Healthy People

Making Cents of Financial Wellness

Making Cents of Financial Wellness

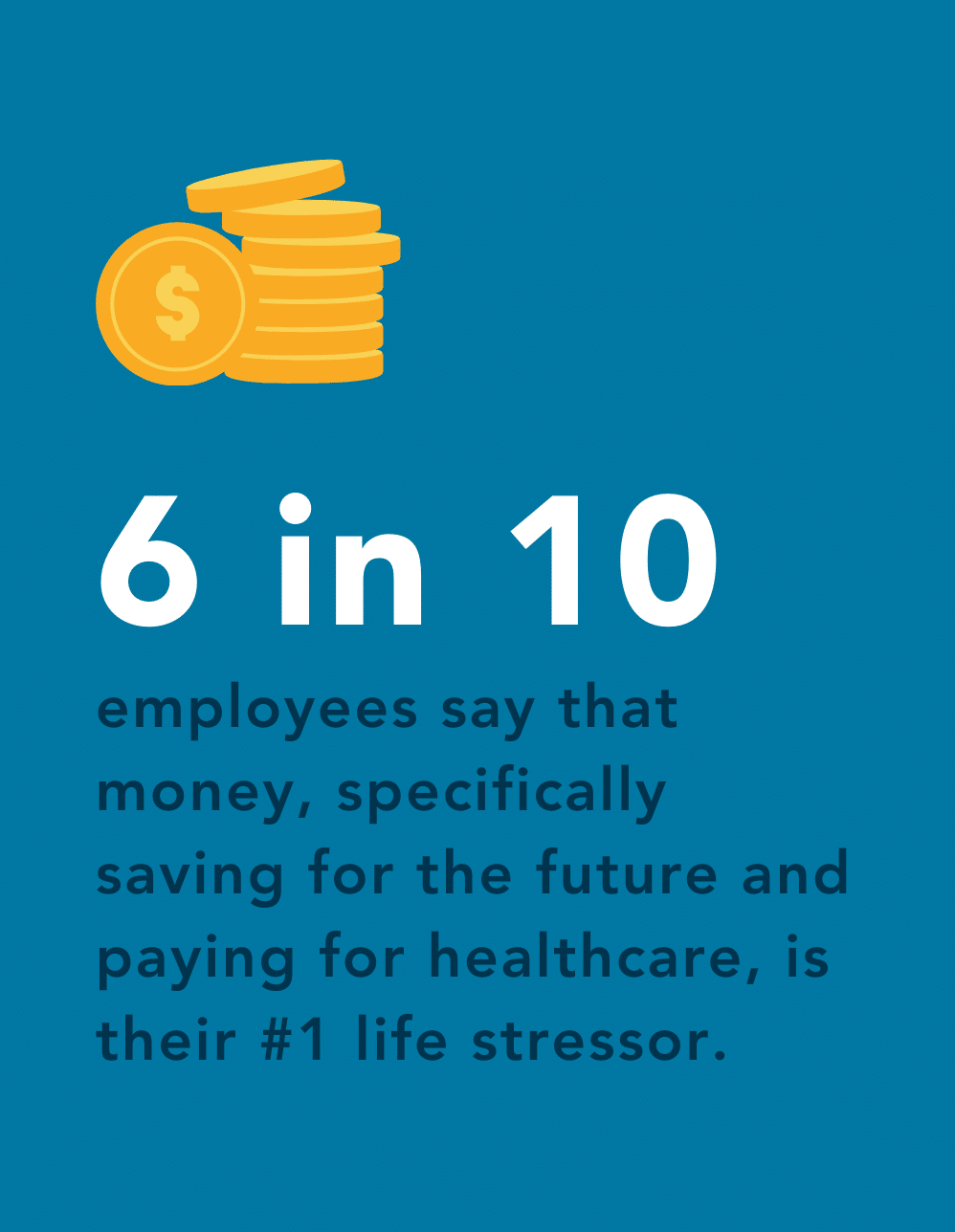

As many employers are well aware, health care costs and saving adequately for retirement are two of the most pressing financial issues facing Americans—regardless of income level—today.

For employees, health and finances are impossible to separate. As employers seek to build trust and form lasting relationships amongst their workforce, financial wellness programs have moved from “nice to have” to an expected component of a comprehensive employee benefits package.

As Millennial workers take over as the largest population in modern workplaces, many of them enter with student loan debt, and 35% of those in debt report having over $30,000 of debt. Countless studies indicate that financial worries are a major cause of stress for Americans and employees regardless of age and demographics. Not only does stress have a significant impact on health status, but the distraction and worry associated with money matters contribute to lost productivity at work.

According to David Griffin, SVP, Atlanta Retirement Partners, OneDigital, the average American worker is woefully underprepared in the world of personal finance.

The root of the problem is societal, and also from our education system. Discussing salaries or retirement savings ranks at the very top of ‘taboo’ subjects to discuss with your peers. Why is that? We find that most people pick up money habits (good and bad) from their parents. When you look back at high school and college, how much personal finance education did you receive? Likely not much. In today’s competitive labor environment, assisting employees in becoming financially adept is beneficial for both employee and employer.

Many employers ask what the long-term ROI is on Financial Wellness. It’s hard to quantify, but the impact is significant. Financial stress is rampant, and stressed workers are less likely to be doing an exceptional job at whatever their job may be. As an employer, fortunately, many options exist in the world of financial wellness. Some technologies work in tandem with live counselors that we find are accessible from a cost perspective and very impactful on a workforce. Some employers even go so far as to assist employees with debt repayment programs and offer personalized financial counseling with 2–3-year strategies. The ‘right’ design is dependent upon many factors, and knowing your workforce is key. Capable advisory teams can assist in evaluating available strategies and implementing programs. Critically, make sure to measure results.

How Employers Can Help Reduce the Stigma

Acknowledging financial stress as a significant cause of low employee engagement and work productivity has paved the way for a more holistic approach to employee wellness. Financial wellbeing is just one of many “personal” issues that plague employee wellbeing and performance. The transition of financial wellness into a significant component of total wellbeing has proven to be a worthy investment. It has led employers to embrace a belief system that supports employees holistically, affording programs and benefits offerings for other personal challenges. These benefits and services range from fertility and adoption counseling to career counseling, early childhood development education, advanced employee assistance programs (EAPs) and meal home delivery services.

Before patting yourself on the back for being part of the 83% of employers that offer employees financial wellbeing programs, ask yourself, are you getting the most cents on your dollar? Find out if you are taking the most productive approach to financial wellness by answering these two questions:

-

Do your employees value the services you are sponsoring?

Sixty-four percent of employers offer benefits to support retirement, but research suggests that financially stressed employees are not contributing to retirement. They are either struggling to pay their bills week to week or overburdened by student loans. Depending on your workforce demographics, you may be offering a benefit that your employees don’t value. Spend less and get more perceived value by offering benefits that appeal to your organization’s demographics. Employees are typically made aware of their benefits offerings during open enrollment. Coupled with the complexities of our health care system, it’s likely that employees do not know all options available to them. If your company offers a matching program or tax benefit, make sure this is communicated to employees year-round.

-

Are you offering programs and services that align with your long-term business strategy?

If you are looking to create more tenure within your workforce, investing in your retirement benefits is a great option. If you are looking to recruit prospective employees right out of school, looking into student loan repayment programs are sure to give you more bang for the buck. Take inventory of your employee demographics, and assess the financial challenges of the population. Once you’ve determined how to make an impact through benefits offerings, you can take a multi-year approach and establish how these offerings will help your employees as their lives, and needs evolve.

Best Practices for Creating a Culture of Financial Wellness

With concern around financial stability heightened due to COVID-19, a holistic approach to health, wealth and retirement is the opportunity to show up as a true forward-thinking employer during this time of uncertainty. Financial wellness support is the next generation of workplace perks that forward-thinking employers can make available.

To show up for your workforce and prioritize your people, offer solutions that support employees through all stages of their life and career. Consider offering small loan programs for when times are tough to prevent employees from borrowing against their 401k. Investigate the tax benefits for tuition assistance and look into budgeting tools and traditional retirement benefits. There are also non-traditional financial wellness benefits such as Health Savings Accounts (HSA) and parental leave benefits.

Curious to know the most valuable financial wellness benefit? Education. Improve financial literacy. Offer one-on-one non-biased, individual, customized planning and strategy tailored to each employee’s personal goals. Focus on elements that are meaningful to the individual and craft a plan to help them get there. This offering is priceless.

However, when seeking a partner to help bring this benefit to life, make sure you have a solid vetting process in place. Institutions eager to offer these services for “free” most likely have an ulterior motive.

To learn more about the importance of health and financial wellbeing, watch: Closing the Health and Financial Literacy Gap for Your Employees.