While not ideal, some ERISA plan document vendors combine the ERISA wrap plan document and SPD into one document. In this case the combined document must follow SPD distribution requirements and be distributed to participants upon request.

When to Distribute:

- Brand new plans must furnish the SPD to participants within 120 days of the plan’s effective date.

- Established plans must furnish the SPD within 90 days of an individual becoming a participant in the plan.

- If there are any material plan changes (e.g., change in plan year, carrier change, adding a benefit, etc.) a summary of material modification (SMM) or an amended/restated SPD must be distributed within 210 days after the end of the plan year in which the change occurred. If there is a significant reduction in benefits, then the SMM or amended/restated SPD must be distributed within 60 days of the effective date of the change.

- An SPD must be distributed every 5 years if there are any modifications since the initial SPD was created, or every 10 years if there were no modifications.

- The wrap plan document must be distributed within 30 days upon participant request.

How to Distribute:

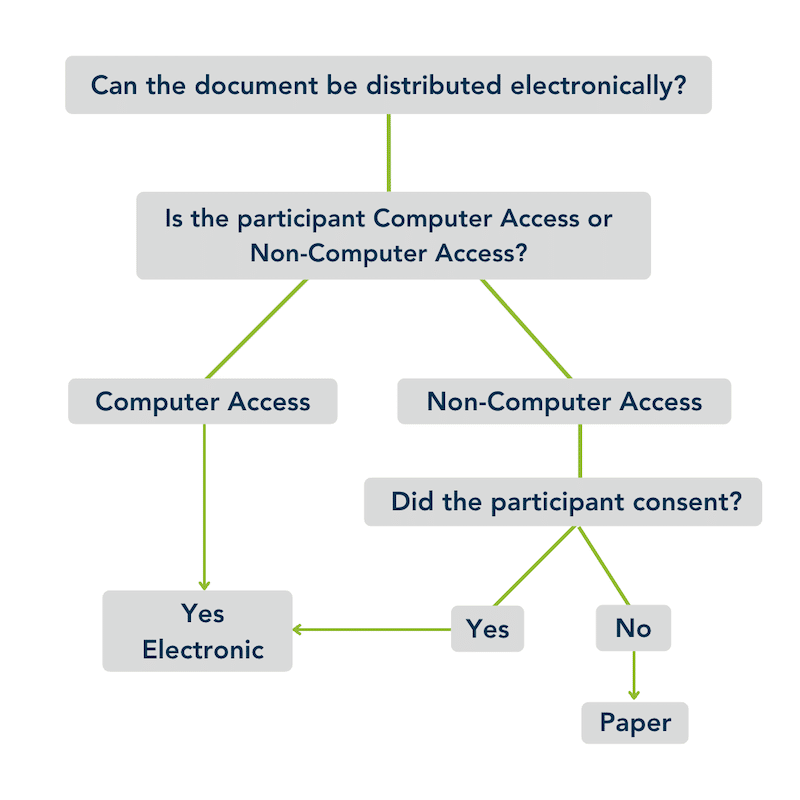

SPDs and SMMs must be furnished in a way “reasonably calculated to ensure actual receipt of the materials.” Employers generally distribute a paper copy of the SPD but depending on the employer’s workforce, they may be able to distribute it electronically. Examples of electronic distribution include posting the document to a company intranet or sending via email. To distribute the document electronically, the employer must determine if their participants are considered “Computer Access” or “Non-Computer Access.” If a participant is considered Non-Computer Access, the employer may still be able to distribute the documents electronically as long as the Non-Computer Access participant has consented to receiving the documents electronically. Computer Access participants do not have to consent. Both Computer Access and Non-Computer Access participants can request a paper copy at any time.

Computer Access Employee:

This includes employees who (1) have the ability to access documents furnished in electronic form at any location where the employee is expected to perform their work and (2) access to the employer or plan sponsor’s electronic distribution system is an integral part of the employee’s job duties.

Non-Computer Access Participants:

This includes employees who do not have work-related computer access and all non-employee beneficiaries (e.g., former employees under the plan, COBRA qualified beneficiaries, alternative recipients under QMCSO). For these individuals to consent to receiving the SPD electronically they must be provided with a clear statement that indicates:

- What documents they are consenting to receive electronically (e.g., SPD)

- They can withdraw their consent at any time with no charge

- The procedures for withdrawing consent or for updating the individual’s method of electronic receipt

- The right to request a paper copy of the document and the cost (if any)

- Computer requirements for accessing the documents

Note: A revised statement and an updated consent must be obtained if system hardware or software requirements change.

If an employer needs to distribute via paper method (e.g., electronic consent is not received from a Non-Computer Access participant or a paper copy is requested), a paper copy can be distributed using First-Class Mail. The Department of Labor (DOL) does provide other methods that may be acceptable (e.g., second- or third-class mail, by hand, company publication) however employers need to be prepared to show the method chosen was reasonably calculated to ensure actual receipt.

Staying on top of compliance requirements is challenging. Visit and bookmark OneDigital’s Compliance Confidence blog to ensure you never miss an update.