Better Benefits, Lower Costs

Want to Reduce the Cost of Your Employer-Sponsored Health Plan? Maximize Savings with Reference-Based Pricing

Want to Reduce the Cost of Your Employer-Sponsored Health Plan? Maximize Savings with Reference-Based Pricing

Adopting a Reference-Based Pricing health plan is among the most effective steps that an organization can take to tame out-of-control health spending. However, a successful rollout requires lots of planning and employee education.

What is Reference-Based Pricing?

Reference-Based Pricing (RBP) is an alternative network option that allows members to go to any provider at a fraction of the price of traditional carrier networks. RBP Plans are unique in that there is no network of participating providers or facilities — members are free to seek care from any provider or facility they want. RBP plans allow employers to cap the amount paid for specific services by their health plan by referencing Medicare pricing as a baseline.

How does Reference-Based Pricing work?

RBP plans are offered by many entities, including both major carriers and smaller “boutique” providers.

Unlike most health plans, RBP plans do not use a predetermined fee-for-service model with a network of preferred vendors. Instead, Medicare pricing is used as a baseline for the prevailing cost of medical services in the marketplace.

In RBP plans, medical charges are paid as a percentage of what Medicare enrollees would pay for the same service. RBP plans are not a new concept, but they are becoming more and more prevalent in the marketplace due to the potential for employers to save 20%-30% on healthcare costs.

How does Reference-Based Pricing help control costs?

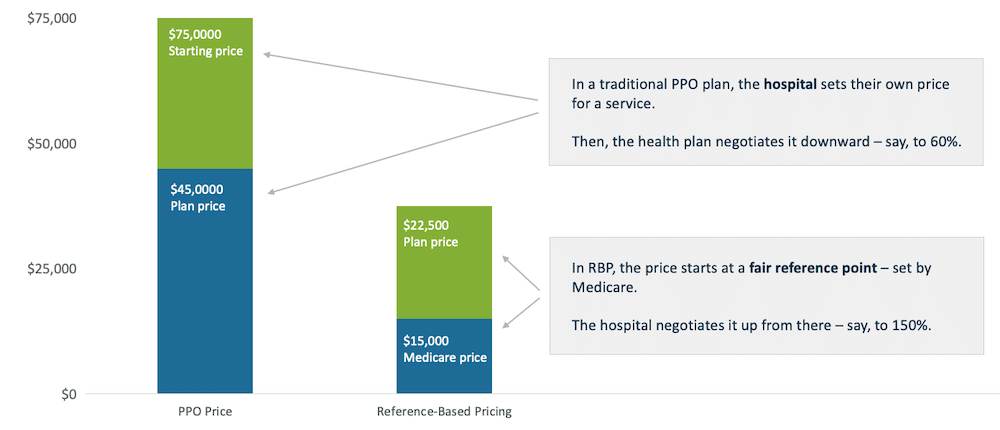

RBP plans use Medicare fee schedules and cost data to determine the prevailing cost of medical services and set price caps on procedures. This results in lower claim payments for plan sponsors and reduced premiums, deductibles, and coinsurance costs for plan members. An example of how this can work is illustrated below:

In this example, one patient with a traditional PPO plan and another patient with an RBP plan go to the same hospital and undergo the same procedure. The first patient is charged $75,000, a price which was set by the hospital. This patient's PPO plan receives the $75,000 bill and negotiates this amount down to an allowable charge - in this case, $45,000. This represents a 40% discount from the hospital's "sticker price." The employee must pay their covered portion of this charge, while their PPO plan covers the rest.

The patient with an RBP plan has a different billing experience. This patient's plan references the Medicare price of the service provided by the hospital, which is $15,000. The hospital then negotiates this price upwards, to $22,500. The patient still pays their covered portion of the charge and their health plan still covers the rest, but the overall amount is significantly lower.

Are there potential downsides or considerations that RBP adopters should be aware of?

In a word, yes. Transitioning to an RBP plan can be quite disruptive to plan members and administrators because it represents a significant departure from traditional PPO plans. Some key considerations for those considering an RBP plan are outlined below:

- The absence of a preferred provider network means members may have access to a greater variety of providers and facilities than they would under more conventional health plans. However, this access is not guaranteed – while any medical provider can agree to see a patient and reimburse them according to their plan’s reference-based pricing policies, there is no contractual obligation for them to do so. Some medical providers and facilities may be unfamiliar with reference-based pricing and require an explanation before determining how they react.

- Due to the complexity of these plans, careful planning and member education is necessary for successful adoption and utilization. This cost containment tactic requires a heavy lift for both employers and employees.

- Routine auditing should take place to ensure that reference-based claims are being processed correctly.

- If an employer sets a benchmarked limit on how much they will spend on a certain type of care and an employee receives said care at a higher price, said employee may be charged for the difference in cost (this is called “balance billing”). This is especially concerning in the context of emergency situations, where employees may not be able to properly evaluate their options.

- Because of this, employers looking to implement this strategy should find a vendor with a track record in managing RBP plans and a known focus on member advocacy. It is advisable to plan ahead, establish safeguards, and consider ways to support employees who have received a balance bill.

In short, transitioning to an RBP plan requires a comprehensive employee communication initiative to ensure that plan members understand the nuances of the program and how to navigate health services properly. In some cases, adopting this plan type could cause serious disruption. However, many employers find this tradeoff to be worthwhile due to the large savings potential of RBP plans, which tend to see year-over-year cost trends that are more closely aligned with the inflation rate of the general economy, rather than the higher inflation rate that is typical within the healthcare industry.

For more information on how to optimize your corporate health plan, check out this blog post: Which Funding Model is Right for Your Employer-Sponsored Health Plan? It Depends on Your Appetite for Risk.