Better Benefits, Lower Costs

Why Self-Funded Plans Should Carve-Out Transplant Services

Why Self-Funded Plans Should Carve-Out Transplant Services

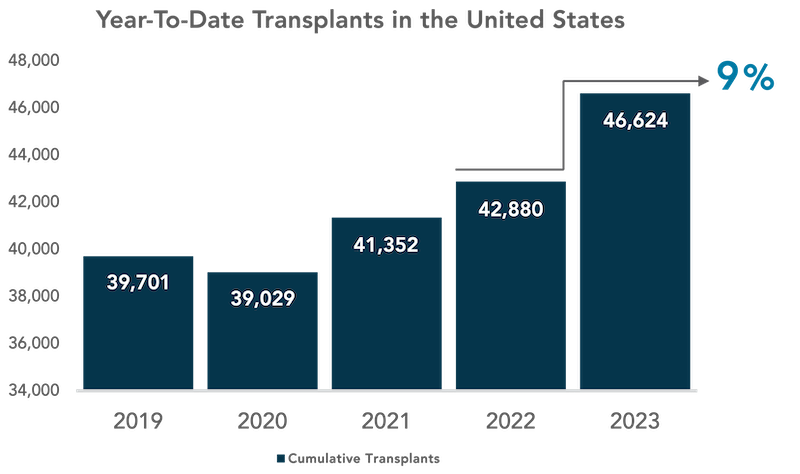

As medical advances continue, transplants are becoming more commonplace. However, these advancements bring higher costs for health plan sponsors as well.

According to data collected by the United Network for Organ Sharing (UNOS), the number of transplants conducted in the United States increased by about 9% from 2022 to 2023.

Studies on the medical costs associated with organ transplants are less frequent than for other types of care, but there is little doubt that they are among the most expensive procedures that a plan member can undergo. One of the most recent comprehensive studies, conducted by Milliman Inc. in 2020, found that the average billed charges for a kidney or pancreas transplant ran over $400,000, while the total for a lung or liver transplant averaged around $900,000. Charges had risen about 11% from the previous report, which was authored in 2017. Considering how much healthcare costs have climbed since 2020, it is likely that current costs are substantially higher.

With the frequency of claims and costs rising, companies are looking for solutions to mitigate the financial risks associated with transplants. The most direct and effective way to manage this risk is by introducing a transplant insurance policy to your organization’s health plan.

Why Should Employers Consider Adding a Transplant Policy?

Transplant insurance policies are a way for employers to mitigate both the severity and frequency of catastrophic health claims stemming from transplant procedures. These policies are often called transplant carve-outs, because the financial risk posed by transplant procedures is being “carved out” from the regular plan and covered with a supplementary insurance policy. Transplant carve-outs promotes predictability rather than variability of cost in terms of budgeting, thus helping to stabilize a group’s stop loss rates. Carve-out policies are a proactive way to isolate and manage financial risk while providing policyholders with high-quality care.

Additional Points for Employers to Consider:

- Stop loss deductibles and the contract basis (Paid vs. Incurred) can result in gaps in coverage which leaves the employer group exposed to unnecessary risk, which a separate transplant insurance policy can mitigate.

- Transplant claims experience can drive increased stop loss persistency and a significant portion of stop loss renewal rate increases.

- This coverage should be considered when there is no current potential future risk related to transplants on the plan, as any current or future transplant risk will result in automatic DTQ (Decline to quote) from the market.

How an Organ Transplant Policy Aids Your Business and People

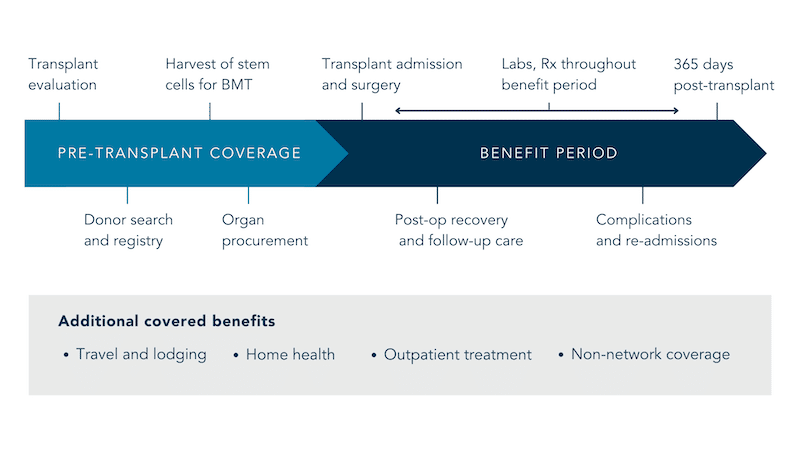

Having a transplant carve-out plan in place alleviates the financial burden brought about by high transplant costs. A transplant carve-out product not only covers the actual transplant but also the transplant-related treatment and preparation leading up to the procedure.

These types of costs can accumulate for quite some time while the patient waits for an organ match. In addition to this, the carve-out policy will also cover post-op care after a successful transplant surgery, including travel and lodging, outpatient treatment, home health needs, and some out-of-network expenses. These expenses can accumulate for quite some time while the patient waits for an organ match. The carve-out will also cover post-op care following successful transplant surgery. See below for an example transplant timeline provided by the healthcare company Optum:

It should be noted that self-funded companies that elect to partake in a transplant policy will be able to submit the policy for consideration during their stop loss insurance marketing. During the marketing process, stop loss carriers will strip the specific transplant claims out of the experience for rating purposes when there is a standalone policy in force. This will account for a 2-5% savings on the stop loss premiums, which allows for some fixed costs to be mitigated.

Standard suite of coverages that can be included in a Transplant Policy:

- All major solid organs (heart, lungs, liver, kidney, pancreas, intestines), bone marrow, stem cell and cord blood transplants

- Benefit period starts at evaluation

- Travel, lodging and meals benefits

- Benefit maximums options of: $1M, $2M, and unlimited

- Coverage for all clinical trial phase

- Post-transplant drugs

- Coverage up to 365 days after transplant for follow-up and care of complications

- Plan document review on transplant language to ensure no future litigation