Better Benefits, News

Jason Chepenik Provides Thoughts on Lifetime Income

Jason Chepenik Provides Thoughts on Lifetime Income

Fifty-seven percent of employees believe that employers are responsible for providing an option for lifetime income during retirement.

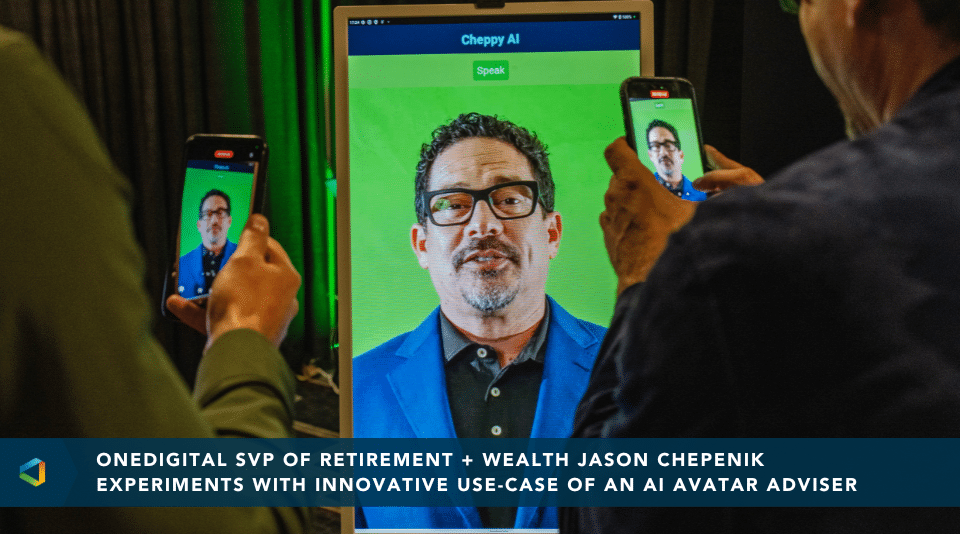

Jason Chepenik, Senior Vice President at OneDigital, was featured in a video series produced by Nuveen, a TIAA Company, where they talk to industry professionals who are “Leaders in Lifetime Income.” Leaders for change that recognize that there is a great need for lifetime income within 401(k) plans. Chepenik was brought on to discuss his unique perspective on how to “think different” and tackle a leading challenge for many 401(k) participants as they exit the retirement plan.

When examining the leading challenges for 401(k) plans today, Chepenik stated:

401(k) plans have gotten really good at getting people into plans. What we haven’t figured out is how to get people out of a plan systematically, easily, and really replace income for their life. It’s a critical mission that we must solve together.

Jason Chepenik, Senior Vice President, Retirement + Wealth

He also addressed advisers and how they can incorporate lifetime income into their practice. Chepenik challenged advisers to, “Have the courage to present something different.” If an adviser does not present something new to a plan sponsor, then they should not expect change. It’s a collaboration between the adviser and the plan sponsor to look at the plan from different perspectives and work together to achieve the common goal of better outcomes for the plan and its participants.

To learn more on lifetime income, watch the full video here: Leaders in Lifetime Income | Jason Chepenik

Want to hear more from Jason Chepenik? Check out this article: How to Help Employees Save for Retirement and Plan for the Future.

Investment advice offered through OneDigital Investment Advisors LLC, an SEC-registered investment adviser and wholly owned subsidiary of OneDigital.