No Headaches

Salary Benchmarking Compensation the Right Way

Salary Benchmarking Compensation the Right Way

Salary Benchmarking Ensures That Pay Doesn’t Hinder an Organization’s Ability to Attract and Retain Talent

As the number of states that have implemented pay transparency laws continues to grow, more and more companies are faced with the challenge of determining what salary range to put on their job postings. Employers looking to fill those open positions are finding out the hard way that their first offer may be the only offer they get the chance to make because it is below market and the candidate moves on to another opportunity.

One critical component to making an informed decision is a sound market pricing process. Similar to how retailers consider competitors' rates when setting prices for their products, salary benchmarking is the process of comparing pay rates within the organization to market pay data to understand the position's value relative to the market.

A typical approach to market benchmarking includes the following steps:

-

Identify reputable compensation data sources.

Not all surveys offer the same information - consider at least 2 sources, ensure those sources are based on employer reported data (self-reported data cannot be verified and may be overstated) and they include a listing of participants.

-

Accurately match your jobs to the survey benchmarks.

Before you can compare jobs to a survey, you must have accurate job descriptions which outline the responsibilities, scope, skills, and education for the position. While the job title is essential, remember that not all titles are comparable, so look carefully at the job description to make a good match.

-

Collect data.

Determine what data would be helpful. For example, collecting the 25th, 50th, and 75th percentile data will allow you to understand the market across a wide range. You may also want to look at incentive or bonus data for the positions.

-

Age the data.

In today's changing and tight economic climate, applying an aging factor is crucial to keep pace with rapid changes in the marketplace. Aging the data will allow you to ensure that based on when the survey was published, the data is current and competitive.

-

Consider Internal Data.

In addition to external market data, you will need to review your internal incumbent data and how employees fall within your salary ranges to ensure you do not create inequities. Many pay transparency laws require that an employer be able to justify the placement of employees within a salary range.

-

Make recommendations.

Once the correct data has been mined, you’ll want to make recommendations based on what you’ve found. There may be some jobs that fit perfectly into your established ranges and others that fall outside of your ranges and pay strategy. Paying close attention and taking action to rectify these jobs and then evaluating your employees’ placement within those ranges to ensure equity is key for attracting and retaining talent.

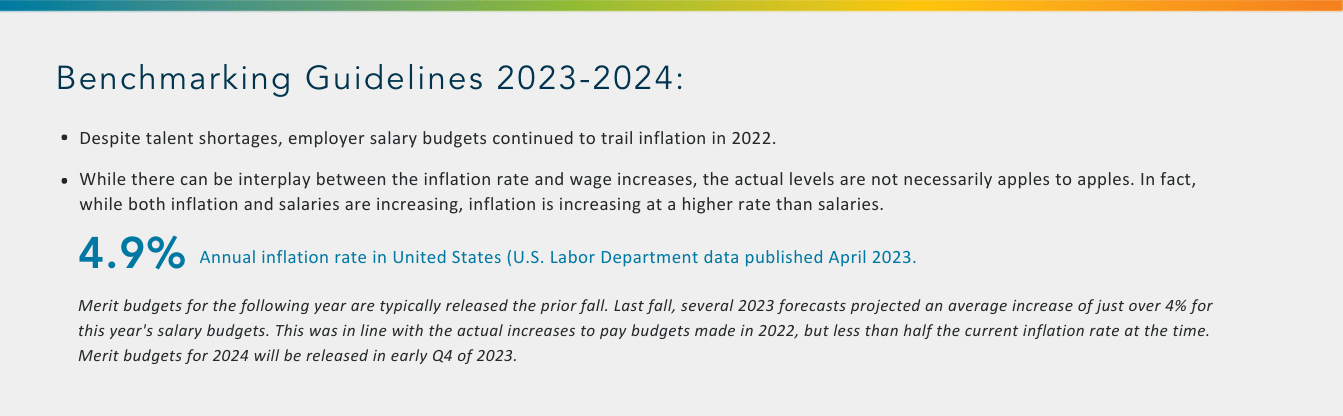

In times of inflation and with the current talk of a recession, the use and importance of salary benchmarking can be confusing for employers making them wonder if now is the time to benchmark. Many are questioning the validity of benchmarking and how inflation correlates to compensation; for example, if inflation is up 8%, should salaries be increased the same percentage? While not a perfect science, staying on top of benchmarking will ensure confidence that compensation is market competitive.

Creating a schedule to review a portion of jobs each year will help you stay aligned with the market so that you can attract and retain in this challenging job market. In addition, you may wish to consider “off cycle” actions should you run into hiring challenges, add a new position, or change your compensation philosophy.

Benchmarking is one piece of the pay puzzle, for more information about the benefits of outsourcing your payroll, download OneDigital's Compensation Toolkit.